This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

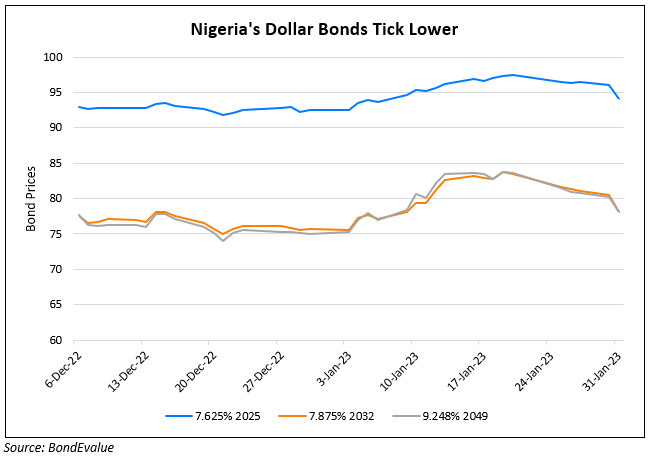

Nigeria’s Dollar Bonds Drop after Downgrade to Caa1

January 31, 2023

Dollar bonds of Nigeria dropped by as much as 2.5 points across the curve. This comes after the sovereign was downgraded to Caa1 from B3 by Moody’s primarily on the back of expectations that the “government’s fiscal and debt position will continue to deteriorate”. While the rating agency did note that the immediate default risk was low, its dollar bonds moved lower on the weak outlook. Apart from its bonds, Bloomberg also notes that forward contracts on the currency traded 28% weaker than the official rate on the 1Y tenor at NGN 645 per US dollar. “Some investors appear to be wondering whether this is a buy-on-the dip opportunity”, said Samir Gadio, head of London-based Africa Strategy at Standard Chartered.

Go back to Latest bond Market News

Related Posts:

Nigeria Explores Debt Restructuring

October 13, 2022

Pakistan and Nigeria Downgraded to CCC+ and B3

October 25, 2022

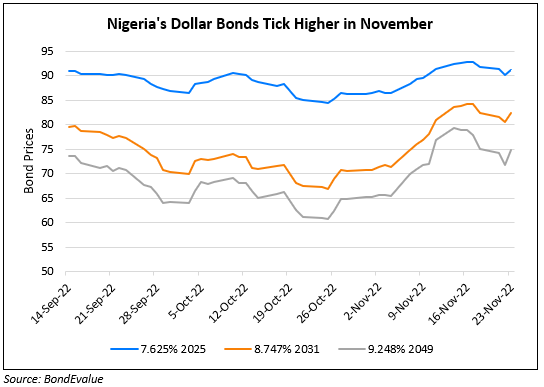

Nigeria’s Dollar Bonds Trend Higher in November

November 23, 2022