Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

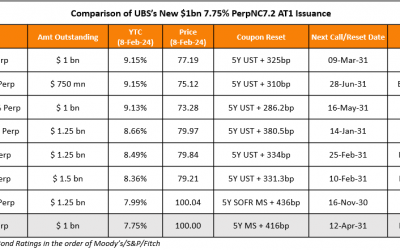

UBS Prices $1bn PerpNC7.2 AT1 at 7.75%

UBS raised $1bn via a PerpNC7.2 bond at a yield of 7.75%, 62.5bp inside initial guidance of 8.375% area. The subordinated notes are rated Baa3/BB/BBB-. The coupons are fixed until the first reset date of 12 April 2031, and if not called by then, it resets to the 5Y MS...

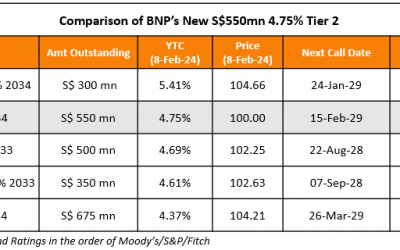

BNP Prices S$ 10NC5 Tier 2 at 4.75%

BNP Paribas raised S$550mn via a 10NC5 Tier 2 bond at a yield of 4.75%, 35bp inside initial guidance of 5.1% area. The subordinated bonds are rated Baa2/BBB+/A-. The first call date on the notes occurs on 15 February 2029. The issuer may redeem them bond at par upon...

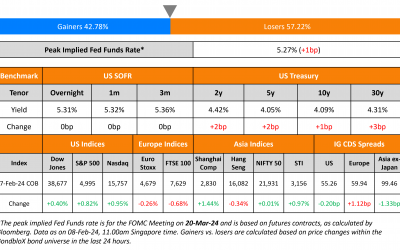

Strong US 10Y Auction; Turkey Wealth Fund Prices 5Y at 8.375%

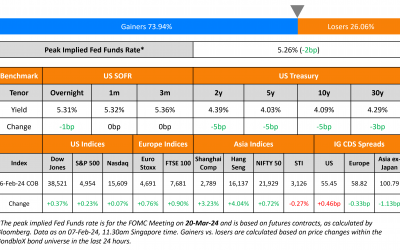

US Treasury yields were marginally higher on Wednesday, up by 2-3bp. The US Treasury's largest ever auction of the 10Y, issuing $42bn saw solid demand at a yield of 4.093%, stopping through (Term of the Day, mentioned below) by 1.2bp. The bid-to-cover came at 2.56x,...

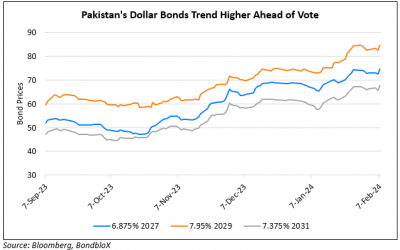

Pakistan’s Dollar Bonds Rally as S&P Sees Rating Upgrade Path

Pakistan's dollar bonds rallied by over 2 points across the curve after S&P said that it saw the nation being on a path to secure a possible upgrade to B. It said that the move would depend on whether the elections today will bring about a government that can push...

Frontier Communications Downgraded to B+ by Fitch

Frontier Communications (Frontier) and its subsidiaries have been downgraded by a notch from BB- to B+ by Fitch. Fitch also has a negative outlook on all the entities. The rating downgrade and negative outlook results from Fitch expectations that Frontier will require...

Kenya Launches Tender Offer for 2024s

Kenya's 6.875% 2024s jumped by 1.7 points after the country launched a tender offer for the bonds. According to the statement released, the buyback offer closes on February 14 and the buyback price is at par value. Kenya has also mandated Citigroup Global Markets and...

Ecuador’s Dollar Bonds Rise on VAT Increase Resolve

Ecuador's dollar bonds were amongst the top gainers, up by over 1 point. This comes after the President Daniel Noboa decided to use his 'line-item authority' to raise the permanent VAT (value-added tax) band of 13-15%, in order to curb the budget deficit. The...

Treasury Yields Ease Slightly; BNP Launches S$ Tier 2

US Treasury yields eased on Tuesday by 3-5bp across the curve. Three Fed speakers came out noting easing inflation amid a resilient economy. Cleveland Fed President Loretta Mester said that policymakers will probably gain confidence to cut interest rates "later this...

Unigel Readies For Bankruptcy Filing in Brazil

Unigel is preparing to file for bankruptcy in Brazil as it failed to reach a mediation with creditors, according to some sources. The court had granted 60-day protection from creditors on 14 December 2023. In November 2023, the company had missed a coupon payment of...