This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

February 22, 2022

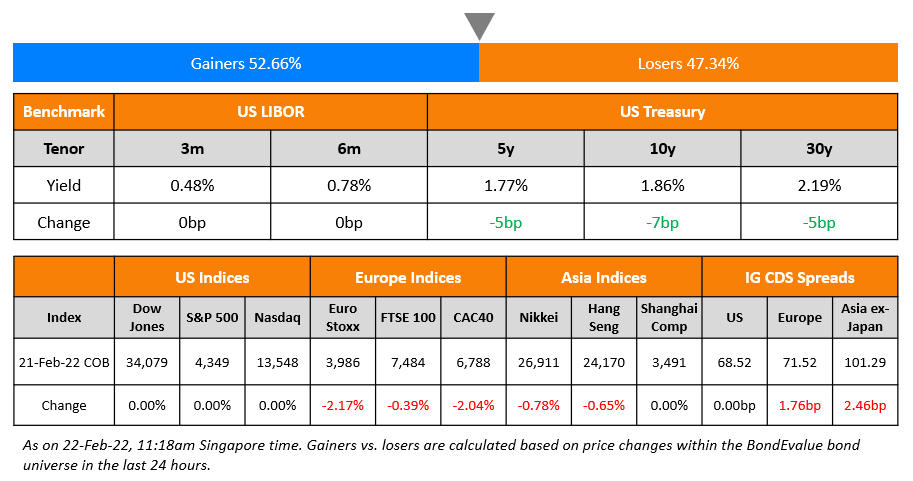

US equity markets were closed due to President’s Day holidays. The US 10Y Treasury yield dropped 7bp to 1.86% on the back of risk-off sentiment due to Russia-Ukraine tensions. European markets closed lower – DAX, CAC and FTSE were down 2.1%, 2% and 0.4% each. Brazil’s Bovespa closed 1% lower. In the Middle East, UAE’s ADX was down 1.2% while Saudi TASI closed 0.8% higher. Asian markets have opened with a strong negative bias led by HSI, down 3% on growing fears of further crackdowns by the Chinese government on tech companies. Nikkei, Shanghai and STI are also down 2.2%, 1.2% and 0.8% respectively. EU Main CDS spreads were 2.4bp wider and Crossover CDS spreads were 6.7bp wider. Asia ex-Japan CDS spreads were 2.5bp wider.

Guangzhou-based Nanfang Daily reported that the biggest state-owned Chinese banks cut mortgage rates for home buyers from Monday, thereby also helping some Chinese developers’ shares pare losses.

New to the BEV App? Join us later today for an interactive session on how to leverage the BEV App to better track your bond investments. The webinar is free for all App users and is scheduled for 5pm SG / 1pm UAE / 9am UK. Click on the banner below to sign up.

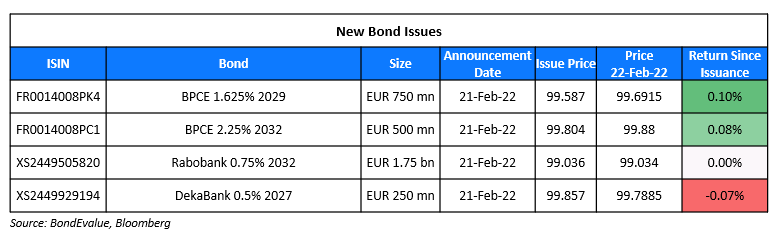

New Bond Issues

- China Tourism Group $ 5Y at T+155bp area

- Agricultural Bank of China Ltd (Hong Kong Branch) $ 3Y green/5Y at T+75/90bp area

Rabobank raised €1.75bn via a covered bond at a yield of 0.851%, 4bp inside initial guidance of MS+10bp area. The bonds were rated Aaa, and received orders over €2.5bn, 1.4x issue size.

BPCE raised €1.2bn via a two-trancher:

- It raised €700mn via a 7NC6 bond at a yield of 1.698%, ~12.5bp inside initial guidance of MS+120/125bp area. The bonds were rated Baa1/BBB+/A, and received orders over €1bn, 1.4x issue size. The coupons are fixed until the call date of March 2, 2028 where if not called, the coupon refixes to 3m Euribor +110. Proceeds will be used for general corporate purposes.

- It also raised €500mn via a 10NC5 Tier 2 bond at a yield of 2.292%, ~22.5bp inside initial guidance of MS+195/200bp area. The bonds were rated Baa2/BBB/A-, and received orders over €1.1bn, 2.2x issue size. The coupons are fixed until the call date of March 2, 2027 where if not called, the coupon refixes to 5Y MS + 175bp. Proceeds will be used for general corporate purposes and for capital adequacy regulatory purposes.

Danyang Investment Group raised $50mn via a 3Y SBLC-backed bond at a yield of 2.5%, unchanged from price guidance. Phoenix Charm International Investment is the issuer and Danyang Investment is the guarantor. The notes also have the benefit of an irrevocable standby letter of credit provided by Bank of Jiangsu Zhenjiang branch.

New Bonds Pipeline

- Yunnan Provincial Investment Holdings hires for $ bond

- Quzhou State-owned Capital Operation hires for $ bond

- Mumbai International Airport hires for $ bond

- China Tourism Group hires for $ 5Y bond

- The Republic of the Philippines hires for $ bond

- Aluminium Corporation of China hires for $ bond

- Petron hires for $ 7NC4 bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

Rating Changes

- Moody’s downgrades Zhenro’s ratings to Caa2/Caa3, outlook remains negative

- Fitch Downgrades Zhenro Properties to ‘C’ on Distressed Debt Exchange; Off RWN

- Moody’s downgrades EDF’s issuer rating to Baa1; negative outlook

- Electricite de France Downgraded To ‘BBB’ From ‘BBB+’ On Strong Debt Increase In 2022-2023; Outlook Negative

- Outlook On Japan’s Norinchukin Bank Revised Up To Stable On Healthy Capital Buffer; ‘A/A-1’ Ratings Affirmed

Term of the Day

Covered Bonds

Covered bonds are senior secured debt instruments that are typically issued by banks. These bonds are secured (i.e. covered) by a pool of assets referred to as the “cover pool”, which typically consists of mortgages or loans. In an event that the bank defaults, holders of covered bonds have a preferential claim to the cover pool, which ensures interest payments and repayment of principal. This makes covered bonds relatively more secure vs. other debt and therefore results in a higher credit rating. While they have similarities with Mortgage-Backed Securities (MBS) in terms of the pool of assets there is a difference – the transfer of mortgages to an Special Purpose Entity (SPE) in a MBS issue means that the issuing bank no longer bears the risk of the loans and the mortgage pool is static. This is in contrast to Covered Bonds where, because the mortgage pool is constantly adjusted to maintain the pool size, the issuing bank bears the credit risk of the mortgages.

Talking Heads

“I support raising the federal funds rate at our next meeting in March and, if the economy evolves as I expect, additional rate increases will be appropriate in the coming months… I, as all of my colleagues will as well, will be watching the data closely to judge the appropriate size of an increase at the March meeting… I think between now and then it is very important that we continue to watch how the economy develops and understand whether or not things are improving or getting worse”

On ECB Shift May Also End World’s Longest-Running Subzero Rates

Frederik Engholm, chief strategist at Nykredit

“For many, the negative rates have been an abnormality and I’m sure that especially the banks will be happy to see them go away”

Jan Storup Nielsen, chief analyst at Nordea Markets

“The Danish central bank has underlined its willingness to go very far and further than most expected to defend the peg. You might have expected Danes to turn against the peg with the consequences of negative interest rates, but we haven’t seen that at all.”

Wei Chong, head of bond research at Hangzhou-based Fuhui Juli

“The property market is full of big opportunities for us, but both the price declines and the evolution of sector fundamentals have exceeded our expectations… It’s hard for us to tell who can survive… We locked in the potential sellers, waiting for them to offload when their pressures peaked.”

On Brazil central bank chief says inflation still climbing

“We actually see an inflation trend that is still growing” Only Brazil and Russia’s current interest rates are above the neutral level, which supports the economy at full employment without pressuring or decelerating inflation. The most crucial point for the central bank today is to understand how the normalization of monetary policy will take place in an environment of higher global inflation”.

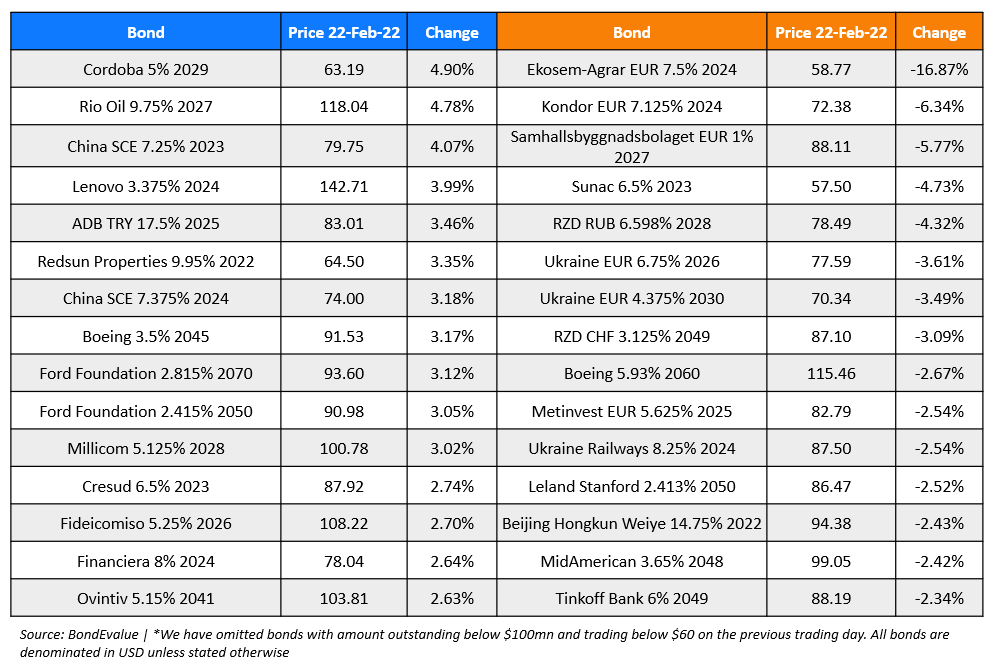

Top Gainers & Losers – 22-Feb-22*

Go back to Latest bond Market News

Related Posts:.png)