This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

New World Development Launches Buyback at Strong Premiums

December 5, 2022

New World Development (NWD) launched a buyback offer for its $600mn 4.5% 2030s, $200m 3.75% 2031s and $1.3bn 5.75% Perps callable in January 2024. Besides, the buyback offer also included a $335.95mn 4.25% bond due 2029, issued by Celestial Dynasty and guaranteed by NWS Holdings. NWD is a major shareholder in the latter.

- For the 2030s, the minimum purchase price has been set at $814 per $1,000 in principal. The maximum repurchase amounts for the 2030s were set at $250mn. The buyback price is at a premium of 2.8 cents on the dollar over its 4.5% 2030s that are currently trading at 78.58, yielding 8.43%

- For the 2031s, the minimum price has been set at $765 per $1,000 in principal. No maximum acceptance size is stated for the 2031s. The buyback price is at a premium of 5.25 cents on the dollar over its 3.75% 2031s that are currently trading at 71.25, yielding 8.78%

- For the 2029s, the minimum price has been set at $865 per $1,000 in principal. The final acceptance size for the 2029s will be determined later. The buyback price is at a premium of 2.6 cents on the dollar over its 4.25% 2029s that are currently trading at 83.92, yielding 7.39%

- For the Perps, the minimum price has been set at $955 per $1,000 in principal. The maximum repurchase amounts for the perps were set at $250mn. The buyback price is at a premium of ~5 cents on the dollar over its 5.75% Perps that are trading at 90.8, yielding 14.7%

NWD said that the tender offers were made in order to optimize its cost of capital, its debt profile and provide liquidity to investors. The tender offers will expire on December 31.

Go back to Latest bond Market News

Related Posts:

Sun Hung Kai Becomes HK’s Largest Home Seller Overtaking NWD

January 6, 2022

NWD Announces Results of Tender Offer

June 21, 2022

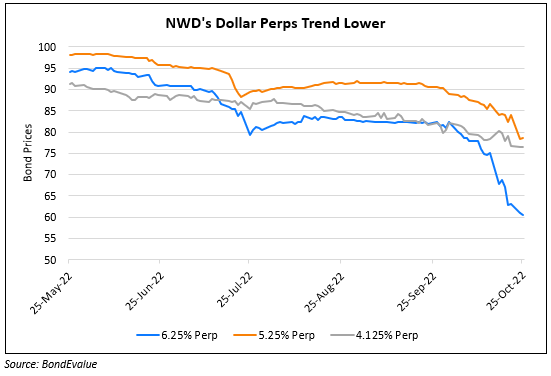

NWD’s Dollar Perps Fall by Over 5 Points

October 25, 2022