This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

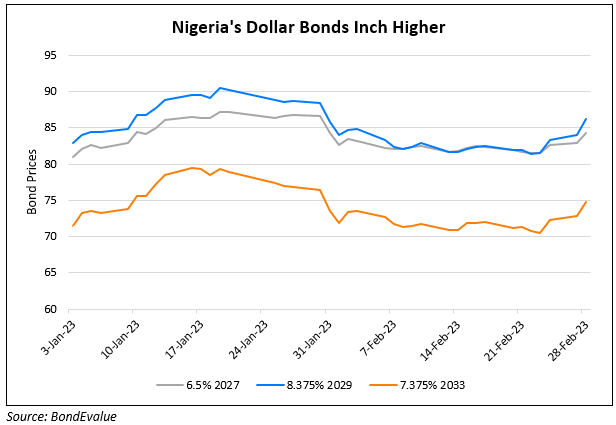

Nigeria Bonds Up Over 2% as Ruling Party Candidate Leads in Election Tally

February 28, 2023

Nigeria’s dollar bonds were higher by over 2% across the curve after the ruling-party candidate Bola Tinubu took an early lead in the presidential election tally. This was considered a positive news for the market as Tinubu is set to make reforms to pull Nigeria out of its financial situation. The vote count is ongoing and currently shows that Tinubu is leading in three key states. Tinubu is expected boost revenues, stabilize the naira and cut down sovereign debt, and that he could undertake these reforms faster than other candidates. JPMorgan data shows that the sovereign-risk premium also narrowed 42bp to 723bp yesterday, with a 104bp drop in the last three days.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Nigeria Explores Debt Restructuring

October 13, 2022

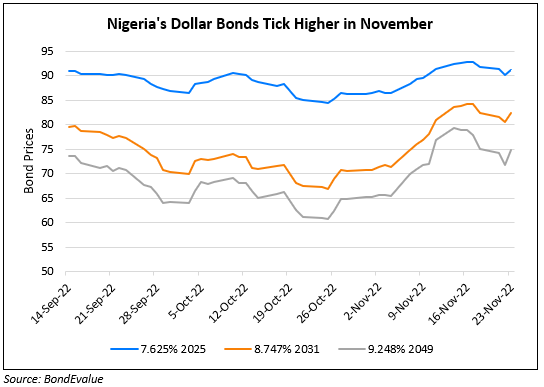

Nigeria’s Dollar Bonds Trend Higher in November

November 23, 2022

Nigeria’s Downgraded to Caa1 by Moody’s

January 30, 2023