This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

CMB Launches $ Bond; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 25, 2021

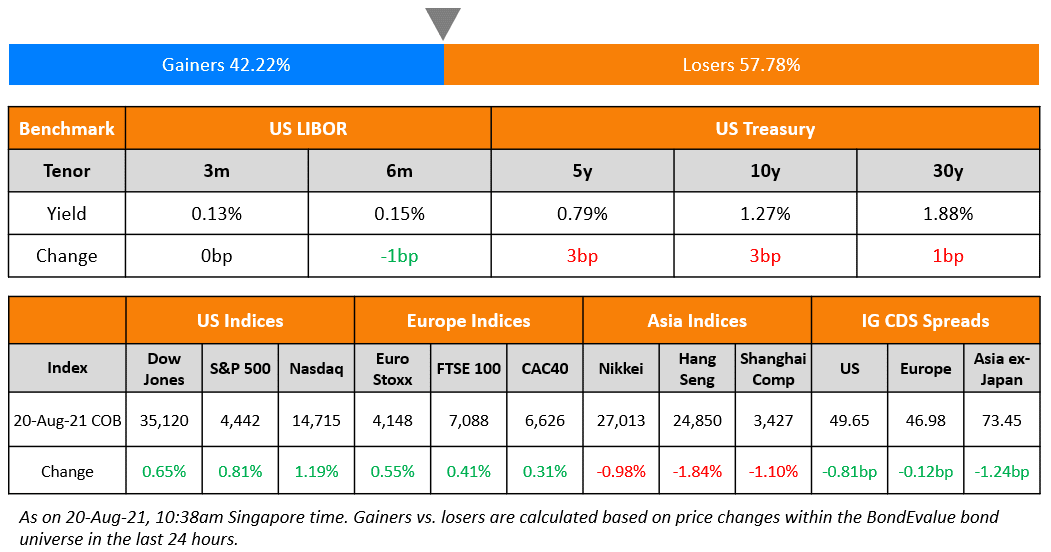

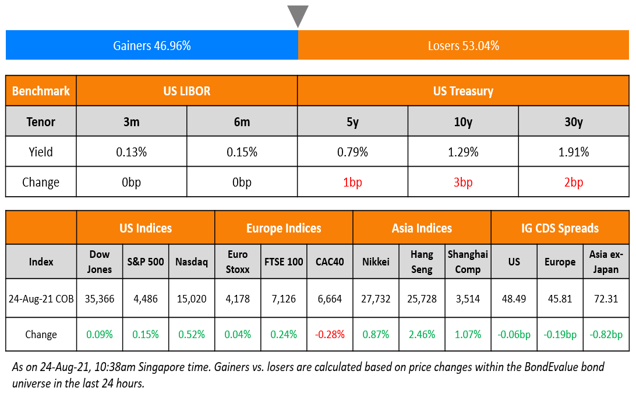

US markets rose for a fourth straight day to close at new records after Chinese tech stocks staged a recovery – S&P and Nasdaq gained 0.2% and 0.5%. Energy, up 1.6% led the gains for a second day, followed by Consumer Discretionary, Financials, Materials and Industrials that were up more than 0.5%. Consumer Staples, Real Estate and Utilities on the other hand were down over 0.5%. European markets had a mixed day – DAX and FTSE were up 0.3% and 0.2% while the CAC was down 0.3%. Saudi’s TASI gained 0.7% while UAE’s ADX was broadly flat. Brazil’s Bovespa staged a impressive recovery and was up 2.3%. Asian markets are having a mixed start – HSI and Singapore’s STI are up more than 0.5%, Nikkei is up more than 0.3% while Shanghai was broadly flat. US 10Y Treasury yields rose 3bp to 1.29%. US IG tightened 0.1bp while the HY CDS spreads tightened 1.1bp. EU Main and Crossover CDS spreads also tightened 0.2bp and 1.1bp respectively and Asian ex-Japan CDS spreads tightened by 0.8bp.

New Bond Issues

-

CMB Luxembourg Branch $ 2Y SOFR sustainability bond at T+85bp area / 5Y green bond at T+95bp area

.png?width=1400&upscale=true&name=New%20Bond%20Issues%2025%20Aug%20(1).png)

Nordea Bank raised $1bn via perpNC8 AT1 at a yield of 3.75%, 62.5bp inside the initial guidance of 4.375% area. The bonds have expected ratings of BBB/BBB+. The coupon is fixed until the first reset date of September 1, 2029. If not called, it will reset on that date and every 5Y thereafter (non-step) to the 5Y Treasury + 260.2bp, payable semi-annually in arrears on the principal amount, subject to Interest Cancellation. The trigger level is set at CET1 ratio of 5.125% of Nordea Group or Nordea Bank. The new AT1s were priced 75bp over its older 6.625% Perps callable in March 2026.

Credit Suisse (London) raised €3bn via a dual trancher. It raised €1.75bn via a 2Y floater at a yield of 0.249%, 10bp inside the initial guidance of 3mE+40 area. The unrated bonds received orders over €2.35bn, 1.3x issue size. It also raised €1.25bn via a 7Y bonds at a yield of 0.639%, 15bp inside the initial guidance of MS+80 area. The unrated bonds received orders over €1.75bn, 1.4x issue size.

ABC International Holdings raised $800mn via a dual trancher. It raised $500mn via a 3Y bond at a yield of 1.144%, 70bp over Treasuries and 45bp inside the initial guidance of T+115 area. It also raised $300mn via a 5Y bond at a yield of 1.627%, 85bp over Treasuries and 50bp inside the initial guidance of T+135 area. The bonds have expected ratings of A2 and received combined orders over 4.3bn, 5.4x issue size. The proceeds will be used for proceeds for general corporate purposes by investment banking arm of Agricultural Bank of China. The bonds will be issued by its wholly owned subsidiary Inventive Global Investments with guarantee from ABC International Holdings. ABC’s new 5Y bonds priced ~5bp inside its older 1.65% bonds due 2025 despite the longer tenor. UOL Group raised S$400mn via a 7Y bond at a yield of 2.33%, 17bp inside the initial guidance of SOR+110.5bp. The unrated bonds received orders over S$700mn, 1.75x issue size. Fund managers and insurance companies bought 74%, banks and public sector agencies 22% and private banks 4%. Singapore accounted for 97% of the deal with others making up 3%. Singapore bought 97% and others 3%.

New Bonds Pipeline

- SGX hires for $ 5yr Reg S bond

- Perusahaan Pengelola Asset hires for $ bond

Rating Changes

- Fitch Upgrades Gabon to ‘B-‘; Outlook Stable

- Fitch Downgrades Intralot’s IDR to ‘RD’ on Exchange Completion; Subsequently Upgrades to ‘CCC+’

- Quad/Graphics Inc. Outlook Revised To Positive By S&P On Debt Paydown, Improving Operating Performance; Ratings Affirmed

- Fosun International Outlook Revised To Stable By S&P On Lengthening Debt Maturities; ‘BB’ Rating Affirmed

- Fitch Affirms Telecom Argentina’s Ratings; Revises LC Outlook to Stable

- Fitch Revises Rating Watch on Huarong Financial Leasing to Evolving

Term of the Day:

Yankee Bonds

These are a type of Eurobond issued and traded in the US and denominated in USD. In essence, if a non-US based company issues a USD bond which is traded in the US, the bond is considered a Yankee bond. This is in comparison to a Eurodollar bond that is issued by a foreign entity denominated in USD, but the bonds are issued and traded outside of the US.

Indonesia’s Medco Energi recently announced plans to issue up to $800mn of Yankee bonds with a maximum of 8% annual coupon and expected tenor of 7Y.

Talking Heads

“While the market will likely hold up through Fed tapering, those wishing to hedge associated risk should consider using credit or credit volatility rather than equities given credit’s more limited upside and lower implied volatility levels.” “We are positive on spreads but anticipate near-term choppiness due to delta risks and Jackson Hole.”

On the recent bond rally a signal of bad news – in a report by Bank of America strategists Paul Ciana, Adarsh Sinha and Janice Xue“This cross asset conundrum casts a shadow over risk taking in 2H21.” “Rising ratios suggest a rotation into safety and/or rebalancing trend that can continue while supports remain or top form.”

On the optimistic outlook for China – Cathie Wood, head of Ark Investment Management

“I’m not pessimistic about China longer run because I think they’re a very entrepreneurial society.” “Sure, the government is putting more rules and regulations in, but I don’t think the government wants to stop growth and progress at all.” “What I will say, though, is I’m a little more optimistic about the United States and other economies, so it’s more of a relative sort of thing.”

“China’s bond markets are governed by multiple regulators with different sets of requirements, which could lead to regulatory arbitrage.” “Now the unified application of the securities law to bond issuance will help streamline the process and eliminate the difference in regulations. This is a positive step for the development of the industry.”

On the possibility that Citic becomes more important to the government following Huarong bid – in a report by S&P

“CITIC Group Corp. could increase its importance to the Chinese government, if the conglomerate proceeds with plans to make a sizable investment in the struggling China Huarong Asset Management Co. Ltd.”

Top Gainers & Losers – 25-Aug-21*

.png)

Go back to Latest bond Market News

Related Posts: