Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

HDFC Bank Launches $ Bond

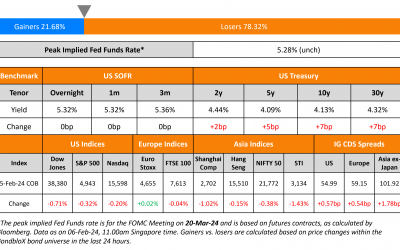

US Treasury yields climbed higher, continuing the move seen on Friday, with the 10Y yield up 7bp. US ISM Services PMI increased to 53.4 last month from 50.5 in December. The group’s metric of prices paid jumped 7.3 points, the most since 2012, to 64, and is also its...

Vedanta Receives Enquiries for Its Non-Core Assets

Vedanta Ltd. (Vedanta) has received enquiries for its non-core assets that include iron ore mines and a steel plant of ESL Steel, according to its CFO Ajay Goel. Currently, the process in terms of due diligence, data rooms, Q&As, site visits is ongoing and they...

Fosun Considering Up to $800mn Stake Sale in Ageas

Fosun International is considering selling its minority stake in Belgian insurer Ageas, to reduce its debt burden, according to the sources. The company is exploring either a partial or full divestment of its 10% stake in Ageas, currently worth €736mn ($792mn). The...

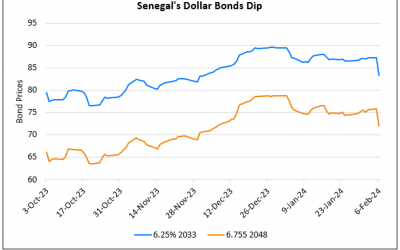

Senegal’s Dollar Bonds Drop 4 Points on Election Postponement

Senegal's dollar bonds fell by nearly 4 points after its President Macky Sall announced that the presidential vote would be postponed. The date on which it would be held was unspecified. The President said that the delay was due to a dispute over the candidate list...

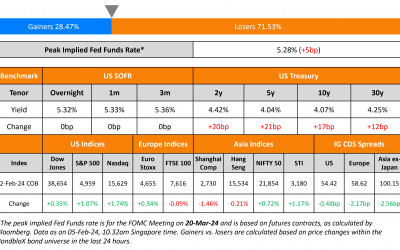

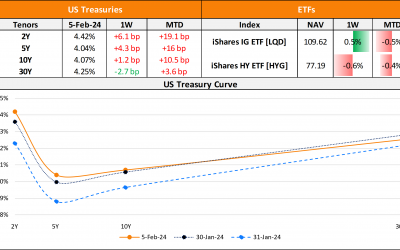

Treasuries Sell-Off ~20bp on Strong Jobs Print, Powell Remarks

US Treasuries saw a sharp sell-off led by the short-end of the curve. The 2Y yield soared 20bp and the 10Y was up 17bp after a strong jobs print and Jerome Powell hinting at an unlikely March rate cut. US Non-Farm Payrolls (NFP for January 2024 came at a strong 353k,...

The Week That Was (28 Jan – 04 Feb, 2024)

US primary markets continued to stay active, with new deals at $28.3bn vs. $24.8bn seen a week before this. IG issuers racked up $20.9bn in deals led by IBM's $5.5bn seven-part debt deal and Kinder Morgan's $2.25 two-part deal. HY issuers accounted for $6.9bn of the...

Zambia Said to Make Progress on Debt Revamp

Zambia is said to have made progress regarding its debt restructuring proposals with commercial creditors in China. The country's debt revamp plans have been affected for the last three years. Its Treasury Secretary Felix Nkulukusa added, "there is no definition and...

Over 30 COGARD Projects White-Listed for Support as per Reports

Over 30 projects of Country Garden's (COGARD) have been put on "white-list" to receive support from the Chinese local governments, according to a news report by Reuters. Its whitelisted projects included those from provinces of Henan, Hubei, Sichuan, Shandong and the...

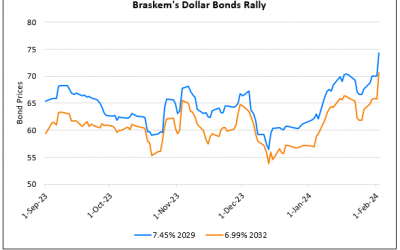

Braskem’s Dollar Bonds Rally on Reports of Stake Acquisition

Braskem Idesa's dollar bonds were the top gainers yesterday, rallying by over 2.5-5 points. The company is said to have received interest from petroleum companies PIC from Kuwait and Saudi's Aramco to acquire a stake in it, as per newspaper Folha de Sao Paulo. The...