Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

SBI Prints $300mn Formosa at 2.496%; First Ever Formosa by an Indian Issuer

State Bank of India (SBI) raised $300mn via a 5Y formosa bond at a yield of 2.496%, 30bp inside the initial guidance of T+130bp area. The bonds have expected ratings of BBB-/BBB- (S&P/Fitch), and received orders over $1bn, 3.3x issue size. SBI is the first Indian...

5 New $ Deals Launched incl. SBI, SIA; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

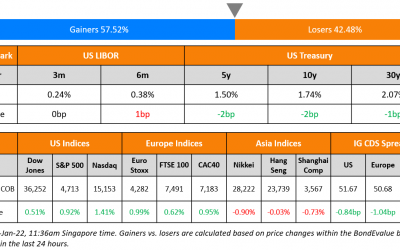

US equity markets saw strong gains with the S&P and Nasdaq up 0.9% and 1.4% respectively. Energy led the gainers, up 3.4% with IT, Materials, Consumer Discretionary and Communication Services up over 1% each. US 10Y Treasury yields were down 2bp to 1.74%. European...

R&F Properties Manages to Delay Bond Maturity Despite Buyback Failure

R&F Properties succeeded in delaying payment on its $735mn 5.75% dollar bond due Thursday. The company said it was able to buy back only 16% ($116.4mn) of the note under a tender offer as it did not have sufficient liquidity to complete the tender. As part of the...

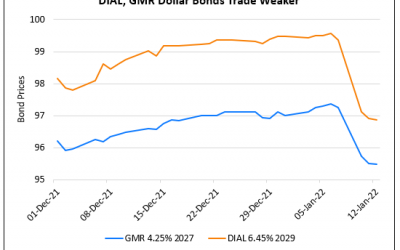

DIAL, GMR Airport Bonds Down 3-4 Points

Dollar bonds of Indian airports like Delhi International Airport Ltd (DIAL) and GMR are down 3-4 points in the week. The moves come after the new Covid variant Omicron which has seen some airlines cut their capacity. For example, Vistara, the airline JV between Tata...

Citi to Exit Mexico Retail Banking

Citigroup plans to exit its Mexican retail banking operations, its largest branch network in the world. Citi however will continue its institutional businesses in Mexico. The exit could take place in the form of a sale or a public-market alternative, and will be...

UniCredit Mulling Takeover of Russian Lender Otkritie Bank

Italian lender UniCredit SpA is said to be mulling a takeover of Russian lender Otkritie Bank FC as the former's CEO Andrea Orcel explores M&A opportunities after negotiations with the Italian government for the takeover of Banca Monte dei Paschi di Siena SpA...

American Airlines Betters Q4 Revenue Forecast

American Airlines has narrowed the fall in its Q4 revenue forecast than previously expected. American Airlines said that it expects revenues to be down 17% vs. pre-pandemic levels, compared with its prior forecast of a 20% fall. However, American expects cost per...

SPH Reports Improvement in Business Segments

Singapore Press Holdings (SPH) released a business update for its first quarter ended November where it reported an improved operational performance with the gradual recovery in the economy. Within the retail segment, SPH REIT witnessed a high occupancy rate of 98.8%...

10 New $ Deals incl. MUFG, AgBank; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

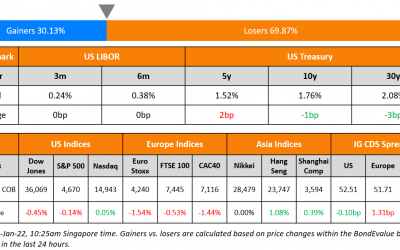

US equity markets ended mixed with the S&P down 0.1% and the Nasdaq flat after initial losses of 2% and 2.7% respectively. Healthcare led the gainers, up 1% while Industrials led the losers, down 1.2%. US 10Y Treasury yields were down 1bp to 1.76%. European...