Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

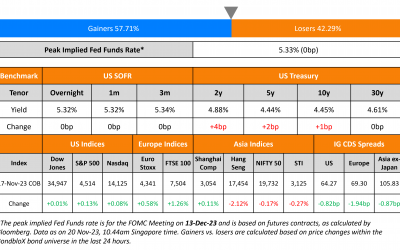

Fed Minutes Sound Cautious Tone; ADCB Prices AT1 at 8%

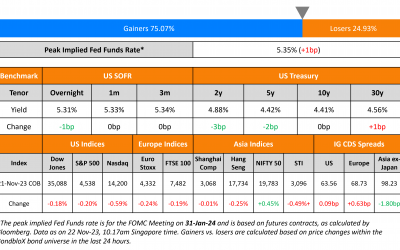

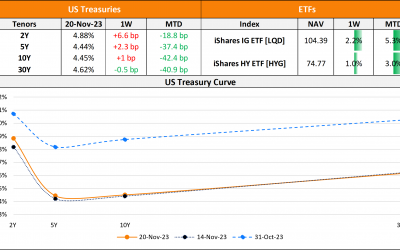

US Treasury yields were steady across the curve on Tuesday. The Federal Reserve's minutes released yesterday showed that policymakers agreed on a stance to "proceed carefully" on future interest-rate moves and base any further tightening on progress toward their...

China Drafting ‘White List’ of Developers for Funding Options

China is said to be drafting a 'white list' of 50 developers, both private and state-owned, to be eligible for a range of funding options to help the property market, as per sources. They noted that some of the names include China Vanke, Seazen Group and Longfor Group...

Macy’s Bonds Rally On Better than Expected Q3 Numbers

Macy's Inc. reported better than expected Q3 results yesterday. Overall sales came in at $4.86bn, topping forecasts of $4.77bn for the quarter. The company raised the forecast of full-year revenue to $22.9-23.2bn and the adjusted earnings to $2.88-3.13/share. This is...

Lippo Karawaci Downgraded to CCC+ by Fitch

Lippo Karawaci was downgraded to CCC+ from B- by Fitch. Fitch also downgraded the ratings of its 8.125% 2025s and 6.75% 2026s to CCC+ from B-. The rating action reflects the heightened refinancing risk of Lippo's dollar bonds due to prioritization of refinancing...

ADCB Launches $ Perp; New Issues; Ratings; Gainers and Losers

US Treasury yields were marginally lower across the medium and long-term tenors on Friday. The US Treasury's $16bn 20Y bond auction was met with stronger than expected demand. The final yield on the auction stopped through by 1bp at 4.78% and the bid-to-cover came at...

Bayer’s Bonds Drop on Court and Drug Setback

German pharmaceutical company Bayer AG saw its bonds drop over 1.2 points across the curve after it suffered a setback from a court ruling and its drug development halt. Ever since Bayer's acquisition of Monsanto in 2018, the latter's herbicide known as Roundup has...

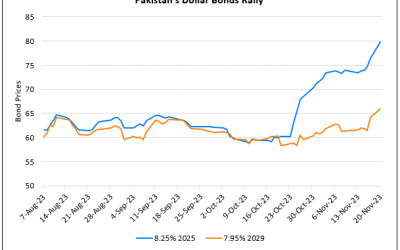

Pakistan’s Dollar Bonds Continue to Rally

Pakistan's dollar bonds continued to rally after it received a $700mn agreement from the IMFs executive board. This is as part of the total $3bn IMF bailout program to help the nation emerge from its financial troubles. The total disbursements under the package would...

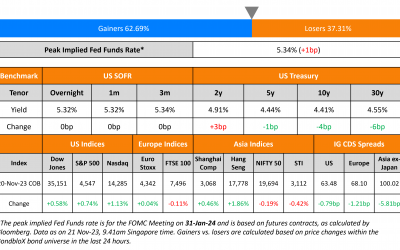

Macro; Rating Changes; Talking Heads; Gainers and Losers

US Treasury yields edged lower yesterday, reversing the pick-up seen a day prior. Yields were down 6-7bp across the curve. The Fed's Vice Chair for Supervision and voting member, Michael Barr reiterated officials are likely at or near the end of their tightening...

The Week That Was (13 – 20 November, 2022)

US primary market new deals jumped higher last week to $41bn vs. $33.7bn a week prior with IG deals at $31.2bn led by Tapestry's $4.5bn five-trancher and Carrier Global's $3bn three-tranchers respectively. HY issuances stood at $7.5bn with TransDigm's $2bn...