This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

KDB Launches $ Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 31, 2022

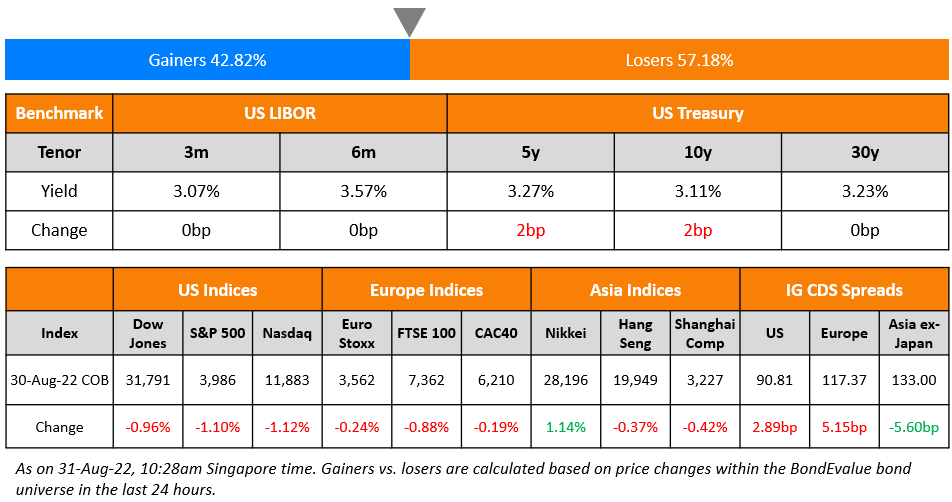

US equity markets further extended its downward move on Tuesday with the S&P and Nasdaq down by 1.1% each. All sectors were in the red, with Energy falling the most, by 3.4%, followed by Industrials and Materials, down over 1.5% each. US 10Y Treasury yields were 1bp lower at 3.09%. European markets were mixed – DAX ended 0.5% higher while CAC and FTSE were down 0.2% and 0.9% respectively. Brazil’s Bovespa was down 1.7%. In the Middle East, UAE’s ADX ended almost unchanged while Saudi TASI was down 0.6%. Asian markets have opened with a negative bias today – Shanghai, HSI, STI and Nikkei were down 0.8%, 1.2%, 0.7% and 0.6% respectively. US IG CDS spreads widened 2.9bp and US HY spreads were wider by 14.4bp. EU Main CDS spreads were 5.2bp wider and Crossover spreads widened by 21.7bp. Asia ex-Japan IG CDS spreads tightened 5.6bp.

New Bond Issues

-

KDB $ 3Y/3Y Floating/10Y at T+90bp area/SOFR Equivalent/T+140bp area

BNP Paribas raised €1bn via a PerpNC7.25 AT1 bond at a yield of 6.869%, 13.1bp inside initial guidance of 7% area. The AT1 Perps have expected ratings of Ba1/BBB-/BBB, and received orders over €1.7bn, 1.7x issue size. Proceeds will be used for the general corporate purposes. The bonds have a call date on 6 December 2029 and every five years thereafter. If not called, the coupon rate resets to 5Y EURIBOR plus a spread of 464.5bp.

NatWest raised €1bn via a 6NC5 green bond at a yield of 4.067%, 25bp inside initial guidance of MS+210bp area. The bonds have expected ratings of Baa1/BBB/A, and received orders over €1.9bn, 1.9x issue size. Proceeds will be used to finance Eligible Green Loans in the ‘Renewable Energy and Green Buildings’ categories as described in NatWest’s ‘Green, Social and Sustainability Bond Framework’. The bonds have a call date of 6 September 2027. If not called, the coupon rate will reset quarterly to 3M EURIBOR plus a spread of 191.4bp

Commerzbank raised €500mn via a 10.25NC5.25 Tier 2 bond at a yield of 6.56%, 460bp inside initial guidance of MS+460bp area. The Tier 2 bonds have expected ratings of Baa3/BB+, and received orders over €1.5bn, 3x issue size. The bonds are callable from 6 September 2027 to 6 December 2027. If not called, the coupon rate resets to 5Y EURIBOR plus a spread 430bp.

Westpac raised S$450mn via a 10NC5 Tier 2 bond at a yield of 4.65%, 25bp inside initial guidance of 4.9% area. The Tier 2 bonds have expected ratings of Baa1/BBB+. The bonds have a call date of 7 September 2027. If not called, the coupon rate resets to 5Y SORA OIS plus a spread of 175.1bp.

Siemens raised €3bn via a four-tranche deal as shown in the table below

The senior unsecured bonds have expected ratings of A1/A+. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Macquarie Bank hires for € 5Y bond

- Aozora Bank hires for $ 3Y Green bond

- Tianjin Binhai New Area Construction & Investment hires for $ bond

- NH Investment hires for $ 3Y and/or 5Y Green bond

Rating Changes

- Moody’s downgrades CIMIC’s rating to Baa3; outlook stable

- Envision Healthcare Corp. Downgraded To ‘SD’ From ‘CCC’ On Distressed Debt Exchange

- FirstGroup Outlook Revised To Stable On Solid Operating Performance; ‘BBB-‘ Ratings Affirmed

Term of the Day: Three Red Lines

The ‘three red lines’ are leverage guidelines set for select property developers in China. They consist of caps on the following ratios:

- Liabilities to assets (ex-advanced proceeds) not more than 70%

- Net Debt to Equity not more than 100%

- Cash to Short-term Debt greater than 1x

These ratios were devised by China’s PBOC and Ministry of Finance. Not adhering to these ratios would result in them being cut-off from new loans. Those who adhere to all three ratios can increase debt by 15% in the subsequent year.

Talking Heads

On Size of September Rate Hike Hinging on ‘Totality’ of Data – Fed’s Williams

“We need to have somewhat restrictive policy to slow demand and we’re not there yet”. The size of the move at the Fed’s move at its Sept. 20-21 meeting will depend on the “totality” of the data.

On Inflation Progress Could Allow Slowing of Rate Hikes – Fed’s Bostic

“Incoming data — if they clearly show that inflation has begun slowing — might give us reason to dial back from the hikes of 75 basis points that the Committee implemented in recent meetings. We will have to see how those data come in… History is instructive on this point… This summer’s data showed glimmers of good news on the fight against inflation”

On Credit Markets Underpricing Recession Risk – UBS

“Remain cautious on credit. With labor markets too strong and inflation too high, tightening needs to persist with risks to growth and vol now greater to the downside and upside, respectively, implying a widening bias for spreads”… Current credit spread levels imply a 25% chance of a recession, compared to UBS’s forecast of a 55% chance.

On ECB needing to act decisively; Recession fears should not constrain policy -ECB’s Nagel

“Monetary policy must react decisively in order to preserve the credibility of the inflation target. Data from a number of countries shows that frontloading or bringing interest rate increases forward, reduces the risk of a painful economic downturn… In my view, a larger interest rate hike reduces the risk of inflation expectations becoming de-anchored”

Top Gainers & Losers – 31-August-22*

Go back to Latest bond Market News

Related Posts: