Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

KWG Downgraded to B2 from B1 by Moody’s; Shimao Cut to CCC from B- by Fitch

KWG Group was downgraded to B2 from B1 by Moody's on the back of weakening contracted sales and heightened refinancing risks ahead of sizeable debt maturities. Contracted sales are expected to fall 10-15% over the next two years. KWG has around $900mn of offshore...

Argentina Closes $45bn Deal with IMF

Argentina has finally closed a deal with the IMF to restructure $45bn in debt. The announcement came after a report that Argentina was struggling to get the deal to pass through the Congress. The agreement includes a 30-month extended fund facility, reduced monetary...

Future Retail, Amazon Plan Out-of-Court Settlement Talks

Future Retail and Amazon's lawyers have agreed to initiate talks for an out-of-court settlement to break the impasse regarding the sale of the troubled Indian retailer to Reliance Retail. With the dispute being adjourned in court for 10 days, the chief justice said,...

UniCredit’s Bid for Banco BPM Hits a Roadblock Over Russia-Ukraine Crisis

Italian lender UniCredit is said to have halted its efforts to acquire Banco BPM after the former's stock has fallen over 20% since Russia invaded Ukraine. According to Reuters sources, "A strong share price was critical to pulling off the deal to combine the second...

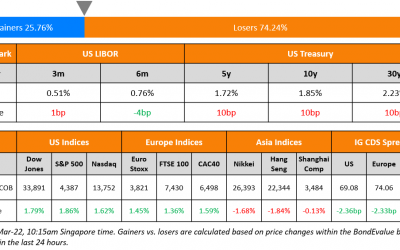

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

US equity markets ended higher on Wednesday with the S&P and Nasdaq closing 1.9% and 1.6% higher each. Sectoral gains were led by Financials, Materials, Energy, IT and Industrials up over 2% each. European markets recovered some of Tuesday's losses - DAX, CAC and...

Agile Group to Redeem March 2022s; Shimao Hires Advisers for Restructuring; COGARD Contracted Sales Down 30% in Feb

Agile Group said that it has deposited funds into the designated bank account of the trustee to redeem its $436.5mn 6.7% bonds due March 7, 2022. Agile said there will be no material impact on its financial position as a result of the redemption. Shimao is said to...

Vedanta Approves $638mn Dividend, with 2021 Total at $2.2bn

Vedanta Ltd. has approved a dividend of INR 13/share ($0.17), amounting to INR 48.3bn ($638mn), its third dividend in the financial year. This brings its total 2021 dividend to around $2.2bn for the full year, ending March 2022. Vedanta last announced a dividend of...

Citigroup Warns of $4bn Loss from Russian Exposure

Citigroup warned that it risks losing $4bn due to its exposure to Russia given the ongoing Russia-Ukraine crisis. This comes after Citi earlier disclosed that it had $9.8bn in total exposure to the country as of December 2021, including its Russian retail bank which...

DP World Temporarily Halts Ukraine Operations, Trafigura Freezes Russia Investments

Dubai's DP World has temporarily halted its Ukraine operations after attacks in different parts of the country, according to a company source. The sources added that the port operator was also reviewing its business in Russia due to the sanctions imposed by EU and its...