This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

June 22, 2022

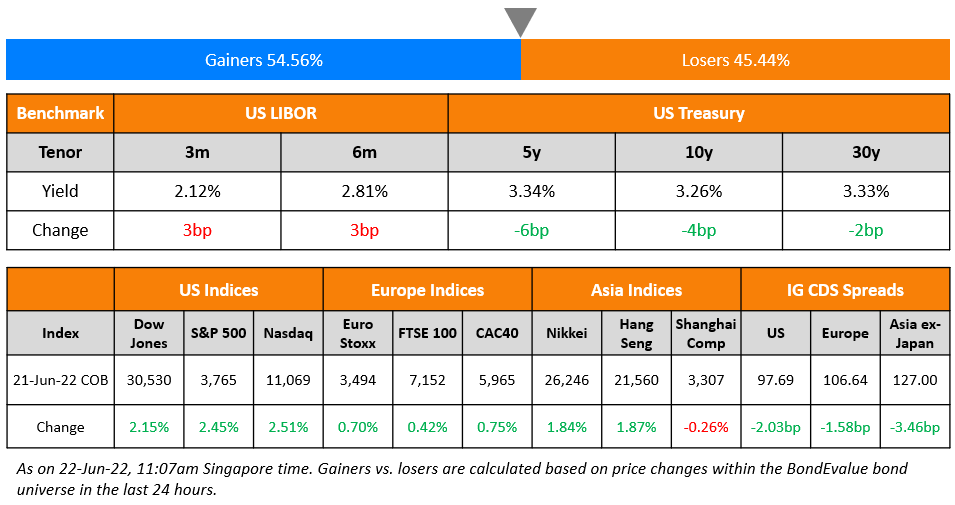

Snapping its recent downtrend, US equity markets posted strong gains on Tuesday with the S&P and Nasdaq up 2.5% each. Sectoral gains were led by Energy and Consumer Discretionary that gained 5.1% and 2.8 respectively. US 10Y Treasury yields fell 4bp to 3.26%. European markets inched higher too, with the DAX, CAC and FTSE up 0.2%, 0.8%, and 0.4% respectively. Brazil’s Bovespa was down 0.2%. In the Middle East, UAE’s ADX and Saudi TASI closed 1.2% and 2.6% higher respectively. Asian markets have opened lower – HSI, STI and Shanghai were down 1.3%, 0.6% and 0.5% respectively while Nikkei was flat. US IG CDS spreads tightened 2bp and HY spreads were 12.3bp tighter. EU Main CDS spreads were 1.6bp tighter and Crossover spreads were 5.7bp tighter. Asia ex-Japan IG CDS spreads tightened 3.5bp.

Unsure of what to expect when an issuer is on the brink of default? Sign up for the new two-session masterclass focused on debt restructuring. The masterclass will be conducted virtually by Asian high yield and liability management expert Florian Schmidt on 30 June and 18 July and will cover, among other things, case studies on Sri Lanka and recent consent solicitation and schemes transacted by Chinese property developers including Guangzhou R&F Properties.

New Bond Issues

- GS Caltex $ 3.5Y at T+170bp area

Korea Western Power (Kowepo) raised $300mn via a 3Y green bond at a yield of 4.273%, 40bp inside initial guidance of T+130bp area. The bonds have expected ratings of Aa2/AA (Moody’s/S&P). Proceeds will fund and/or refinance new and existing eligible projects under Kowepo’s green and sustainability financing framework.

HSBC France raised €750mn via a 6Y covered bond at a yield of 2.564%, 2bp inside the initial guidance of MS+22bp area. The bonds have expected ratings of Aaa/AAA, and received orders over €1bn, 1.3x issue size.

VW International raised €1.5bn via a green dual-trancher. It raised €750mn via a 2.75Y bond at a yield of 3.152%, ~32.5bp inside initial guidance of MS+145/150bp area. It also raised €750mn via a 5.25% bond at a yield of 3.85%, ~42.5bp inside initial guidance of MS+195/200bp area. The senior unsecured bonds are rated A3/BBB+ and received orders over €5.4bn, 3.6x issue size. Net proceeds will be used to finance and / or refinance eligible Green Projects as defined by VW‘s Green Finance Framework (GFF) dated March 2020. A Second Party Opinion (SPO) (Term of the Day, explained below) on the GFF has been issued by Sustainalytics

Fujian Jinjiang Urban Construction raised $142mn via a 364-day bond at a yield of 4.5%, 30bp inside initial guidance of 4.8% area. The bonds are unrated. Proceeds will be used for project construction and debt repayment, as well as for working capital.

Linyi City Development Group raised $300mn via a 3Y bond at a yield of 5.2%, 30bp inside initial guidance of 5.5% area. The bonds have expected ratings of BBB-. Proceeds deal will be used for project construction and operational capital.

Hanwha Energy raised $300mn via a 3Y green bond at a yield of 4.237%, 37.5bp inside initial guidance of T+125bp area. The bonds have expected ratings of Aa2/AA/AA-. Proceeds will be used to refinance renewable energy projects in accordance with Hanwha’s green financing framework.

New Bonds Pipeline

- Bank of East Asia hires for $ 6NC5 bond

- Busan Bank hires for $ Social bond

- Continuum Energy Aura hires for $ Green Bond

Rating Changes

- Moody’s upgrades InfoPro Digital’s CFR to B2 from B3; outlook stable

- Moody’s downgrades Jingrui to Ca/C; outlook negative

Term of the Day

Second Party Opinion

A Second Party Opinion (SPO) in the ESG bonds space refers to an independent review of the selection criteria for the projects financed by ESG bonds and of the allocation of funds. An SPO tries to provide an assurance that the bond framework is aligned to accepted market principles like the ICMA Green Bond Principles for example. There are separate companies that provide SPOs, having been considered to have expertise and reputation in this field. Prominent players in this space include Sustainalytics, CICERO, Vigeo Eiris, ISS ESG, S&P Global amongst others.

Talking Heads

On Ray Dalio Saying Reducing Inflation Will Come at Great Cost

There isn’t anything that the Fed can do to fight inflation without creating economic weakness… With debt assets and liabilities as high as they are and projected to increase due to the government deficit, and the Fed also selling government debt, it is likely that private credit growth will have to contract, weakening the economy… long run the Fed will most likely chart a middle course that will take the form of stagflation”

On Backing a 50 or 75bp rate hike in July – Richmond Fed President Thomas Barkin

“I am pretty comfortable with what Jay (Powell) said…He gave a range that feels pretty reasonable… “You really don’t want to inadvertently break something and lead to a significant pullback in the reactions of economic actors that you weren’t anticipating.”

On not all recessions being alike – US Treasury Secretary Janet Yellen

“A shorthand of two quarters of negative growth has typically worked, and so a lot of people think of it that way… But recessions aren’t all the same… There are deep recessions. There are shallow recessions. There are recessions that have rapid recovery. There are recessions that might raise the unemployment rate slightly, but not a whole lot”

On Brazil’s Central Bank Backs Higher Key Rate to Anchor Prices

Adriana Dupita, Brazil economist

“The message is consistent with our view that policy makers will keep interest rate high for longer to bring inflation down around the target over the medium term. We believe the rate will peak at 13.75% after 25-bp increases in August and September”

Mirella Hirakawa, an economist at local asset manager AZ Quest Investimentos Ltda

“The minutes were “more hawkish than markets expected… They need higher rates to anchor estimates”

Top Gainers & Losers – 22-June-22*

Go back to Latest bond Market News

Related Posts: