Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

Chemours Bonds Drop On Delayed Results and Accounting Fraud Suspicions

Chemours' dollar bonds dropped lower by 4-5 points, after the company put its top management including its CEO, CFO on administrative leave to investigate the pending internal accounting fraud. As a result, Chemours full year results were further delayed and the...

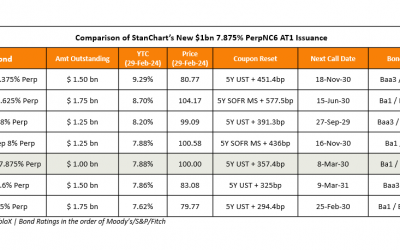

StanChart Prices $ PerpNC5 AT1 at 7.875%

StanChart raised $1bn via a PerpNC6 AT1 bond at a yield of 7.875%, 50bp inside initial guidance of 8.375% area. The subordinated notes are rated Ba1/BB-/BBB-, and received orders of over $3bn, 3x issue size. The issuer is Standard Chartered PLC. The bonds are callable...

Vedanta Plans $3bn Debt Reduction Through FY 2027

Vedanta Resources Limited (VRL) plans to reduce its debt by $3bn through FY 2027 by using cashflows from brand fees and dividends from subsidiaries, according to its management. The company expects cashflows of $1.3bn from brand fees and $4.5bn from dividends over the...

Gol Gets $1bn Bankruptcy Loan Approval From Court

Brazilian carrier Gol received US court approval for a $1bn loan during its ongoing bankruptcy process, after it was able to resolve the concerns of its lenders. Objecting lenders who had previously loaned to the company, feared being sidelined by the new loan. The...

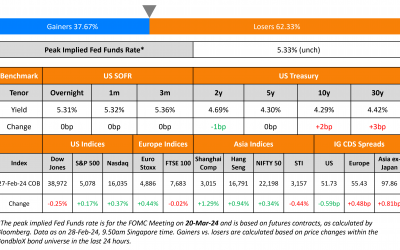

IRB Infra Launches $ 8Y; US Averts Govt Shutdown

US Treasury yields were marginally lower across the curve, down by 1-3bp. US 4Q 2023 GDP (second estimate) came in slightly lower at 3.2% than the preliminary estimate of 3.3%. Also, the US congress reached a deal to provide one week of temporary funding to avert a...

Adani Group Mandates Banks for $409mn Bond Raise

Adani Group has mandated banks to sell $409mn of bonds as part of its first dollar bond sale following Hindenburg's allegations early last year. As per Adani Green's statement on the stock exchange, they plan an "18 year door to door tenor" with a 12.7Y weighted...

Pemex Reports Upbeat Q4 Profits

Pemex reported a profit in its Q4 results with a net income of MXN 106.9bn ($6.3bn) as compared to a loss of MXN 79.13bn ($4.6bn) in the previous quarter. The company has received about MXN 870bn ($51bn) in capital injections from the government since 2019 alongside...

San Miguel and Metro Pacific in Talks to Merge Toll Businesses Worth $10bn

San Miguel and Metro Pacific Investments Corp. are said to be in talks to merge their toll businesses creating an entity worth $10bn, according to sources. If the deal is reached, it would be the country's biggest ever merger, surpassing SM Prime Holdings Inc. $7.3bn...

Mapletree Launches S$ Bond; SMFG, BPCE, Rabobank Price Bonds

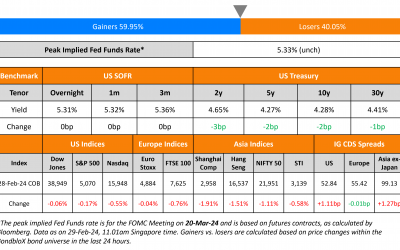

US Treasury yields were nearly unchanged. US Durable Goods Orders for January fell by the most in nearly four years, down 6.1%, worse than expectations for a 5% drop. This happened amid a sharp drop in bookings for civilian aircraft orders that plunged 58.9% following...