This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

September 30, 2022

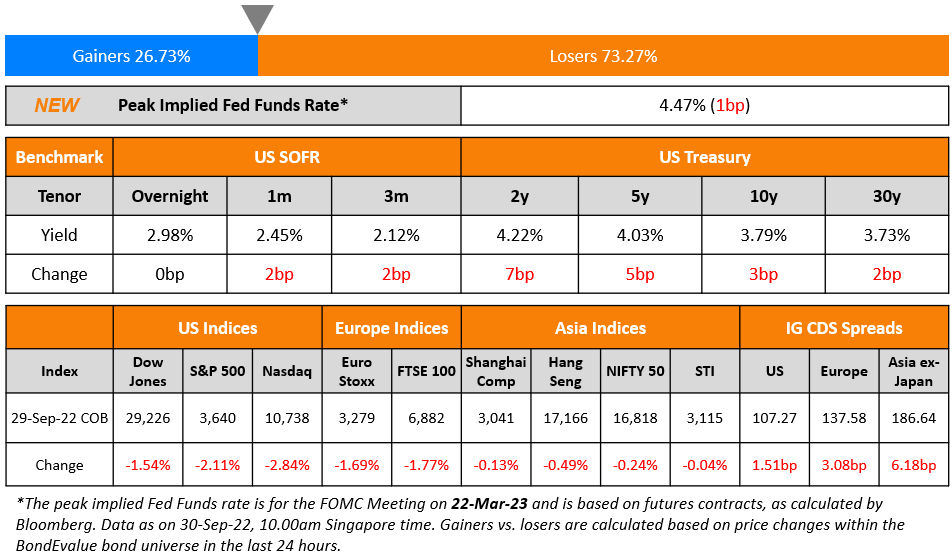

US Treasury yields rose on Thursday with the 10Y yield up 3bp to 3.79% and the 2Y higher by 7bp to 4.22%. The peak Fed Funds Rate currently stands at 4.47% for the FOMC’s March 2023 meeting. US credit markets saw a widening of CDS spreads, with IG wider by 1.5bp and HY moving up by 7bp. US equity markets ended lower with the S&P and Nasdaq down 2.1% and 2.8% respectively.

European equity markets were broadly negative, down over 1.5% and credit markets saw EU Main CDS spreads widen by 3.1bp and Crossover spreads move 11.6bp higher. Inflation in Germany surged to 10% in September, against estimates of 9.4% and August’s print of 7.9%. Also, the ECB’s preferred gauge of inflation, the Harmonised Index of Consumer Prices (HICP) hit double digits for the first time in 20 years to 10.9% for September against expectation of 10%, and August’s 8.8% print. Regarding the sell-off in UK gilts earlier this week, it is said that Liability Driven Investors (LDIs) like pension funds had exacerbated the move on the long-end after having received margin calls. CNBC notes that long-maturity bonds represent around 67% of Britain’s roughly £1.5tn ($1.6tn) liability driven investment funds that are leveraged and use gilts as collateral to raise cash.

Asia ex-Japan CDS spreads widened 6.2bp and Asian equity markets have opened mixed today.

Complimentary Webinar | How to Use the BondEvalue App to Better Track Your Bonds | 10 Oct 2022

New Bond Issues

Kepco raised $800mn via a two-tranche green deal. It raised

- $500mn via a 3.5Y bond at a yield of 5.426%, 30bp inside initial guidance of T+150bp area. The new bonds are priced at a new issue premium of 47.6bp vs. its existing 6% 2026s that yield 4.95%

- $300mn via a 5.5Y bond at a yield of 5.598%, 30bp inside initial guidance of T+190bp area

The senior unsecured green bonds have expected ratings of Aa2/AA. Proceeds will be used to finance eligible projects as defined in Kepco’s sustainable finance framework dated September 2021.

Tongling State-owned Capital Operation Holding Group raised $200mn via a 3Y bond at a yield of 6%, 45bp inside the initial guidance of 6.45% area. The senior unsecured credit enhanced bonds are unrated and supported by a letter of credit from Huishang Bank.

New Bonds Pipeline

- Public Investment Fund hires for $ Green bond

- Aozora Bank hires for $ 3Y Green bond

Rating Changes

- Fitch Upgrades Cheniere Energy Partners’ IDR to ‘BBB-‘; Outlook Stable

- Moody’s downgrades Zhenro’s ratings to Ca/C; outlook remains negative

- Moody’s affirms China Jinmao’s Baa3 ratings; outlook stable

Term of the Day

Catastrophe Bonds

Catastrophe Bonds also referred as Cat Bonds are risk-linked securities that are designed in favor of the issuer as these allow the transfer of risks related to a major catastrophe or a natural disaster to the investors. These are generally high yield debt instruments that payout to issuers in case of specific triggers. These bonds essentially act as insurance policies against natural disasters and are generally purchased by governments, insurance and reinsurance companies. In the event of a trigger event, the proceeds are paid to the borrower and the principal repayment and interest payments are either deferred or cancelled. In case the trigger event does not occur, the borrower continues to pay the interest and the principal as scheduled, similar to a regular bonds. These bonds have gained traction as the frequency of natural disasters is on the rise.

Bloomberg reports that investors buying cat bonds are preparing to face large losses from Hurricane Ian.

Talking Heads

“At this point price stability is still job one. We have to get that out of the way… As inflation moves back down, then those decisions become judgments about when do you hold, how long do you hold, when do you move things back down. But right now the focus is on making sure that we’ve achieved price stability”

On ‘Comfortable’ with 4.5%-5% Fed policy rate in 2023 – San Francisco Fed’s Mary Daly

“I’m quite comfortable. It’s going to take restrictive policy for a duration of time to get clear and convincing evidence that inflation is getting back to 2% — so from my mind, that’s at least through next year… I’m really looking at have financial conditions tightened more than the funds rate has tightened, and more than they were projected to be tight”

On China Junk Dollar Bonds Extending Record String of Quarterly Losses

CreditSights analyst Zerlina Zeng

“Most investors deem the property market entering into a prolonged structural downcycle and it just doesn’t make sense for them to bet on property bonds”

On BlackRock, Amundi Stumbling in China as Wealth Products Disappoint

Harry Hendley, senior associate, Z-Ben Advisors

“They entered the market at a difficult time. For fixed income-focused Amundi, it faces an environment where onshore yields are falling… Amundi made it clear from the outset of this joint venture that it will stay away from the shadow-banking exposure that is a yield-enhancing staple of products from local banks. It is essentially a trade-off between instilling global risk management standards and meeting onshore performance expectations”

Top Gainers & Losers – 30-September-22*

Go back to Latest bond Market News

Related Posts: