This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Oman Arab Bank Sells Debut Dollar Perps at 7.625%

May 28, 2021

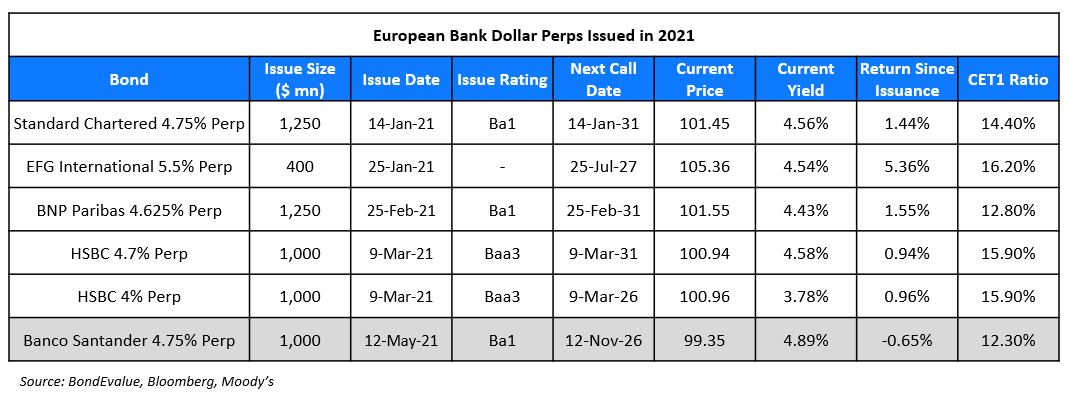

Oman Arab Bank raised $250mn via a debut PerpNC5 Tier 1 bond at a yield of 7.625%, 37.5bp inside initial guidance of 8% area. The bonds were unrated and received orders over $1.1bn, 4.4x issue size. The coupons are fixed until June 4, 2026, and if not called, resets to the 5Y Treasury yield + 680.7bp every five years thereafter. The newly issued bonds were priced ~8bp wider to similar rated peer National Bank of Oman’s (Ba3) 8% Perps callable in April 2026 currently yielding 7.54%.

Go back to Latest bond Market News

Related Posts:

UBS Raises $1.5 Billion via PerpNC10 AT1 at 4.375%

February 2, 2021