This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

July 8, 2022

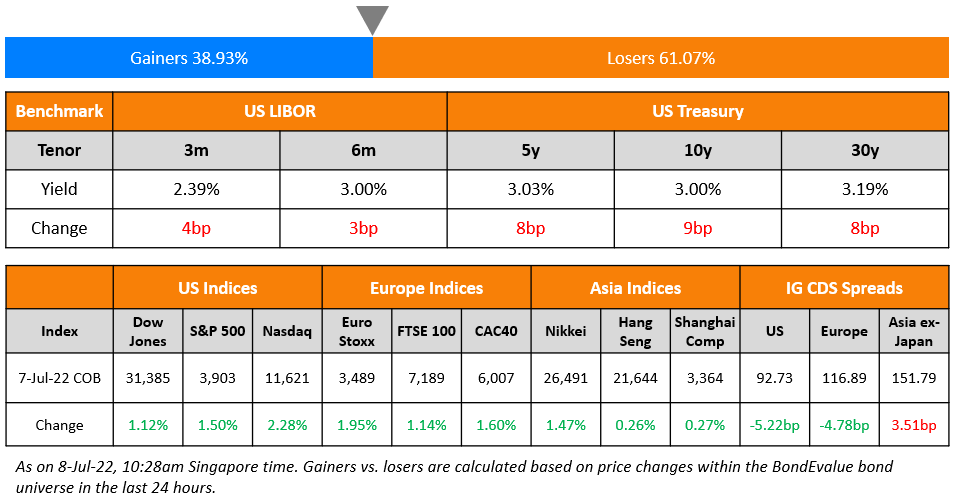

US equity markets continued to trend higher on Thursday with the S&P and Nasdaq up 1.5% and 2.3% respectively. Sectoral gains were led by Energy rose over 3.5% followed by Consumer Discretionary, up 2.5%. US 10Y Treasury yields were 9bp up at 3%. European markets also ended higher with the DAX, CAC, and FTSE rising by 2%, 1.6% and 1.1%. Brazil’s Bovespa also posted strong gains of 2%. In the Middle East, UAE’s ADX fell 0.3% while Saudi TASI gained 0.6%. Asian markets have risen to a positive start – Shanghai, STI, HSI and Nikkei were up 0.2%, 0.3% each and 1.4% respectively. US IG CDS spreads tightened 5.2bp and US HY spreads were tighter by 30.8bp. EU Main CDS spreads were 4.7bp tighter and Crossover spreads were tighter by 23.9bp. Asia ex-Japan IG CDS spreads widened 3.5bp.

Pakistan hiked its benchmark interest rates by 125bps to 15% to tame inflation which rose to 13-year high in June at 21.3%. Pakistan’s central bank expects inflation to be 18-20% levels in 2022 and GDP to grow at 3-4%. Separately, Peru also raised its interest rates, by 50bps to 6%, the twelfth time in the last two years. Inflation was at 8.81% in June, well above central bank target of 1-3%.

Learn about what to expect in a corporate debt restructuring in the upcoming masterclass, which will be conducted virtually via Zoom on 18 July 2022. The session will cover in-court vs. out-of-court restructurings, chapter 11, cross-border insolvencies with a focus on China, and case studies on recent restructurings including a deep dive on the recent consent solicitation and schemes transacted by Chinese property developers including Guangzhou R&F Properties. Click on the banner above to sign up!

New Bond Issues

Societe Generale raised S$200mn via a PerpNC5.5 AT1 at a yield of 8.25%, 25bp inside initial guidance of 8.5% area. The subordinated bonds are rated BB/BB+ (S&P/Fitch). If not called on December 15, 2027, the coupon will reset then and every five years thereafter to the prevailing SORA plus initial credit spread of 560bp. SocGen is the second foreign bank to sell an AT1 note in Singapore this year. Both deals were about a week apart, with Barclays raising S$450mn via a PerpNC5.5 at a yield of 8.3% on June 30. However, in terms of spread adjustment, SocGen’s AT1 was priced at SORA+560bp vs. Barclays’ SORA+545.5bp. IFR noted that there is some indigestion of bank capital notes in the Singapore dollar market, which may explain the relatively small size of SocGen’s deal. In comparison to SocGen’s newly priced Perp, Barclays’ AT1, rated Ba2/BBB, offers a yield pickup of 8.1bp, currently yielding 8.34% to call.

LG Chem raised $300mn via a 3Y green bond at a yield of 4.436%, 25bp inside initial guidance of T+165bp area. The bonds are rated A3/BBB+ (Moody’s/S&P) and received orders over $1bn, 3.3x issue size. Fund and asset managers bought 36%, banks 27%, insurance/pension funds 26%, official institutions 9% and private banks 2%. APAC took up 33%, EMEA 37% and the US 30%. Proceeds will be used for eligible green projects under the South Korean petrochemical producer’s green financing framework.

Shanghai Pudong Development Bank London branch (SPDB London) raised $400mn via a 3Y green bond at a yield of 3.357%, 48bp inside initial guidance of T+80bp area. The bonds are rated Baa2 and received orders over $2.6bn, x issue size. Proceeds will be used to finance and/or refinance eligible green assets or projects as set out in SPDB’s green bond framework.

New Bonds Pipeline

- Korea Housing Finance Corp hires for € 4Y Social Covered bond

- Busan Bank hires for $ Social bond

- Continuum Energy Aura hires for $ Green Bond

Rating Changes

- Moody’s downgrades Times China to Caa1/Caa2; outlook negative

- Fitch Downgrades Helenbergh China to ‘B-‘; On Rating Watch Negative

- Fitch Downgrades Lippo Malls Indonesia Retail Trust to ‘B’; Outlook Stable

- Fitch Downgrades Belarus’s Long-Term Foreign-Currency IDR to ‘C’

- Transocean Ltd. Issuer Credit Rating Lowered To ‘CCC-‘ On Potential Balance Sheet Restructuring; Debt Ratings Lowered

- Fitch Revises Standard Chartered PLC’s Outlook to Stable; Affirms at ‘A’

Term of the Day

Structural Subordination Risk

Structural subordination risk refers to the risk that most of the claims of the holding company are at its operating subsidiaries where these claims have a priority over the claims at the holding company in the event of a bankruptcy. Essentially, a lender to a parent is structurally subordinated to other lenders who have lent money to the subsidiary. Hence, lenders to the parent company will not have access to the subsidiary’s assets until the subsidiary’s creditors have been paid back first.

Talking Heads

On Fed Hawks Back 75 Basis-Point July Hike, Still See Soft Landing

Fed Governor Christopher Waller

“We need to move to a much more restrictive setting in terms of interest rates and policy, and we need to do that as quickly as possible… So I am definitely in support of doing another 75 basis-point hike in July, probably 50 in September”

On Asian dollar bond issuance tumbling as companies turn to bank lending

Leonard Kwan, portfolio manager of T. Rowe Price

“Volumes are definitely slower, … I would say we’re probably tracking for 20 per cent lower gross issuance than we had last year… Investment grade names have had no issues in financing – they just have to accept the reality that there’s a higher cost, … but a lot of high-yield issuers are going to struggle to refinance their maturing debt”

Mildred Chua, head of syndicated finance at DBS

“We have seen more borrowers pivoting to the loan market… and we expect this trend to continue with rates expected to stay high”

Owen Gallimore, head of Deutsche Bank’s credit analysis desk in APAC

If U.S. investment-grade issuance is robust and China and Asia U.S.-dollar issuance is relatively weaker, it supports the valuations for dollar China and Asia investment-grade in the secondary bond market”

On Euro Zone Facing Recession With or Without Gas Cut-Off, ING Says

“The long-awaited economic recovery of the euro zone has been canceled… None of the current risk factors for the euro-zone economy is likely to disappear soon… The looming recession, not only in the euro zone but also in the US, along with doubts about debt sustainability in the euro zone”

On ‘Very Likely’ ECB Rate Hikes to Come as Growth Slows – ECB GC Member Klaas Knot

“It may well be that while the economy is slowing in the coming months and quarters, we will increase interest rates… It’s very likely… In an ideal world, you’d want to stimulate the economy but bring inflation down at the same time… Unfortunately that’s not what we can do, we have to make a choice; in that case our mandate is very clear — we have to choose bringing inflation down.”

Top Gainers & Losers – 08-July-22*

Go back to Latest bond Market News

Related Posts: