This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

More Details On Huarong’s Earnings Delay Emerge

April 23, 2021

Further details on China Huarong’s reason for its earnings delay have emerged. Sources say that Huarong’s earnings were delayed because a plan for the PBOC to buy Huarong assets through Beijing Chengfang Huida Enterprise Management Co Ltd as part of a restructuring was rejected by Chinese regulators. Chengfang Huida is a unit of distressed-asset manager Cinda Asset Management, but is directly supervised and managed by the central bank. Huarong had planned to shift $15bn in assets to Chengfang Huida’s balance sheet but saw objections with the PBOC and Ministry of Finance. These specific details come after sources said that the PBOC was planning to assume more than CNY 100bn ($15bn) of assets from Huarong. An anonymous portfolio manager said, “After the lesson of China Fortune Land and Tsinghua Unigroup, I’ve become sceptical of media reports. Media reports said the government would rescue them, but finally they defaulted on their dollar bonds”

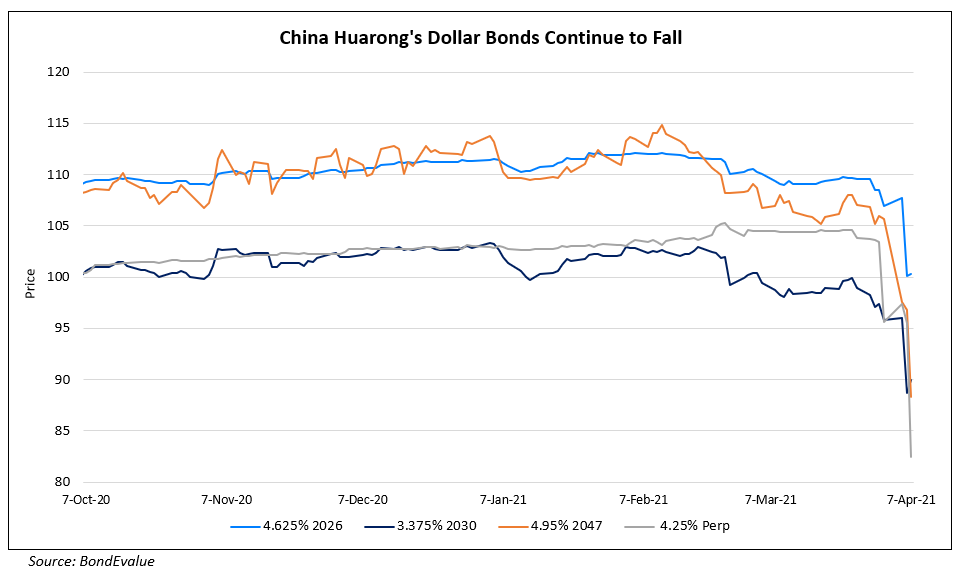

Huarong’s dollar bonds were trending down. Its near term 1.625% 2022s and 3.75% 2022s were down 2.75 and 1.25 points to trade at 77.5 and 86.75 cents on the dollar respectively.

For the full story, click here

Go back to Latest bond Market News

Related Posts: