Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

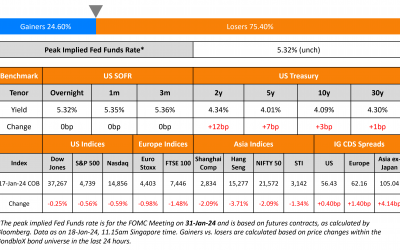

Treasury Yields Trudge Lower

US Treasury yields broadly trudged lower on Friday with the 10Y down 4bp, while the 2Y moved 3bp higher. The University of Michigan’s consumer sentiment index rose 9.1 points, the biggest monthly advance since 2005, to 78.8. The was the highest reading since July...

Macy’s Rejects $5.8bn Acquisition Offer

Macy's rejected a $5.8bn acquisition bid offer from Arkhouse Management Co. and Brigade Capital Management. As reported earlier, the offer was made to the company in December. On Sunday, Arkhouse threatened to take its offer to shareholders if Macys didn't step up the...

Kenya Raises $210mn of Funding from Pan-African Lender

Kenya raised $210mn in funding from pan-African lender, Trade & Development Bank (TDB) on Friday. This funding is in addition to the $941mn funding which was approved by the IMF last week. Kenya is expecting additional funds from the World Bank and African...

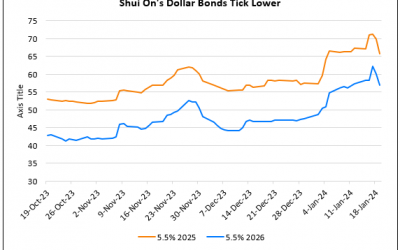

Shui On’s Dollar Bonds Drop 3-4 Points

Shui On's dollar bonds were among the biggest losers, having dropped 3-4 points across the curve. While there was no specific news attributable to the move yet, its bonds have been falling over the last two days. Chinese property developers' dollar bonds have again...

Lufthansa Upgraded to IG-Status at Baa3 by Moody’s

Lufthansa was upgraded to Baa3 from Ba1 by Moody's. The rating agency also upgraded the ratings of Lufthansa's senior unsecured debt to Baa3. The upgrade action follows the strong operating performance achieved by the company last year. The company achieved an...

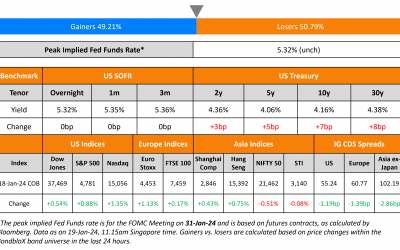

Treasury Yields Tick Higher

US Treasury yields continued to tick higher, with the 10Y up 7bp and 2Y up 3bp. Atlanta Fed President Raphael Bostic urged the Fed to proceed cautiously towards interest-rate cuts given the potential economic impact of unpredictable events, including elections and...

Unifin Files Debt Restructuring Deal

Unifin Financiera filed a debt restructuring deal in a Mexican bankruptcy court last week which is currently under consideration by the judge. The judge must approve the plan before January 28 for the court to process the deal. According to the plan, which was...

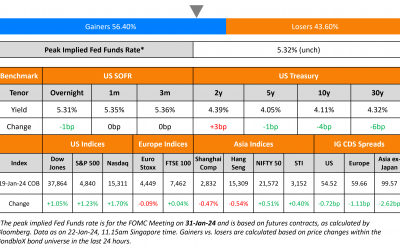

Treasuries Sell-Off After Strong Retail Sales

US Treasury yields jumped further higher, led by the front-end, as strength in economic data saw markets reprice their view on expected Fed rate cuts. The 2Y yield rose by 12bp and the 10Y was up 3bp. US Retail Sales rose by more than expected in December, thanks to...

Kenya Receives $941mn Funding From IMF

The IMF approved funding of $941mn to Kenya on Wednesday, of which $624.5mn was disbursed immediately. The disbursement under the Extended Fund Facility (EFF) and Extended Credit Facility (ECF) programs will be topped by $60.2mn of funds under a Resilience and...