Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

ESR REIT & ARA Logos Plan $1bn Merger

Singapore-based ESR-REIT and ARA Logos Logistics Trust have proposed a S$1.4bn ($1bn) merger that involves ESR acquiring all of ARA Logos' units in exchange for cash and new units. The transaction will be effected by way of a trust scheme of arrangement with a new...

Bolsonaro Inclined to Privatize Petrobras; Company Receives $1.5bn Offering for Oil Field

Brazilian President Jair Bolsonaro is now inclined to privatize Brazilian oil company Petroleo Brasileiro (Petrobras). The President added that he would discuss the idea with economic advisors in order to make a final decision and the decision comes after declaring he...

Xinyuan Succeeds in Completing Exchange Offer

China's Xinyuan Real Estate announced that holders of $207.68m worth (90.7%) of its $229m 14.2% bonds due October 15 have agreed to exchange them for new bonds and cash. Having successfully completed the exchange offer, the company has avoided possible default. The...

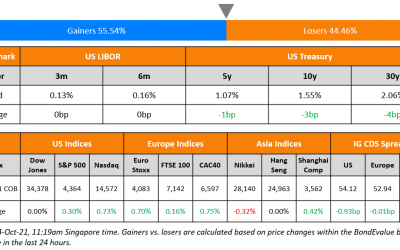

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

US equities closed in the green after three days of losses with the S&P and Nasdaq up 0.3% and 0.7%. Utilities led the gains by ending 1.1% higher with most sectors ending positive, while Financials were down 0.6% despite JPMorgan's strong earnings (scroll below...

Greenland Downgraded to B+ by S&P on Impaired Funding and Weak Operating Conditions

Greenland Holding was downgraded two notches to B+ from BB and its senior unsecured notes to B from BB- by S&P. They also downgraded its subsidiary Greenland Hong Kong Holdings Ltd. to B from BB- with a negative outlook. The downgrade comes on the back of its...

Tata Motors Gets $1bn from TPG & ADQ to Grow EV Business

Indian carmaker Tata Motors announced a $1bn capital raise from private equity firm TPG and Abu Dhabi state holding company ADQ to grow the company's electric vehicle (EV) business. As part of the deal, the Jaguar Land Rover parent will set up a separate subsidiary...

CapitaLand Buys Chinese Logistics Centers for $261mn

CapitaLand China Trust (CLCT) is set to buy four logistics centers in China for RMB 1.68bn ($261mn). The centers in Shanghai, Kunshan, Wuhan and Chengdu will be the company's first foray into China's logistics sector as per the company. This investment comes after the...

E-House Downgraded to To B by S&P On Tough Operating Conditions And Tightening Liquidity

Chinese real estate services company, E-House (China) Enterprise Holdings Ltd has been downgraded to B from B+ by S&P over tough operating conditions and tightening liquidity. S&P concurrently cut its long-term rating on its dollar bonds to B from B+. The...

JPMorgan Beats Earnings Expectations; FICC Revenues Miss

JPMorgan kicked-off the US bank earnings season with strong Q3 results. It reported a net income of $11.7bn, up 24% YoY and an EPS of $3.74/share vs. estimates of $3/share. Profits were helped by a net benefit of $1.5bn from better loan-losses after releasing $2.1bn...