This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

April 21, 2022

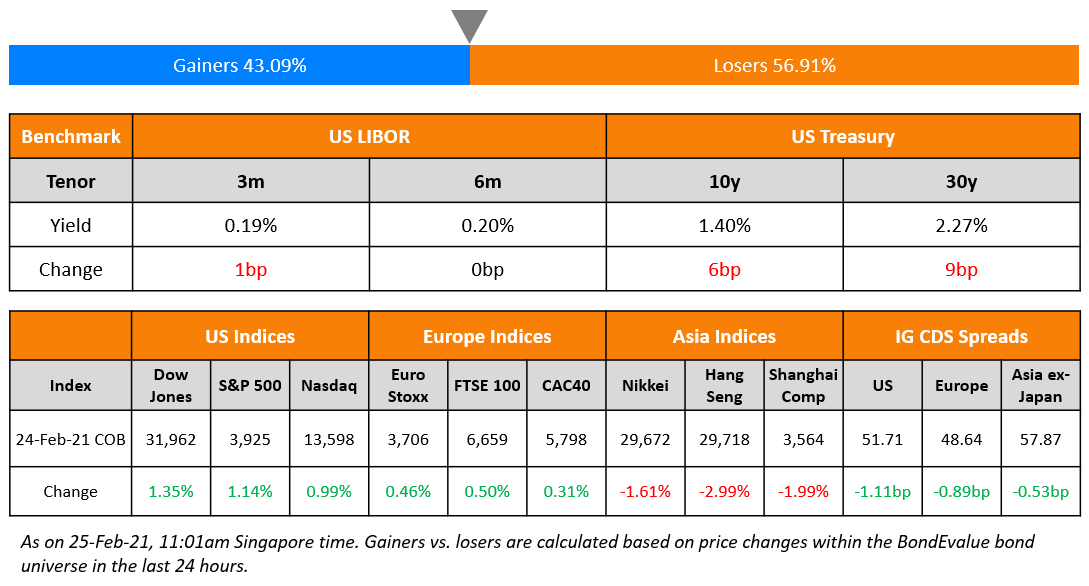

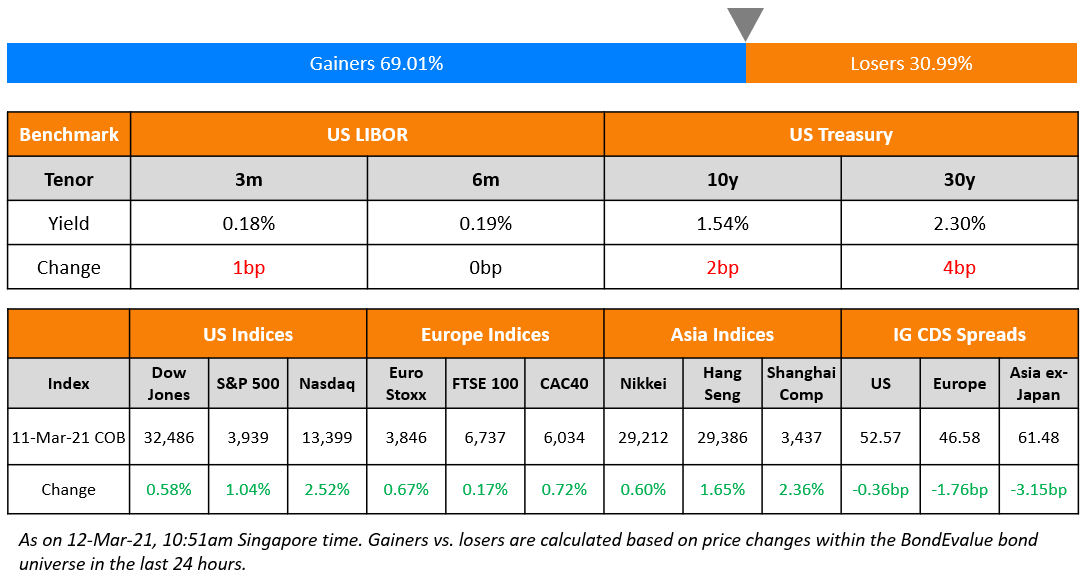

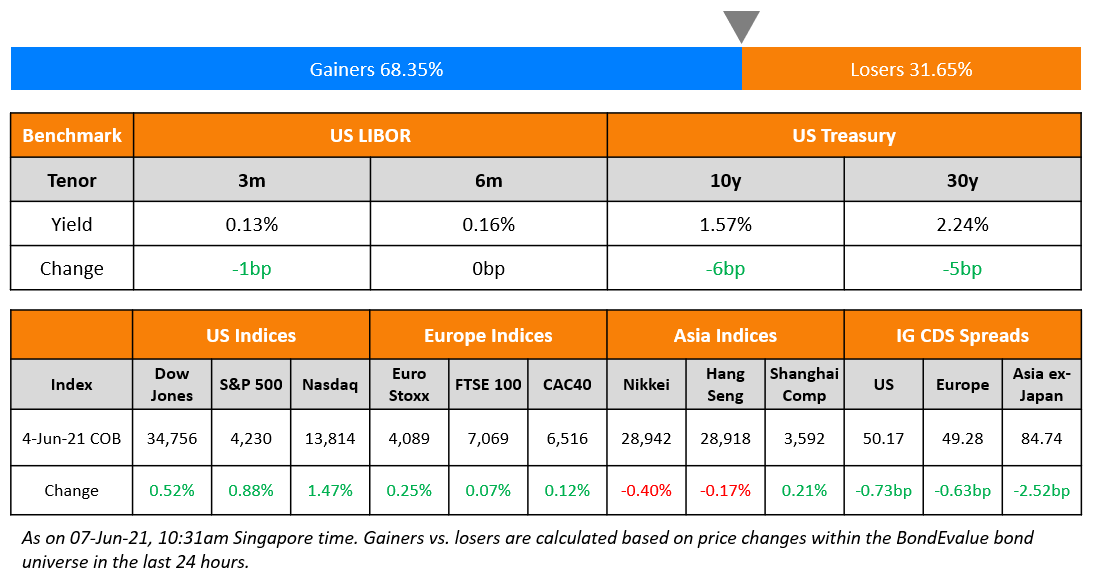

The S&P and Nasdaq closed lower, down 0.1% and 1.2% respectively. Consumer Discretionary, Real Estate, Healthcare and Consumer Staples led the gainers, up over 1.5% each while losses were led by Communication Services, down 4.1%. US 10Y Treasury yields eased 7bp to 2.87%. European markets closed strong with the DAX, CAC and FTSE were up 1.5%, 1.4% and 0.4%. Brazil’s Bovespa ended 0.6% lower. In the Middle East, UAE’s ADX was down 0.9% and Saudi TASI was up 1.2%. Asian markets have opened mixed – Shanghai, HSI were down 1.6%, 1.7% while STI and Nikkei were up 0.5% and 1.1%. US IG and HY CDS spreads tightened 1.3bp and 8.7bp respectively. EU Main spreads were 1.9bp tighter and Crossover spreads were 6bp tighter. Asia ex-Japan CDS spreads were 0.9bp tighter.

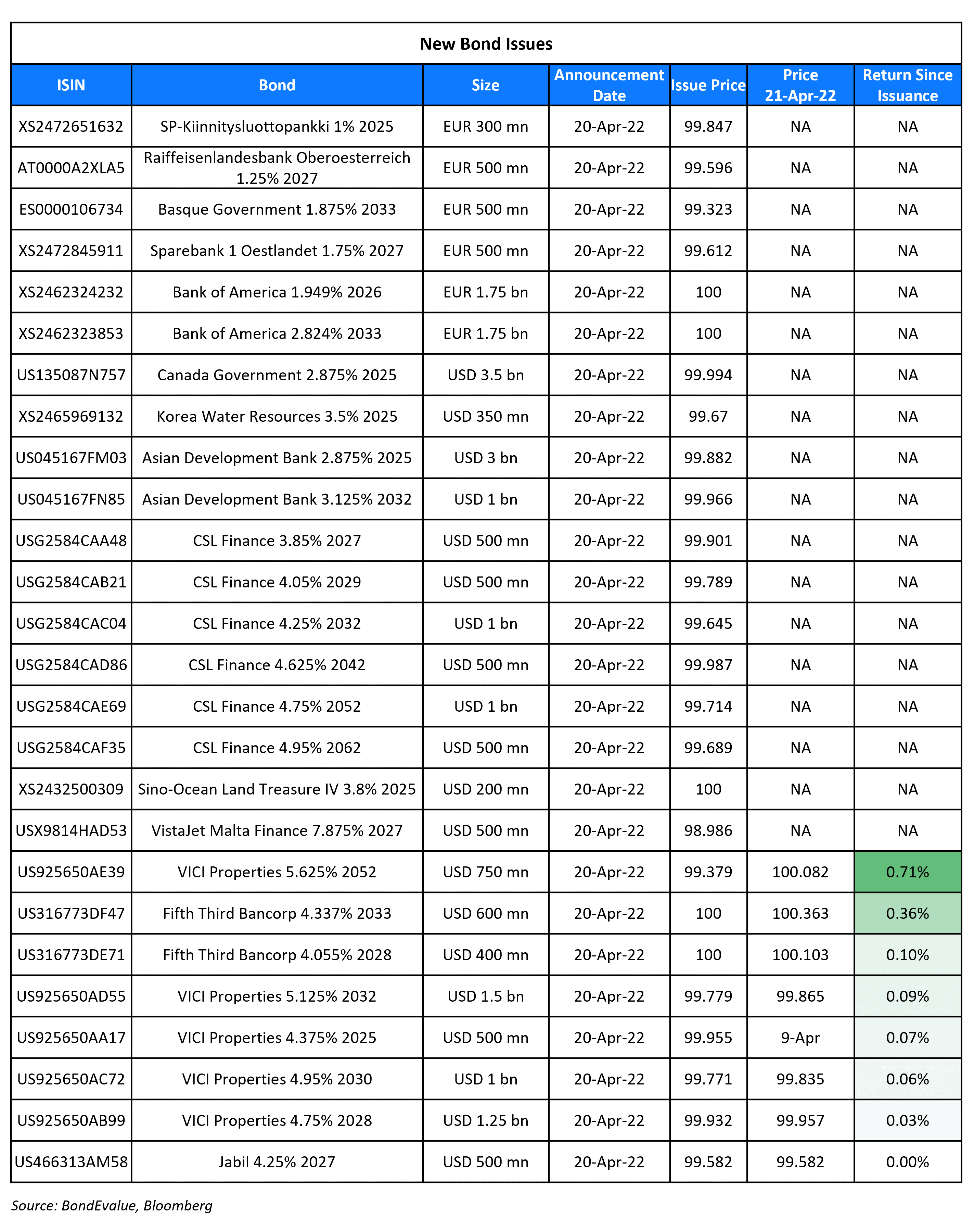

New Bond Issues

- BOC Luxembourg € 3Y Green at MS+70bp area

- Yueyang Construction and Investment Group $ 3Y at 4.7% area

- BOC Singapore $ 3Y Green at T+85bp area

- BOC Macau $ 3Y Green at SOFR+115bp area

- China Great Wall $ 3Y at T+190bp area

- Nanyang Commercial Bank $ AT1 at 6.7% area

Bank of America (BofA) raised $4.58mn equivalent across a multi-currency three-trancher. It raised:

- €1.75bn ($1.9bn) via a 4.5NC3.5Y bond at a yield of 1.95%, 20bp inside initial guidance of MS+105bp area

- €1.75bn ($1.9bn) via a 11NC10 bond at a yield of 2.824%, 20bp inside initial guidance of MS+145bp area

- £600mn ($783mn) via a 9NC8 bond at a yield of 3.584%, 20bp inside initial guidance of UKT+195bp area

The bonds are rated A2/A-/AA-. If the Euro notes are not redeemed on their call dates of October 27, 2025 and April 27, 2032, coupons reset quarterly on to 3m Euribor+91bp and 3m Euribor+120bp for the 4.5NC3.5 and 11NC10 bonds respectively. The GBP bonds’ coupons reset at 1Y UKT+175bp if not called on the call date of April 27, 2030.

PSA International raised S$650mn via a 5Y bond at a yield of 2.9%, 30bp inside initial guidance of 3.2% area. The bonds are rated Aa1 and are issued by funding arm PSA Treasury and guaranteed by the parent. Proceeds will be used for general corporate needs, including acquisitions and investments, debt refinancing and capital expenditure.

Sino-Ocean Group raised $200mn via a 3Y green bond at a yield of 3.8%, unchanged from initial guidance. The bonds are rated Baa3 and come with a standby letter of credit (SBLC) from China Zheshang Bank’s Beijing branch. The guarantor is rated Baa3/BBB- (Moody’s/Fitch), and the SBLC provider is rated Baa3/BBB- (Moody’s/S&P). Proceeds will be used to repay medium and long-term debt that is due within a year.

Korea Water Resources raised $350mn via a 3Y green bond at a yield of 3.396%, 35bp inside initial guidance of T+115bp area. The bonds are rated Aa2/AA (Moody’s/S&P). Proceeds are targeted to fund and refinance new and/or existing eligible projects under the issuer’s green financing framework 2022.

New Bonds Pipeline

- Busan Bank hires for $ Social bond

- Kookmin Card hires for $ Sustainability bond

- ST Engineering hires for $ 5Y and/or 10Y

- Continuum Energy Aura hires for $ Green Bond

- Jubilant Pharma hires for $ bond

- Sael Limited hires for $ 7Y Green bond

- Kalyan Jewellers India hires for $ bond

Rating Changes

- Moody’s downgrades Dexin’s ratings to B3/Caa1; outlook remains negative

- Fitch Downgrades and Withdraws Guacolda’s Ratings

- Macy’s Retail Holdings LLC Second-Lien Notes Downgraded To ‘BB’ From ‘BBB-‘ (Recovery: ‘4’) On Release Of Security

- Fitch Withdraws Sunac’s Ratings

- Fitch Withdraws Shimao’s Ratings

- Fitch Withdraws Logan’s Ratings

Term of the Day: Option Adjusted Spread (OAS)

Option Adjusted Spread (OAS) refers to a measure of the credit spread of a bond with embedded options relative to a benchmark, similar to the z-spread. The key difference between OAS and z-spread lay in the optionality. When comparing two bonds – one with an embedded option and one without – OAS is a better measure compared to z-spread as the former adjusts for/removes the impact of optionality for a like-to-like comparison. Put simply, OAS ≈ Z-Spread + Option cost. On a technical note, the above formula is not an exact equation as the z-spread is calculated from the spot curve while the OAS is calculated from the forward curve. The OAS is less than the z-spread for callable bonds and greater than z-spread for puttable bonds.

Bloomberg reported that OAS’ on CCC-rated bonds have widened the most in 2022 YTD.

Talking Heads

On Fed Should Hike Rates Expeditiously to Neutral by Year-End

Federal Reserve Bank of San Francisco President Mary Daly

“I see an expeditious march to neutral by the end of the year as a prudent path… Moving purposefully to a more neutral stance that does not stimulate the economy is the top priority.”

On Fed Says High Inflation, Geopolitics Are Clouding Outlook

“Inflationary pressures remained strong since the last report, with firms continuing to pass swiftly rising input costs through to customers. Outlooks for future growth were clouded by the uncertainty created by recent geopolitical developments and rising prices.”

On ECB’s Nagel Says a Rate Hike Early in the Third Quarter Is Possible

“It seems that we’ll be able to conclude net purchases, possibly already at the end of the second quarter.” A first interest-rate increase could then happen “at the beginning of the third quarter, if you stick to the sequence that we agreed on.”

On IMF says yen falls driven by fundamentals, urges BOJ to keep easy policy

Sanjaya Panth, deputy director of the IMF’s APAC Department

“What we’re seeing so far on the yen is driven by fundamentals. Economic policymaking should continue to look at fundamentals. We don’t see any reason to change economic policy because what’s happening right now reflects fundamentals…. We do not see disorderly market conditions right now in the foreign exchange market. It’s been driven by fundamentals

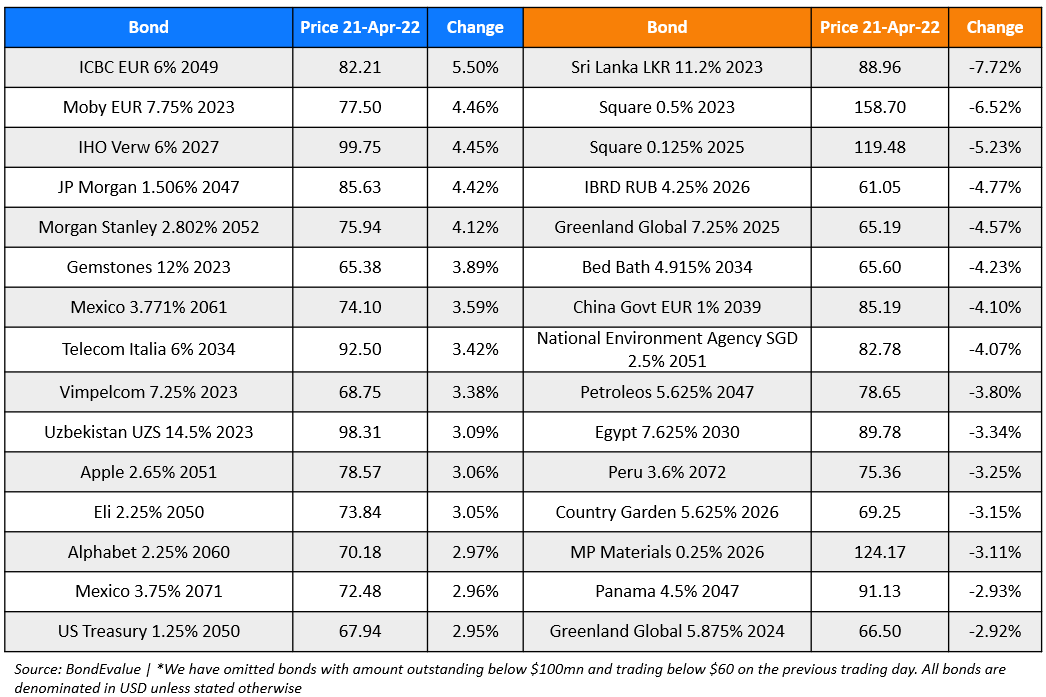

Top Gainers & Losers – 21-Apr-22*

Go back to Latest bond Market News

Related Posts: