This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Mongolia Launches $ 5.5Y at 5.75%a; Evergrande’s $ Bonds Took Another Beating; ArcelorMittal to Consolidate US Assets

September 28, 2020

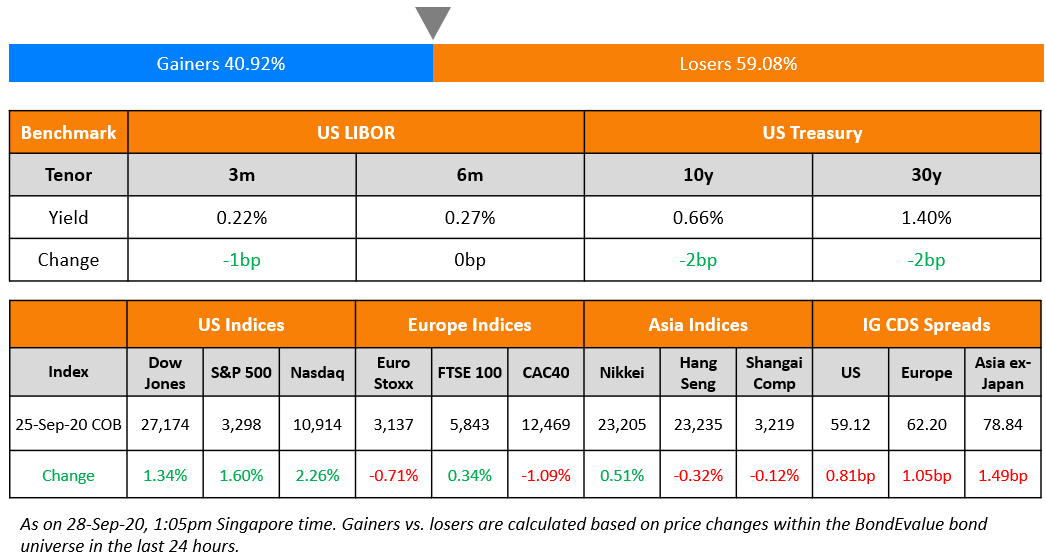

S&P, which began last week with a sharp move lower recovered much of the move by Friday end, down 0.6% for the week while other global equities continue to stay weak. 10Y US Treasury yields fell slightly through Friday. Asian equities are marginally higher today by 0.2%. US durable goods rose 0.4%, less than the 1.5% expected showing some signs of consumer weakness but getting back near pre-pandemic levels. Credit spreads widened marginally across US, Europe and Asia ex-Japan on Friday. US HY ETF saw over $4bn of outflows last week. Issuance remains week with just one deal launched in Asia this morning. Tuesday sees the first of three presidential debates in the US. We have summarized the past week in a new section ‘The Week That Was’ below.

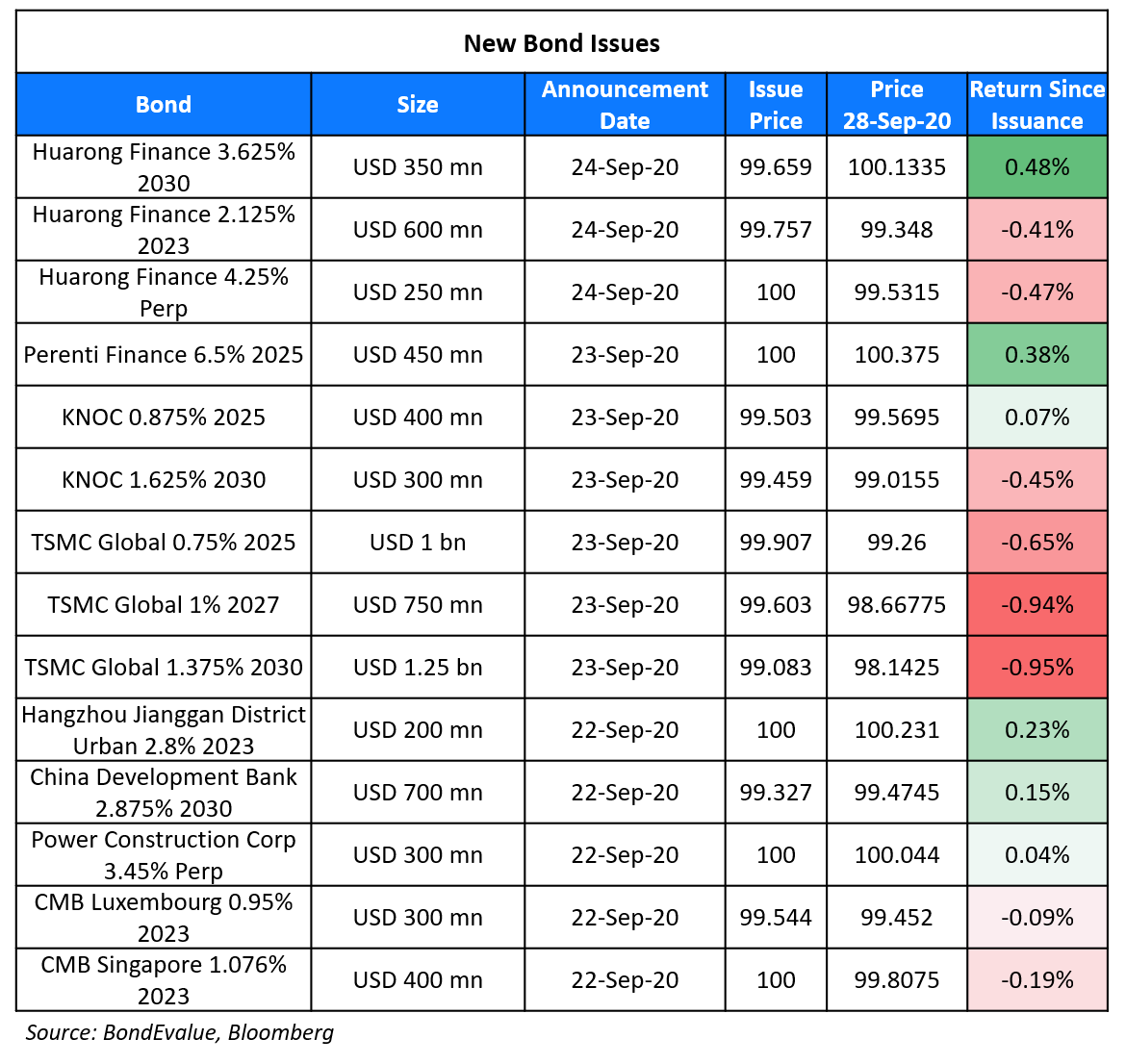

New Bond Issues

- Mongolia $ 5.5yr @ 5.75% area

Rating Changes

Moody’s downgrades Rolls-Royce to Ba3 from Ba2; outlook remains negative

Moody’s changes Hungary’s outlook to positive, affirms Baa3 ratings

Moody’s assigns B3 CFR to J.Crew upon bankruptcy emergence

CEMEX Mexico S.A. de C.V. ‘BB’ And ‘mxA/mxA-1’ Ratings Withdrawn by S&P On Merger With Parent

O1 Properties Ltd. ‘D’ Ratings Withdrawn by S&P At Issuer’s Request

Fitch Withdraws Posadas’ ‘RD’ Ratings

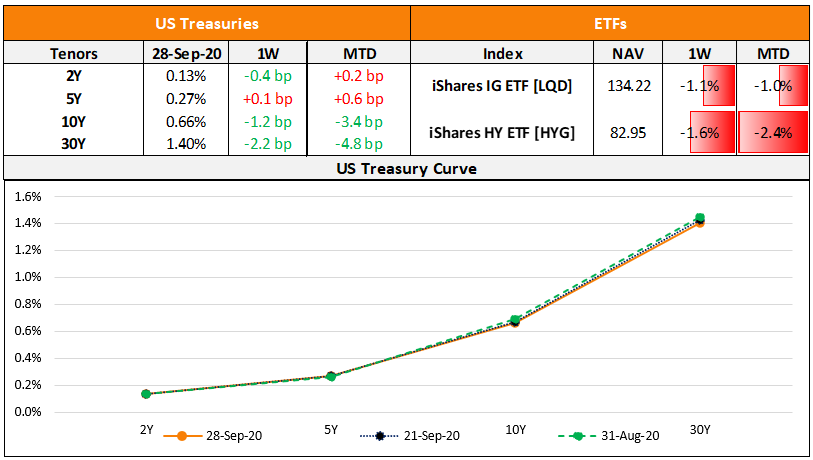

The Week That Was

US Treasuries rallied marginally through the week with the curve bull flattening i.e., long-term yields falling more than short-term yields with economic data weakening slightly and the Fed not being compelled to take any action. US equities sold-off sharply in the beginning of the week but recovered most of the move while other global equities continue to stay weak. Despite the risk-off sentiment, gold saw a sharp move lower. US IG CDS widened ~7bp while HY CDS tightened ~1bp last week. Asia Ex-Japan CDS widened ~20bp in the week. With weak market conditions overall, some corporates have issued less than initially planned and issuance was light overall. Tepid market sentiment led Julius Baer to pull its dollar AT1 issue after fixing the coupon at 4.375%. The week also saw US HY issuance hit an annual record of $329.8bn with three months left for the year.

.png?upscale=true&width=1600&upscale=true&name=BEV%20Weekly%20Bottom%20Half%2028%20Sept%20(2).png)

Evergrande’s Bonds Took Another Beating Late Friday As Liquidity Fears Grow

In our newsletter last Friday, we wrote about how an allegedly fake document of Evergrande requesting expedited approval for the backdoor listing of subsidiary Hengda Real Estate sparked liquidity fears among investors. Dollar bonds of Evergrande saw another round of selling late Friday with some of its bonds falling as much as 18%. The company, which earlier called the documents fake, later published certain financial data via an exchange filing to reassure investors that it had sufficient liquidity. It reported the following:

- Aggregate contracted sales of RMB 504.9bn ($74bn) as of September 24, up 11.4% YoY

- Aggregated cash collection of RMB 452.1bn ($66bn) as of September 24, up 51.3% YoY

- Cash balance on hand of RMB 204.6bn ($30bn) as of June 30

- Expected sales of RMB 200bn ($29bn) from its nationwide sales promotions in September and October

- 866 projects under development with all “progressing normally”

- Decrease of RMB 53.4bn ($7.8bn) in total debt as of September 24 vs. March 31

- 2.24% decrease in financing costs and loan prepayments of RMB 43.5bn ($6.4bn)

- “In the 24 years since the establishment of the Company, the Company has borrowed loans across 20,523 transactions. There has never been any late payment of interest nor overdue repayment of principal.”

As per Bloomberg, the company had total debt of RMB 835.5 ($122.5bn) as of June 30. This makes it the most indebted real-estate company in the world with a larger debt pile than UAE-Kuwait-Bahrain combined ($103bn), Peru ($102bn), Qatar ($90bn) and Switzerland ($88bn). The chart below shows upcoming payouts for Evergrande in terms of coupons and redemptions on its onshore and offshore debt.

.png?upscale=true&width=1600&upscale=true&name=Evergrande%20Debt%20Profile%20(1).png)

Evergrande has $4.5bn due in Q4 this year, $600mn in Q1 2021 and $1.7bn in Q2 2021. We also looked at holders of Evergrande’s largest outstanding dollar bond – listed below – to see investors most at risk in the event of a default.

.png?upscale=true&width=880&upscale=true&name=Holders%20of%20Evergrande%E2%80%99s%20$4.68bn%208.75%25%202025%20Bond%20(1).png)

Many of the top holders of its 8.75% 2025s are large asset managers from developed markets. The risk of default further increases if the three red lines (Term of the day, explained below) are enforced by Chinese regulators. The bonds are currently trading at 73 cents on the dollar, yielding 17.25% on the secondary markets.

Not all investors see Evergrande at risk of default as Hong Kong-listed CST Energy disclosed via an exchange filing that it purchased $5mn each in principal of its 6.25% 2021s and 8.9% 2021s, as per IFR. CST, which engages in mining, financial investment, property investment and money lending, said the purchase will be funded by internal resources. It said the investment presents an opportunity to obtain a “higher and stable return” compared to fixed deposit rates offered by commercial banks in Hong Kong.

ArcelorMittal To Merge US Assets With Cleveland-Cliffs

In its bid to consolidate, ArcelorMittal is looking to merge its US operations with Cleveland-Cliffs Inc. ArcelorMittal owns assets worth $2bn to $3bn in the US and Cleveland-Cliffs, valued at ~$2.3bn, is the largest iron ore pellet producer in the US. The pellet producer has an outstanding debt of $4.5bn as of end June. The proposed merger comes after Cleveland-Cliffs’ $3bn acquisition of AK Steel, a US maker of flat-rolled carbon steels last March. It is seen as a bid to diversify business and make it less vulnerable to demand pressures and is also aligned to ArcelorMittal’s plan to offload $2bn of its assets by mid 2021 to reduce its debt. The world’s largest steelmaker had earlier agreed to sell 50% of its shipping business to Brazilian steelmaker Gerdau. The top line of AK Steel has also been hit due to the drop in demand from its car manufacturing clients due to the slowdown in the automotive industry on the back of the ongoing pandemic.

ArcelorMittal’s bonds were slightly down on the secondary markets. Its 7.25% and 7% bonds due 2039 and 2041 traded at 124 and 123 respectively.

For the full story, click here

Colombia Set to Tap Flexible Credit Line with the IMF for $5.3bn

Colombia is set to tap the flexible credit line (FCL) worth $5.3bn from the IMF to manage ongoing efforts to integrate migrants, foster inclusive growth, and reduce external vulnerabilities due to the pandemic. The line requires the sovereign to repay the FCL debt in 5 years. The FCL was established by the IMF on March 24, 2009 as part of a major lending framework reform to prevent crisis by providing flexibility to draw on the credit line at any time. Presently, this pre-approved facility is available only to Chile, Peru, Mexico and Colombia. The initial 2Y $10.8bn FCL was approved by the IMF on May 1 earlier this year. Ms. Antoinette Sayeh, Deputy Managing Director and Acting Chair, said in a statement, “Colombia’s very strong policy frameworks—anchored by a flexible exchange rate, a credible inflation targeting-regime, effective financial sector supervision and regulation, and a structural fiscal rule— continue to serve the country well and have allowed the authorities to deliver a coordinated and timely response to the Covid-19 pandemic.”

Colombia is yet to make a formal proposal for the line. Colombia’s dollar bonds were largely stable on the secondary markets.

For the full story, click here

Argentine Corporate Dollar Bonds Fall on Capital Controls

Bonds of some of Argentina’s biggest corporations fell sharply on Friday showing lack of confidence on Argentina’s foreign exchange restriction policy announced two weeks back. Corporates with bonds maturing in the next twelve months got hit particularly hard. The rule, which mentions corporates with obligations of over $1mn/month through March will have to push back dues or will not be allowed to buy dollars at the official exchange rates. As per Nasdaq, this means companies with debt payments more than $1mn/month till March end next year can only cover 40% of that in foreign currency, forcing them to refinance the remainder. To make matters worse for the corporates, investors expect the restrictions to be pushed further beyond March, making those redemptions susceptible to default. “Investors expect controls to be extended…no company is immune to the controls or the unfavourable regulations imposed by the government.” said Lorena Reich, Lucror Analytics. Pan American Energy (Caa1), the second biggest oil producer in Argentina and among the safest credits in Argentina as per Bloomberg saw its dollar 7.875% 2021s fall by 5.3% to ~95 cents on the dollar from above par, currently yielding 17.1%. YPF’s (Caa3) dollar 8.5% 2021s fell 5.5% to 89.25 with a yield of 34.5%. The sovereign’s restructured dollar 0.125% 2030s are currently trading at 40 cents on the dollar, down over 8% since last Monday with a current yield of 9.7%.

Term of the Day

Three Red Lines

The ‘three red lines’ are leverage guidelines set for property developers in China. They consist of caps on debt-to-cash, debt-to-assets and debt-to-equity ratios devised by Chinese regulators. Recently, the above ratios were identified to be implemented for major property developers in Beijing effective next year. The framework caps debt-to-asset ratio for developers at 70%, net debt-to-equity at 100%, and short-term borrowings at no more than cash reserves. Not adhering to these ratios would result in them being cut-off from new loans.

Evergrande, which is the world’s most indebted developer and in focus since last Friday has the following ratios: debt-assets at 36%, net debt-to-equity at 200% and short-term borrowings at 2.8x cash reserves, based on our calculations from its interim unaudited reports as of June 30.

Talking Heads

On G7 finance ministers supporting a temporary freeze in debt payments for poorest nations

Taro Aso, Japanese Finance Minister

“China’s participation in DSSI is totally insufficient,” Aso said. “I told (the) G7 that we must apply further pressure on China, that DSSI needs to be extended beyond this year-end deadline, and that we must ensure burdens will be shared fairly by all creditors.”

“The evidence has been encouraging,” she said, adding that cuts in interest rates below zero had been almost fully reflected in reductions in interest rates charged to borrowers. “Banks adapted well – their profitability increased with negative rates largely because impairments and loss provisions have decreased with the boost to activity and the increase in asset prices. Flare-ups like we’re seeing may potentially lead to more localised lockdowns and will keep interrupting that V(-shaped recovery).” “Another factor interrupting the V is a very weak global outlook, with high uncertainties, particularly with a second wave already striking many countries,” she said.

“We continue to see bond yields being depressed and being held down by the policies of central banks to keep rates low, despite concerns of debt issuance that is simply being overshadowed by continued strong demand for bonds,” said de Groot.

On Treasury yields to face stiff headwind for liftoff as market approaches standstill

Subadra Rajappa, head of U.S. rates strategy at Societe Generale

“There really seems only two paths for Treasury yields now, sideways or higher,” said Rajappa. “Given the amount of fiscal and monetary stimulus and supply the market is getting, we’d expected modestly higher Treasury yields.”

In a note by Joshua Younger, JPMorgan Chase & Co. strategist and his team

“Polls suggest debates remain central to how voters form a view,” JPMorgan Chase & Co. strategists including Joshua Younger wrote in a note. Analysis suggests “statistically significant movement of the polls following the first debate, and to a lesser extent, second and third, in both directions is reasonably common.”

“In some ways rates are beholden to the path of stocks at least in a short time frame, just because there are a lot of concerns about these elevated equity valuations and if we see a substantial leg lower in equities it’s likely that we’re going to see a significant rally in bonds,” said Hill.

“The source of financing is running out. We are talking about companies whose cash flows are local and cannot acquire foreign currency. It is crazy,” said Sardáns. “This is a death warrant for many firms, or even directly means default for these companies. They run out of financing, they are out of the game.”

On bondholders facing Zambia haircut wary over Africa

Stuart Culverhouse, head of fixed-income research at Tellimer Ltd. in London

“Zambia is more the exception than the rule at this point; many other sub-Saharan African countries are experiencing problems under Covid, and sought official-sector relief, but have avoided touching the bonds,” said Culverhouse. “Where Zambia may set a precedent is that for countries more obviously in distress, and seeking debt-service relief, perhaps the official sector will be more emboldened to push them to seek private sector restructuring too.”

In a note by Moody’s

“The Zambian government has indicated its commitment to find a collaborative resolution to its debt sustainability challenges,” Moody’s said in a note. However, with the country’s debt burden set to reach 110% of gross domestic product this year, “placing debt on a sustainable trajectory will invariably result in large losses to commercial creditors,” Moody’s said.

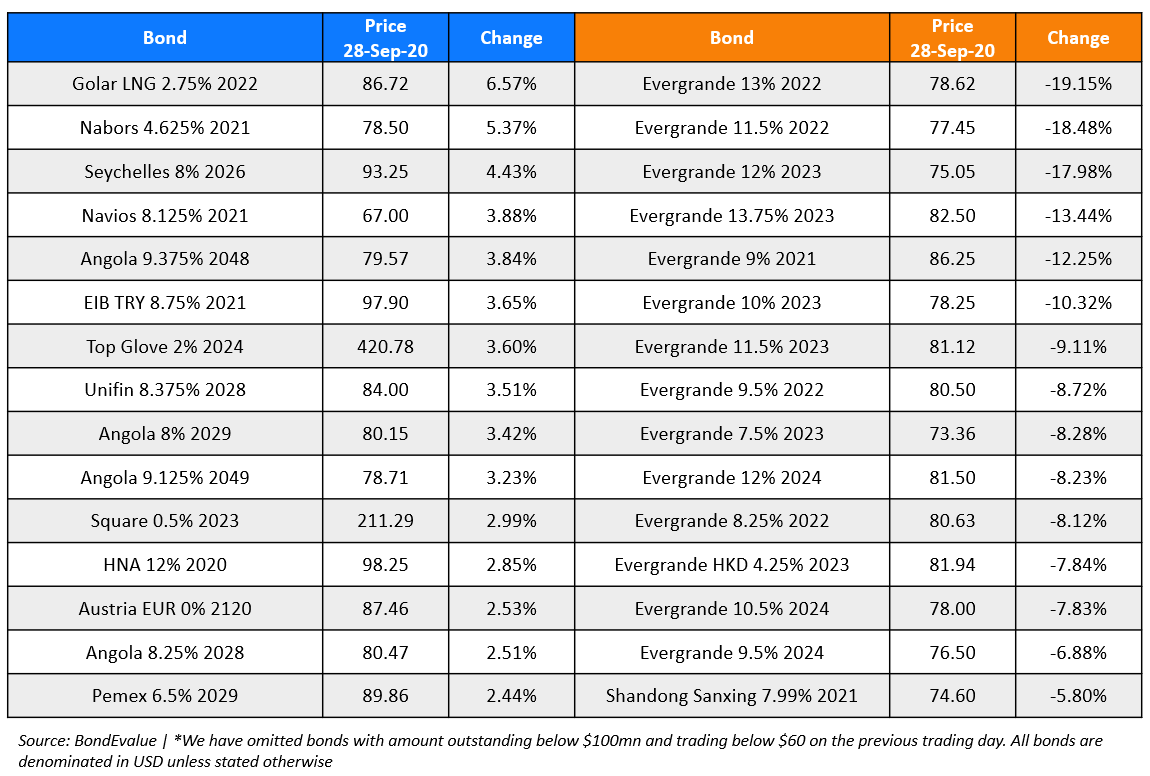

Top Gainers & Losers – 28-Sep-20*

Go back to Latest bond Market News

Related Posts: