Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

Moody’s Withdraws Ratings of Several Chinese Developers

Moody's has withdrawn its ratings for several Chinese developers citing business reasons. The entities whose ratings were withdrawn include Jiangsu Zhongnan (Ca), CIFI (Ca), Powerlong (Caa2), Redsun (Ca), Times China (Ca), Zhenro Properties (Ca), Ronshine (Ca),...

Royal Caribbean Upgraded Two Notches to Ba2

Royal Caribbean Cruises was upgraded by two notches from B1 to Ba2 by Moody's. The credit rating agency also upgraded the ratings of Royal Caribbean's backed senior secured debt to Baa2, backed senior unsecured debt to Ba1 and senior unsecured debt to Ba2. The upgrade...

Pakistan Planning $6bn IMF Loan; Coalition Government Formed

Pakistan is said to plan seeking at least $6bn in new loan from the IMF to help repay its debts this year, as per sources. The country has $25bn in external debt payments for the fiscal year beginning July, an amount that is about 2x its forex reserves. The IMF's...

Garanti, Royal Caribbean Price $ Bonds

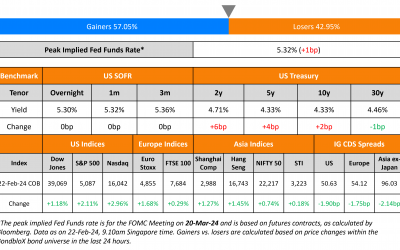

US Treasury yields moved higher with the 2Y yield up 6bp to 4.71% and 10Y up 2bp to 4.33%. Initial jobless claims for the prior week came in better than expected at 201k, decreasing 12k from the previous reading and underscoring continued strength in the labor market....

Sri Lanka Said to Have Proposed Alternate Debt Restructuring Plan

Sri Lanka is said to have proposed an alternate commercial debt restructuring plan to bondholders, according to sources. This is said to be a counter offer to the proposal earlier in October, where it proposed a 20% haircut and issuance of macro linked bonds. The...

Shinhan Card, BNG Launch $ Bonds

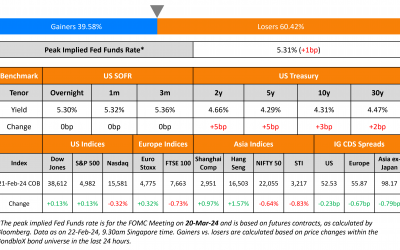

US Treasury yields were 3-5bp higher across the curve on Wednesday. The Federal Reserve's January meeting minutes came out yesterday where, "most participants noted the risks of moving too quickly to ease the stance of policy". Separately, Richmond Fed President...

Unigel’s 2026s Jump 7 Points on Reaching Deal with PIMCO, Creditors

Unigel Participacoes reached an agreement with the PIMCO-led creditor group to start an out-of-court restructuring of its debt. This comes after the Brazilian fertilizer company missed coupon payments on its USD and BRL-denominated bonds and also breached debt...

Chinese Corporate Dollar Bonds Inch Higher on Easing Measures

Dollar bonds of several Chinese corporates especially property developers have inched higher this week. This includes the likes of Longfor, Vanke, GLP China, Ping An amongst several others that have moved 1-1.5 points higher. First, this was helped by Chinese lenders...

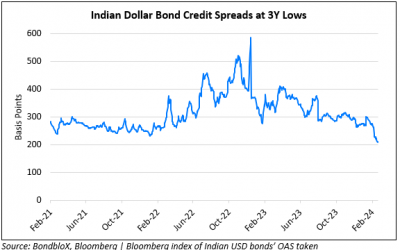

Indian Dollar Bond Spreads Tighten to 3Y Lows Led by HY

Credit spreads of Indian corporate dollar bonds have compressed over the past year and currently stands at 3Y lows of ~209bp as seen in the chart above. The tightening in spreads comes after the broad easing in pressures in Adani Group companies' dollar bonds over the...