Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

Ecuador’s Dollar Bonds Drop over 10% As Incumbent Set for Referendum Defeat

Dollar bonds of Ecuador dropped by over 10% with its 5.5% 2030s falling over 10 points to 59.93, yielding 19.3%. This comes after partial results from the constitutional referendum showed that voters were planning to reject a series of proposals put forward by...

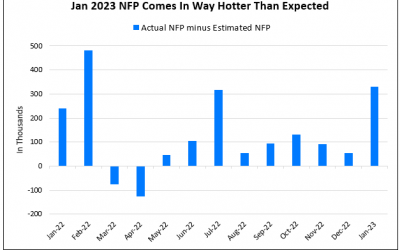

Jan NFP Comes In at 517k, Way Hotter Than Estimates

Bond markets saw a massive sell-off on Friday with benchmark yields sharply higher across the curve on following the strong jobs report. US 2Y and 5Y Treasuries sold-off with yields higher by ~25bp while the 10Y yield was up 18bp. US Non-Farm Payrolls came at...

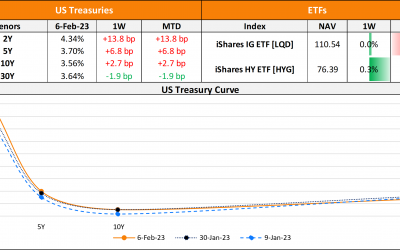

The Week That Was (30 Jan – 5 Feb, 2022)

US primary market issuances stood at $24.5bn last week vs. $27.7bn a week prior. IG issuances stood at $16.3bn led by Oracle's and IBM's $5.25bn and $3.25bn four-tranchers each. HY issuances stood at $8.1bn led by Uniti Group's $2.6bn and CCO Holdings' $1.1bn...

Nigeria’s Dollar Bonds Down Over 1 Point

Nigeria's dollar bonds were lower by over 1 point across the curve with S&P revising their outlook on the sovereign to negative from stable. The rating action came on the back of increasing risks to Nigeria's debt servicing capacity over the next 1-2 years due to...

CFLD Completes Restructuring and Goes into Effect from January 31

China Fortune Land Development (CFLD's) restructuring plan was approved by The High Court of England and Wales where it became effective January 31. To recall its restructuring, CFLD proposed to restructure all of its 11 dollar bonds via three new bonds and a cash...

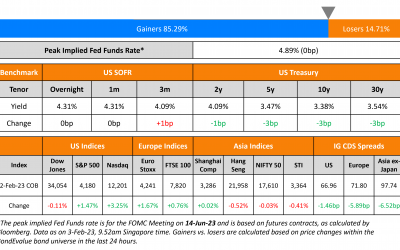

ECB, BOE Hike Rates by 50bp; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

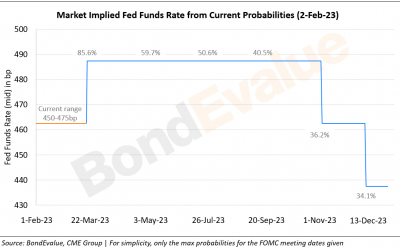

Bond markets continued its rally with benchmark yields down ~3bp across the curve. The peak Fed funds rate was flat at 4.89% for the June 2023 meeting. Currently the probability of a 25bp hike in the FOMC March meeting stands at 89%. US IG CDS spreads tightened by...

Sri Lanka Gets Paris Club Backing for IMF Deal

Sri Lanka has obtained the backing of the Paris Club helping clear a hurdle to unlock a $2.9bn bailout from the IMF, as per Bloomberg sources. The IMF is recently said to have received the assurance from the Paris Club that primarily comprises wealthy, western...

Treasuries Rally Post FOMC Meeting

Bond markets saw a sharp rally with benchmark yields down over 10bp across the curve after the FOMC meeting, where the Fed hiked its policy fed funds target range by 25bp to 4.5-4.75%. The peak Fed funds rate was down 4bp at 4.92% for the June 2023 meeting. At the...

Dalian Wanda Discussing Offshore Loan to Pay Dollar Bond

Dalian Wanda Group is said to be in discussions to secure an offshore loan to pay its $350mn 8,875% dollar bond due on March 21, as per sources. They noted that the company was in talks with ICBC and that the financing would be backed by onshore assets of Wanda. In...