Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

ICICI Bank Reports 59% Rise in Profits

ICICI Bank reported a 59% YoY increase in standalone net profits to INR 70bn ($926mn) during the previous quarter. Total income of the bank rose to INR 274bn ($3.6bn), up 15% YoY. Provisions (excluding provision for tax) declined by 63% to INR 10.7bn ($141mn) during...

IMF Broadly Agrees to Extend Pakistan Loan for One Year

IMF has "largely agreed" to extend its current loan program to Pakistan for another one year, according to Miftah Ismail, Pakistan's finance minister. Details however would be deliberated and decided next month during a mission visit to Pakistan and thus no...

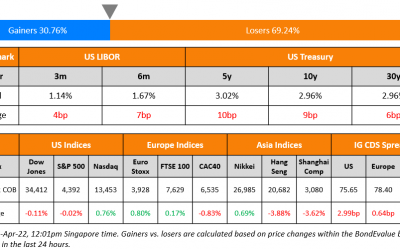

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

The S&P and Nasdaq ended sharply lower, down 1.5% and 2.1% respectively with all sectors in the red, led by Energy, down over 3.1%. US 10Y Treasury yields shot up 9bp to 2.96%, led by the front-end of the curve where the the 2Y yield jumped 15bp after Powell's...

Evergrande to Offer 2,000 Flats in Labor Day Promotion

Evergrande is offering 2,000 completed homes for sale during the upcoming Labour Day holiday. This comes as part of its promotions campaign during what is believed to be a golden week for property sales. Among these, 1,000 units in 10 cities that constitute ~50% of...

Emirates NBD Reports 18% Jump Quarterly Net Profits

Dubai banking major Emirates NBD, reported net profits of AED 2.7bn ($735mn), an 18% jump YoY and its highest quarterly figure since 2019. Total income stood at AED 6.4bn ($1.7bn), up 3% YoY with international operations contributing 37% of it - this was thanks to the...

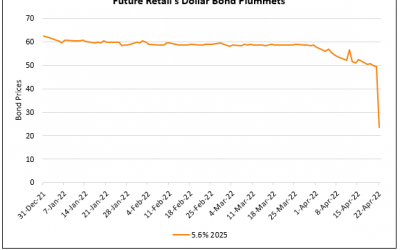

Creditors Reject Future Group Slump Sale to Reliance Retail; Dollar Bonds Collapse

Future Retail's dollar bonds collapsed by over 50% after Future Group lenders rejected a proposal regarding the sale of its wholesale, retail, and logistics assets to Reliance Retail Ventures Ltd. (RRVL). As per Mint, the rejection happened after the deal value was...

SoftBank Plans on Retaining Arm Ltd Controlling Stake post-IPO: Sources

SoftBank Group is expected to retain a controlling stake in Arm Ltd. after the planned IPO of the latter, as per sources. The sources mention that SoftBank decided that selling a smaller portion of Arm Ltd. now would be preferable, given the current slump in chip...

AT&T Reports Earnings

US-based telecommunications giant AT&T posted a 2.5% YoY revenue increase for its core phone and internet business thanks to wireless and broadband revenue growth expansion in fiber internet and 5G services. During Q1, the company added 289k fiber internet...

Keppel Corp Reports Strong Results

Keppel Corporation released a voluntary business update where it said that it saw a higher net profit YoY with increased contributions from all segments except Urban Development. The update comes on the back of a delay in announcing the merger of Keppel Offshore &...