This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

September 23, 2022

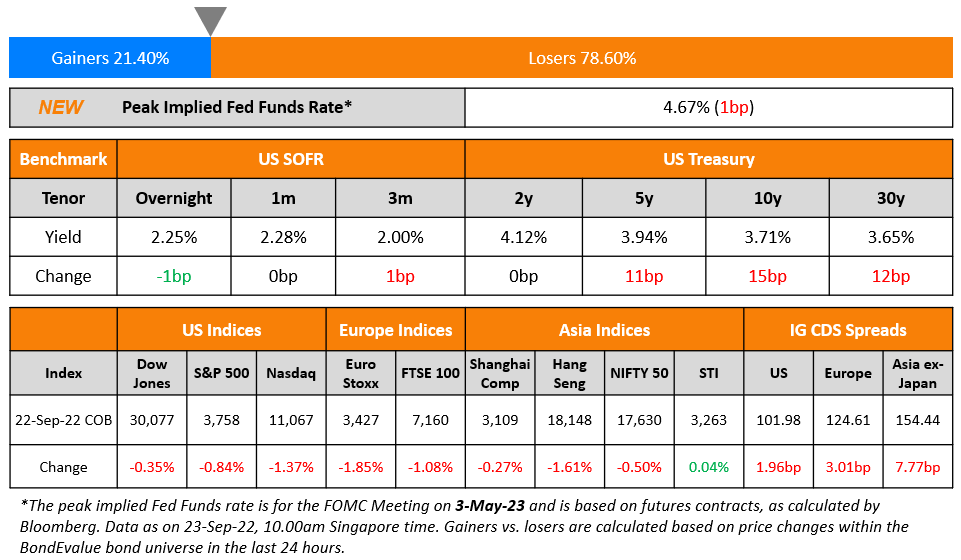

Thursday was a spike in the long-end of the US Treasury curve, leading to a 15bp bear steepening in the 2s10s. 10Y yields jumped 15bp to 3.71% and the 30Y was up 12bp to 3.65% while the 2Y was flat. This comes after the 2s10s curve bear flattened by 16bp in the immediate aftermath of the FOMC meeting a day prior. The US 30Y fixed rate mortgage rate rose to 6.29%, its highest in the last 14 years. The sell-off in the long-end yesterday could be on account of convexity hedging (Term of the Day, explained below). The peak Fed Funds Rate currently stands at 4.67% for the FOMC’s May 2023 meeting. US credit markets saw spreads widening with IG CDS spreads wider by 2bp and US HY spreads wider by 10bp. US equity markets continued to trend lower on Thursday with the S&P and Nasdaq down 0.8% and 1.4% respectively.

European equity markets were down ~1.5%, and credit markets saw EU Main CDS spreads rise by 3.1bp and Crossover spreads move 17.8bp higher. The Bank of England (BoE) hiked its benchmark rates by 50bp to 2.25% and indicated that it will respond forcefully and as necessary to counter inflation. The BoE expects inflation to peak just below 11% in October and after that to remain above 10% for a few months. Inflation in the UK in August stood at 9.9% YoY. The Swiss National Bank (SNB) also hiked its policy rate, by 75bp to 0.5% from -0.25%, thereby exiting over seven years of negative interest rates.

Asia ex-Japan CDS spreads widened 7.8bp. Asian equity markets have opened broadly negative today, down ~0.5%. The Bank of Japan (BoJ) intervened in its currency market for the first time since 1998 as the yen breached the 145-mark against the US dollar. A BoJ official said that the yen’s decline was sudden and one-sided, with the currency depreciating 20% YTD as the central bank’s policy divergence widens vs. the US. The BoJ said that it intends to maintain its negative rate policy.

IBF-STS Course on Digital Assets | 29 Sep 2022 (In-person in Singapore)| 70/90% Funding

New Bond Issues

- Yancheng Oriental Investment & Development Group $ 3Y, final at 7%

- Jinan Shizhong $ 364-day at 6.3% area

Royal Caribbean raised $2bn via a two-tranche deal. It raised

- $1bn via a 6.25NC2.5 bond at a yield of 8.25%, unchanged from initial guidance. The senior secured bonds have expected ratings of Ba3/BB-. Proceeds will be used to redeem its 10.875% 2023 notes.

- $1bn via a 6.25NC2.5 bond at a yield of 9.25%, unchanged from the initial guidance of 9.25% area. The senior guaranteed bonds have expected ratings of B3/B+. Proceeds will be used to redeem its 9.125% 2023 notes.

This is only the second high yield bond issuance over a billion dollars so far this month from the US and the largest in the junk bond space this month, after Nortonlifelock raised $1.5bn two weeks ago, via a dual-trancher.

Citigroup raised $2.75bn via a 4NC3 bond at a yield of 5.61%, 22bp inside initial guidance of T+170bp area. The senior unsecured bonds have expected ratings of A3/BBB+/A. If not called by the redemption date of 29 December 2025, the coupon resets to SOFR plus a spread of 154.6bp. The new bonds are priced 12bp wider to its existing 2.014% 2026s that yield 5.49%.

Clifford Capital raised $200mn via a privately placed 5Y guaranteed bond at a yield of 4.137%. The bonds are guaranteed by the Singapore government.

New Bonds Pipeline

- JBIC hires for $ 5Y Green bond

- Aozora Bank hires for $ 3Y Green bond

- Tianjin Binhai New Area Construction & Investment hires for $ bond

- NH Investment hires for $ 3Y and/or 5Y Green bond

Rating Changes

- Moody’s upgrades NatWest Group’s senior unsecured debt ratings to A3 with stable outlook

-

Moody’s changes Taiwan, China’s outlook to stable from positive, affirms Aa3 rating

- NCR Corp. Ratings Placed On CreditWatch Developing On Planned Business Separation And Uncertain Capital Structure

- Oil And Gas Producer Frontera Energy Outlook Revised To Positive From Stable On Higher Production, ‘B+’ Ratings Affirmed

Term of the Day

Convexity Hedging

Convexity hedging refers to a phenomenon of hedging portfolio interest rate exposure through bonds that stand to get impacted due to duration and convexity changes. This is most commonly used in mortgage-backed securities (MBS), given the prepayment profiles. For example, when interest rates rise, MBS investors would see their portfolio duration rise (as prepayments slowdown) and therefore they would have to cut their exposure to high duration securities – predominantly longer-dated Treasuries and swaps to keep duration levels aligned with the benchmark. Thus for example, if rates rise, principally MBS duration rises and Treasury duration falls thus changing the hedge ratio of MBS vs. Treasuries – effectively having to sell more Treasuries than otherwise to hedge their MBS portfolios. With the US 30Y fixed-rate mortgage rates hitting 6.29%, its highest since 2008, convexity hedging could have been among the factors causing the latest sell-off in ultra-long end yields.

Talking Heads

On Ray Dalio Warning Stocks and Bonds will Fall More

“Right now, we’re very close to 0% a year. I think it’s going to get worse in 2023 and 2024, which has implications for the elections… They need interest rates (short and long rates) up to about 4.5%, and it could be even higher than that level… Who’s going to buy those bonds?… We are in this mode of ‘reducing financial assets”

On Deutsche Bank, UniCredit Signaling Rising Revenue Despite Downturn

Deutsche Bank CFO James von Moltke

On track to reach the “top end” of revenue guidance for the year

UniCredit CEO, Andrea Orcel

“Our financial performance will be further boosted by the constructive rate environment, that was not part of our plan”… bank will give a “substantial upgrade” to its targets alongside third-quarter results.

On Investors Shunnign Macau Casinos’ Bonds as Tourism From China Plummets

Vitaly Umansky, senior analyst for global gaming at Sanford C. Bernstein

“There’s no prognosis for when things will begin to reopen and when you can at least get to a cash-flow-positive environment… At some point, you’re going to have to cut costs because you’re going to run out of money”

James Goldstein, gambling and retail analyst at CreditSights

“It’s just a matter of people becoming impatient with this idea that the recovery is coming, and then it never comes… We need to see some light at the end of the tunnel. People need to see that at least a trend is going in the right direction as opposed to continuing in the current path”

On Hong Kong finance secretary saying no sharp risk to property prices – HK Finance Secy, Paul Chan

“I don’t think there’s a risk of a sharp adjustment. The market transactions are low, but there’s no need to adjust control measures.”

Top Gainers & Losers – 23-September-22*

Go back to Latest bond Market News

Related Posts: