This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

February 10, 2022

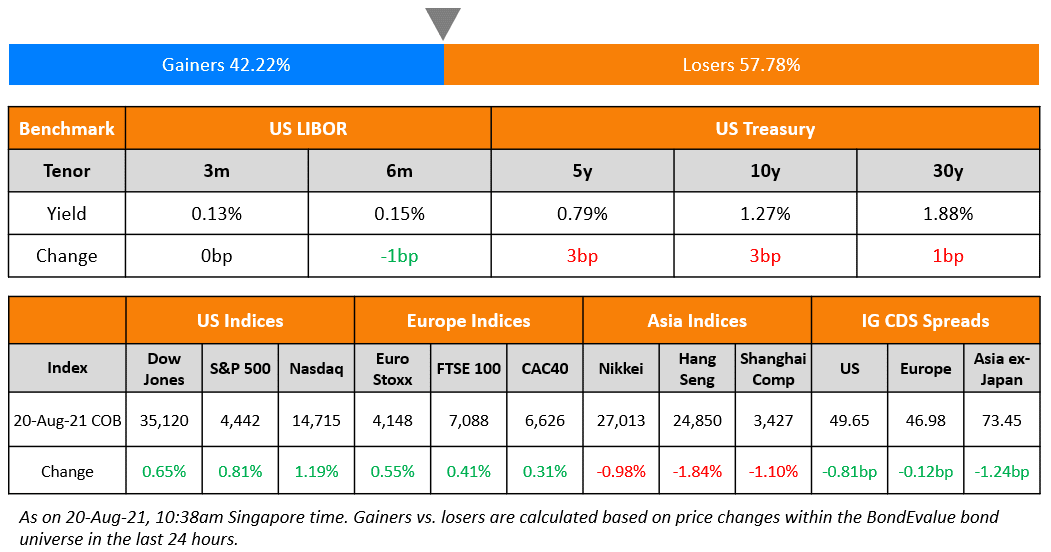

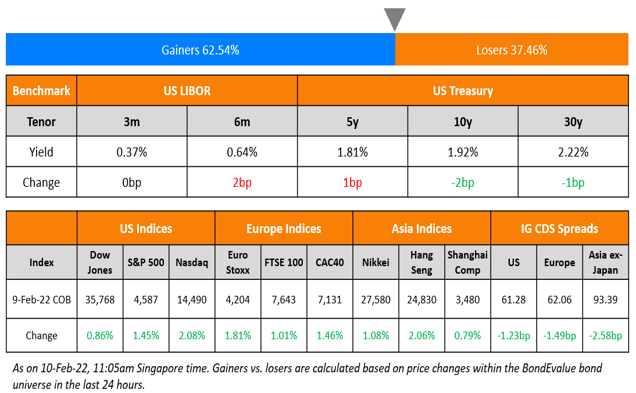

Risk-on sentiment took over global markets with the S&P and Nasdaq ending 1.5% and 2.1% higher. Sectoral gains were led by Communication Services, Real Estate, IT and Materials, up over 2% each. US 10Y Treasury yields eased 2bp to 1.92%. European markets also rallied with the DAX, CAC and FTSE 1.6%, 1.5% and 1% each. Brazil’s Bovespa closed 0.2% higher. In the Middle East, UAE’s ADX was up 0.7% and Saudi TASI closed 0.2% lower. Asian markets have opened with a negative bias – HSI, Shanghai and STI are down 0.44%, 0.10% and 0.06%, while Nikkei is up 0.07%. US IG CDS spreads were 1.2bp tighter and HY CDS spreads were 10bp tighter. EU Main CDS spreads were 1.5bp tighter and Crossover CDS spreads were 5.9bp tighter. Asia ex-Japan CDS spreads were 2.6bp tighter.

New Bond Issues

-

Citic Limited $ 5Y at T+165bp

.png)

Starbucks raised $1.5bn via a two-tranche deal. It raised:

- $500mn via a 2NC1 FRN bond at a yield of 0.47%, 28bp inside the initial guidance of SOFR+70bp.

- $1bn via a 10Y bond at a yield of 3.022%, 25bp inside the initial guidance of T+135bp.

The bonds have expected ratings of Baa1/BBB+. Proceeds will be used for general corporate purposes, which may include the repayment of outstanding indebtedness, including outstanding borrowings under their commercial paper program, the repurchase of their common stock under their ongoing share repurchase program, business expansion, payment of cash dividends on common stock or the financing of possible acquisitions. Starbucks may temporarily invest funds that are not immediately needed for these purposes in short-term investments.

Bank of China raised $600mn via a two-tranche deal across its Johannesburg and Hungary branches. It raised:

- $300mn via a 2Y green bond at a yield of 1.644%, 35bp inside the initial guidance of T+65bp via its Hungary Branch.

- $300mn via a 3Y green bond at a yield of 1.913%, 35bp inside the initial guidance of T+70bp via its Johannesburg branch.

The bonds have expected ratings of A1/A (Moody’s/Fitch). Proceeds will be used to fund and/or refinance eligible green projects under Bank of China’s sustainability series bonds management statement.

CDB HK Branch raised $550mn via a 5Y bond at a yield of 2.125%, 42bp inside the initial guidance of T+75bp. The bonds have expected ratings of A1/A+?A+ (Moody’s/S&P/Fitch). Proceeds will be used for working capital and general corporate purposes.

ING Groep raised €3bn via a two-tranche deal. It raised:

- €1.5bn via a 5NC4 bond at a yield of 1.337%, 20bp inside the initial guidance of MS+105bp. The bonds received orders over €4.1bn, 2.7x issue size. Coupon is fixed until the optional redemption date. If not redeemed, coupon resets quarterly at 3mE+85bp (actual/360).

- €1.5bn via a 9NC8 bond at a yield of 1.821%, 15bp inside the initial guidance of MS+130bp. The bonds received orders over €4.6bn, 3.1x issue size. Coupon is fixed until optional redemption date. If not redeemed, coupon resets quarterly at 3mE+115bp, actual/360.

The bonds have expected ratings of Baa1/A-/A+.

Spain raised €7bn via a 30Y bond at a yield of 1.903%, 2bp inside the initial guidance of SPGB+10bp area. The bonds have expected ratings of Baa1/A/A-, and received orders over €60bn, 8.6x issue size.

Kookmin Bank raised $700mn via a two-tranche sustainability deal. It raised:

- $400mn via a 3Y sustainability bond at a yield of 2.2%, 30bp inside the initial guidance of T+90bp. The bonds received orders over $1.38bn, 3.5x issue size. Asia accounted for 69%, EMEA 13% and the US 18%. Fund and asset managers took 35%, bank treasuries 29%, central banks and agencies took 21%, pension fund and insurance 10%, and private banks and others 5%. The new bonds are priced 6bp wider to its existing 2.125% 2025s that yield 2.14%.

- $300mn via a 5Y sustainability bond at a yield of 2.492%, 30bp inside the initial guidance of T+100bp. The bonds received orders over $1.38bn, 4.6x issue size. Asia took 80%, EMEA 7% and the US 13%. Fund and asset managers bought 44%, bank treasures 53% and private banks and others 3%.

The bonds have expected ratings of Aa3/A+ (Moody’s/S&P).

Japan Bank for International Cooperation (JBIC) raised $1.25bn via a 7Y bond at a yield of 2.157%, 1bp inside the initial guidance of SOFR MS+46bp. The bonds have expected ratings of A1/A+, and received orders over $2bn, 1.6x issue size.

ANZ New Zealand raised $1bn via a two-tranche deal. It raised:

- $500mn via a 3Y bond at a yield of 2.155%, 23bp inside the initial guidance of T+80bp area.

- $500mn via a 3Y FRN bond at a yield of 0.65% vs. the initial guidance of SOFR equivalent.

The bonds have expected ratings of A1/AA–/A+. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Zhengzhou Airport Economy Zone Xinggang Investment Group hires for $ bond

- Dongtai Communication hires for $ 65mn 180-day bond

- Kalyan Jewellers India hires for $ 5Y bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Petron hires for $ 7NC4 bond

Rating Changes

- Fitch Downgrades Yuzhou’s IDR to ‘RD’ on Completion of Exchange Offer

- Fitch Downgrades China Grand Auto’s Ratings to ‘B’, Places on Rating Watch Negative

- Fitch Downgrades Credito Real to ‘RD’ on Bond Payment Default

- Fitch Downgrades El Salvador’s Long-Term IDR to ‘CCC’ from ‘B-‘

Term of the Day:

Distressed Debt Exchange (DDE)

Distressed Debt Exchange (DDE) is an offer made by a company to its bondholders to avoid bankruptcy, improve liquidity, reduce debt, manage its maturity dates (by exchanging debt securities that are coming due for debt securities with an extended maturity) and to reduce or eliminate onerous covenants. Fitch has several criteria for an offer to be called as a DDE which can be seen here.

Talking Heads

On Fitch Citing Bitcoin Risk as It Cuts El Salvador Deeper into Junk

“The weakening of institutions and concentration of power in the presidency have increased policy unpredictability, and the adoption of Bitcoin as legal tender has added uncertainty about the potential for an IMF program that would unlock financing for 2022-2023″.

On Banks Lifting Credit Spread Forecasts as Rate Hikes Rattle Bonds

Goldman Sachs’ strategists led by Lotfi Karoui

“We expect an additional build-up in risk premium, more so than we had initially envisioned in early January, especially in the euro market, where the policy shock has been the largest”

ABN Amro strategists led by Shanawaz Bhimji

“The ECB has clearly added more uncertainty to an already frail market for credit”

On Wall Street Facing Fresh Pain When Key Bond Distortion Fades Out

Jason Pride, chief investment officer for private wealth at The Glenmede Trust Co

“The term premium has been negative for a long time and we need to get back to a natural structure… Investors need to know that if you lend for longer periods off time, they will be compensated.”

David Kelly, chief global strategist at JPMorgan Asset Management

“Failure to push long term rates higher will only mean the Fed is complicit in encouraging the misallocation of capital in the U.S. and global economies. A higher risk premium is important for long-term financial stability.”

Tobias Adrian, chief financial economist and director of IMF’s monetary and capital markets department

While the Fed’s QT will raise term premium, on net, we still might be looking at a pretty negative level going forward”

Kelly Chen, an assistant vice-president and analyst at Moody’s

“Bond market access will remain difficult for the sector as bond price volatility remains high and investors’ and lenders’ risk appetite stays low, and thus, it will increase refinancing risk for financially weak developers in particular.”

Beike Research Institute (BRI), a research arm of KE Holdings, China’s biggest online property broker

“The credit environment has not fully improved, but we see positive signals from the central government are helping to ease the headwinds affecting the sector.”

Leonard Law, credit analyst at Lucror Analytics

“January used to be when there were heavy offshore bond issuances. Given the sector’s troubles, it remains very difficult for property developers to issue offshore bonds, unless the issuer is a state-owned firm or a handful of strong private companies.”

“This [higher yields] is likely to remain the case for the next two to three quarters, unless we see more concrete government support for the sector in terms of boosting contracted sales and the developers’ access to financing.”

Top Gainers & Losers – 10-Feb-22*

.png)

Other Stories

Go back to Latest bond Market News

Related Posts: