This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Mapletree Launches S$ Perp; HY Outperforms IG Again in Apr; Macro; Ratings; Talking Heads; Gainers & Losers

May 3, 2021

S&P fell 0.7% on Friday to reverse the prior day’s gains while Nasdaq was 0.9% lower. US 10Y Treasury yields pushed lower to 1.63%. European equities were also lower with the DAX and CAC down 0.1% and 0.5% while FTSE was 0.1% higher. FT reports that a double-dip recession has emerged in the Eurozone after Germany’s GDP printed a quarterly contraction of 1.7% alongside Spain, Italy and Portugal contracting 0.5%, 0.4% and 3.3% respectively; France was a ray of hope growing by 0.4%. US IG CDS spreads were 0.4bp wider and HY widened 2.3bp. EU main CDS spreads were 0.3bp tighter and crossover spreads tightened 0.6bp. Asian equity markets are trading lower by 0.3% today and Asia ex-Japan CDS spreads were 0.5bp tighter.

New Bond Issues

- Mapletree Industrial Trust S$ PerpNC5 at 3.375% area

New Bond Pipeline

- Golden Energy and Resources $ bond

- Indonesia’s Sarana Multi Infrastruktur $ 5Y bond

- Khazanah Nasional Berhad $ 5Y/10Y Sukuk

Rating Changes

- Fitch Upgrades Drax’s Senior Secured Rating to ‘BBB-‘; Removes UCO

- Future Retail Upgraded To ‘CCC-‘ By S&P Following Debt Restructuring; Outlook Developing; ‘CCC-‘ Issue Rating Affirmed

- Fitch Downgrades Future Retail to ‘RD’ on DDE; Fitch Revises Outlook on GLP to Negative; Affirms at ‘BBB’

- Moody’s downgrades Staples ratings; CFR to B2; outlook negative

- Moody’s downgrades Golden Wheel to B3; outlook negative

- Moody’s downgrades Huarong Financial Leasing to Baa2; ratings remain on review for downgrade

- Norwegian Oil And Gas Company Aker BP Outlook Revised To Positive By S&P; ‘BBB-‘ Rating Affirmed

- Papua New Guinea ‘B-/B’ Ratings Placed On CreditWatch Negative By S&P On Debt Repayment Uncertainty

- Fitch Affirms Orbia’s Ratings at ‘BBB’; Outlook Revised to Stable

- Fitch Revises Daycoval LT National Rating Outlook to Stable; Affirms IDR at ‘BB-‘

- Fitch Upgrades RUSAL to ‘BB-‘; Outlook Stable

- Fitch Puts Consus’s ‘B-‘ Ratings on Rating Watch Positive

- Fitch Assigns ‘BB-‘ IDR to Frontier Communications Holdings; Outlook Stable

April 2021: 65% of Dollar Bonds Deliver Positive Price Returns; HY Outperforms IG Again

The month of April showed a reversal in fortunes for bond investors after a dismal first quarter when 74% of dollar bonds traded lower. In April, 65% of dollar bonds in our universe delivered a positive price return (ex-coupon) as the 10Y Treasury yield eased 4-5bp during the month. In comparison, March and February saw 82% and 66% of dollar bonds delivering negative price returns.

IG performed much better than the prior two months as US Treasury yields eased in April after the 10Y yield rose a massive ~67bp in February and March. An exception to this was China Huarong’s dollar bonds that went through high bouts of uncertainty over its financial position leading to a sharp selloff in its bonds, causing the long tail in the box and whisker plot below.

The Week That Was

US primary market issuances fell to $19.2bn, down 30.7% vs. $27.7bn priced in the week prior. The drop in issuance can be attributed to both IG and HY issuances. IG new bond deals stood at $13.2bn vs. $18.3bn in the prior week while HY new bond deals were at $5.95bn vs. $9bn in the prior week. The largest deals in the IG space were led by Citi’s $5.5bn three-trancher followed by Coca-Cola’s $3.45bn issuance. In the HY space, CSC Holdings raised $2bn followed by MSCI’s $600mn deal. In North America, there were a total of 47 upgrades and 48 downgrades combined across the three major rating agencies last week. LatAm saw $2bn in new bond deals last week vs. $4.2bn in the week prior with Natura Cosmeticos alone raising $1bn. EU Corporate G3 issuance saw a sharp decrease last week to $13bn vs. $28.4bn in the week prior – issuances were led by Credit Mutuel’s €1.25bn and KfW’s €1bn issuances. Across the European region, there were 39 upgrades and 23 downgrades across the three major rating agencies. GCC and Sukuk G3 issuances were at $1.75bn vs. $2.3bn in the week prior with Abu Dhabi Ports’ and Oman’s OQ SAOC raising $1bn and $750mn via new bonds. Across the Middle East & Africa region, there were 2 upgrades and 8 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances decreased sharply to $5.4bn vs. $18.3bn in the prior week led by Australia’s NBN raising $2bn followed by Kookmin Bank and Kaisa’s $500mn issuances. In the Asia ex-Japan region, there were 7 upgrades and 19 downgrades combined across the three major rating agencies last week.

Term of the Day

Cost of Risk

Cost of Risk refers to the losses that arise out of ‘expected losses’ and the ‘cost of losses over and above the average loss’. Expected losses are those that arise on average due to defaults and depend on the credit risk of the borrower. The cost of losses over and above the average loss are measured by either Basel related regulatory capital or risk based capital. BNP notes that their cost of risk has improved year-over-year in its Q1 earnings.

Talking Heads

Jerome Powell, Federal Reserve Chairman

“We want it to average 2%,” Powell said. “And for that we need to see inflation expectations that are consistent with that, really well-anchored at 2%. We don’t really see that yet.”

Craig Brothers, senior portfolio manager and co-head of fixed income at Bel Air Investment Advisors

“It’s sort of like the perfect storm” with “the economy getting every benefit possible as the Fed is standing aside and Washington is helping as much as they can,” he said. “What I worry about regarding inflation is that the main areas many people feel, which is in food, energy and shelter, are all going up at a very strong rate.”

Robert Kaplan, Dallas Federal Reserve president

“We’re now at a point where I’m observing excesses and imbalances in financial markets,” said Kaplan. “I’m very attentive to that, and that’s why I do think at the earliest opportunity I think will be appropriate for us to start talking about adjusting those purchases.” “I think we’re going to reach that benchmark sooner than I would have expected in January and others would have expected,” he said. “I think the U.S. economy will be far healthier when we have the ability to start weaning off those purchases.” “We’ve got real excesses in the housing market,” Kaplan said. “It’s not yet the speculative situation that we had back in ‘07, ‘08 and ‘09, but I think it bears watching and keeping a close eye on.”

Brett Ryan, senior US economist at Deutsche Bank AG

”It’s not surprising that Kaplan is making a case now for tapering because he’s already been making the case,” said Ryan. “The surprising thing is that it’s so soon right after Chair Powell had been very explicit in saying now is not the time to talk about tapering. That’s the dichotomy there.”

Janet Yellen, US Treasury Secretary

“I think we’re in a good fiscal position. Interest rates are historically low. They’ve been that way for a long time, and it’s likely they’ll stay that way into the future. But we do need fiscal space to be able to address emergencies, like the one that we’ve been in with respect to the pandemic,” Yellen said. “We don’t want to use up all of that fiscal space and over the long run, deficits need to be contained to keep our federal finances on a sustainable basis. So, I believe that we should pay for these historic investments,” she said. “We will monitor that very carefully,” she said. “We are proposing that the spending be paid for. And I don’t believe that inflation will be an issue, but if it becomes an issue, we have tools to address it. These are historic investments that we need to make our economy productive and fair.”

“I think we’re in a good fiscal position. Interest rates are historically low. They’ve been that way for a long time, and it’s likely they’ll stay that way into the future. But we do need fiscal space to be able to address emergencies, like the one that we’ve been in with respect to the pandemic,” Yellen said. “We don’t want to use up all of that fiscal space and over the long run, deficits need to be contained to keep our federal finances on a sustainable basis. So, I believe that we should pay for these historic investments,” she said. “We will monitor that very carefully,” she said. “We are proposing that the spending be paid for. And I don’t believe that inflation will be an issue, but if it becomes an issue, we have tools to address it. These are historic investments that we need to make our economy productive and fair.”

Rob Portman, the Ohio Republican senator

“There are ways to get there,” Portman said. “We’ve got some phone calls scheduled this week. I met with the White House late last week. There’s a way forward here if the White House is willing to work with us.”

“There are ways to get there,” Portman said. “We’ve got some phone calls scheduled this week. I met with the White House late last week. There’s a way forward here if the White House is willing to work with us.”

Ron Klain, the White House chief of staff

“We have time to talk to people in both parties, find where the common ground is, find what people agree as mutually shared interests. I’m optimistic that we can make progress on that in the weeks ahead,” he said.

“We have time to talk to people in both parties, find where the common ground is, find what people agree as mutually shared interests. I’m optimistic that we can make progress on that in the weeks ahead,” he said.

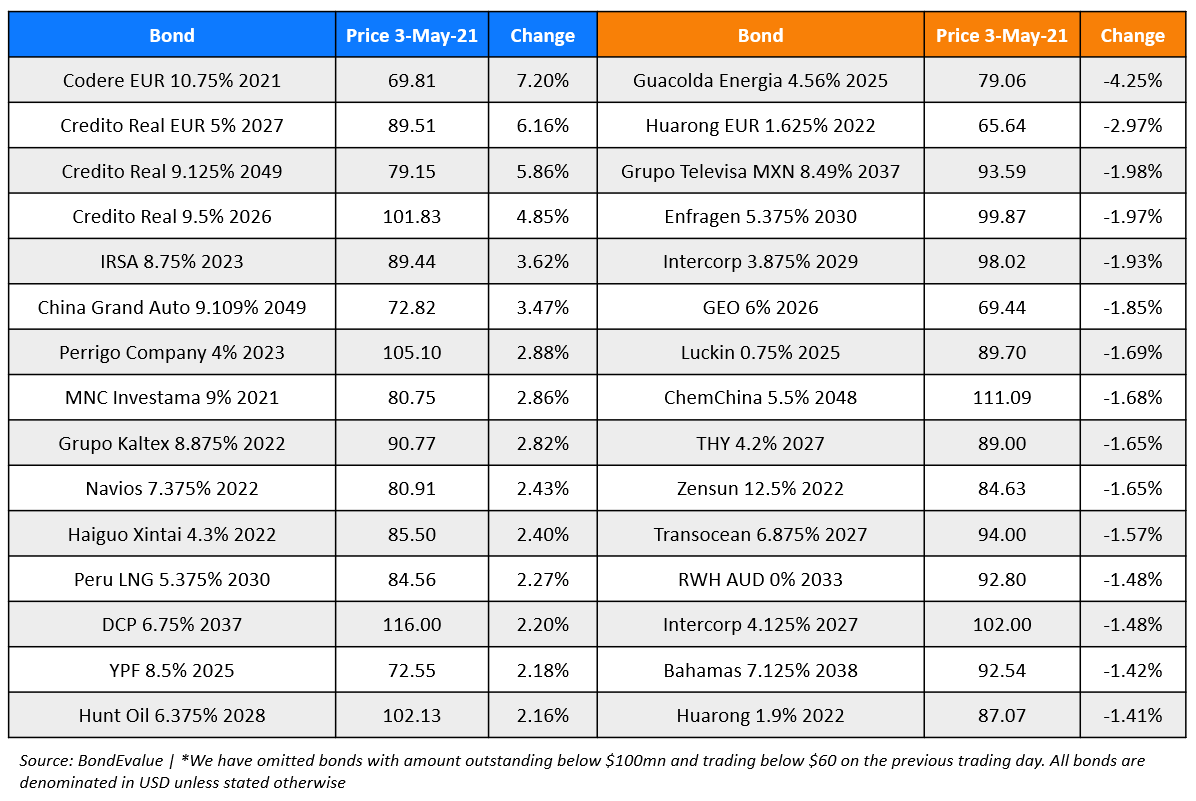

Top Gainers & Losers – 3-May-21*

Go back to Latest bond Market News

Related Posts: