This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Westpac Launches S$ Bond; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 30, 2022

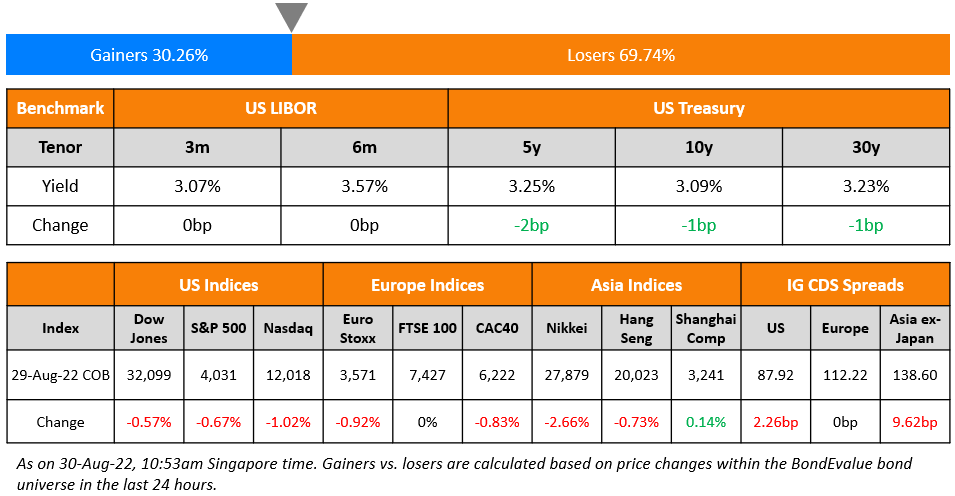

US equity markets continued its broad downward move on Monday with the S&P and Nasdaq down by 0.7% and 1% respectively. Sectoral losses were led by IT, down 1.3% and Real Estate, down 0.9% while Energy rose 1.5%. US 10Y Treasury yields were 1bp lower at 3.09%. European markets trended broadly lower – DAX and CAC were down 0.6% and 0.8% while FTSE was closed due to the summer bank holiday. Brazil’s Bovespa was flat. In the Middle East, UAE’s ADX fell 0.6% while Saudi TASI was flat. Asian markets have opened mixed today – Shanghai and HSI are down 0.6% and 0.9% respectively while Nikkei and STI were up 1% and 0.5% respectively. US IG CDS spreads widened 2.3bp and US HY spreads were wider by 14.9bp. EU Main CDS spreads were flat and Crossover spreads widened by 29.6bp. Asia ex-Japan IG CDS spreads widened 9.6bp.

New Bond Issues

- Westpac S$ 10NC5 Tier 2 at 4.9% area

New Bonds Pipeline

- Macquarie Bank hires for € 5Y bond

- Aozora Bank hires for $ 3Y Green bond

- Tianjin Binhai New Area Construction & Investment hires for $ bond

- NH Investment hires for $ 3Y and/or 5Y Green bond

Rating Changes

- Moody’s upgrades DTE Energy Center to Baa2; outlook revised to stable

- Range Parent Inc. Downgraded To ‘CCC’ On Weaker Operating Performance And Constrained Liquidity; Outlook Negative

- Chalieco Downgraded To ‘BB-‘ On Slow Deleveraging Prospects; Outlook Stable

- Dalian Wanda Commercial Outlook Revised To Negative On Uncertainty Over Subsidiary Listing; ‘BB+’ Ratings Affirmed

Term of the Day

Bid-to-Cover

Bid-to-cover is a ratio of the number of bids or orders received for a particular security issuance vs. the amount issued. The bid-to-cover ratio indicates the demand for an issuance – higher the ratio, higher the demand and lower the ratio, lower the demand.

Longfor Group last week issued the first state-backed local bonds under China’s developer rescue pilot program by raising RMB 1.5bn ($219mn) 3Y notes at a yield of 3.3%, with the issuance receiving a bid-to-cover of 2.86x.

Talking Heads

On Fed’s QT Ramp-Up Threatening Market Liquidity – Macro Strategist Tchir

“What I find most difficult to talk about is if you go back to last summer when the Fed insisted on doing QE, they kept talking about market liquidity as the reason to do QE… I can guarantee you that market liquidity, especially in Treasuries, is way worse now than it was last summer… I think we’ve already turned the corner on the economy in a negative way. We’re seeing things roll over and I’m willing to bet that by December we’re complaining about deflation and real problems in the economy”

On ECB Setting the Stage for Another Big Hike With Jumbo Move Possible

Executive Board member Isabel Schnabel

“We have basically little choice than to continue our normalization path.”

Bundesbank chief Joachim Nagel

“It is much too early to think about” when rate increases should stop.

Latvia’s Martins Kazaks

“What I would very carefully monitor is inflation expectations, headline inflation, but most importantly, core inflation”

On Fed to stay focused on inflation, markets will be volatile – UBS Global Wealth CIO, Mark Haefele

“We do think that inflation is going to start to come down… (Value) is one area where we would be more focused… We’re very focused on when there is a catalyst because many EM stocks are much cheaper than U.S. stocks”… The US Fed will not back away from “talking tough” on the markets until there is significant progress on inflation.

On ECB should raise rates at steady pace – Chief economist, Philip Lane

“A steady pace – that is neither too slow nor too fast – in closing the gap to the terminal rate is important for several reasons… The appropriate size of the individual increments will be larger the wider the gap to the terminal rate and the more skewed the risks to the inflation target… While upside risks to inflation are currently more intense than downside risks, if the incoming data…call for a downward shift in the terminal rate, this would be easier to handle under a step-by-step approach”

Top Gainers & Losers – 30-August-22*

Go back to Latest bond Market News

Related Posts: