Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

Sri Lanka’s Dollar Bonds Rise on IMF Disbursement Expectations

Sri Lanka's dollar bonds inched higher by over 1 point across the curve on the back of expectations that they could receive a new disbursement from the IMF in December. In late October, Sri Lanka's government won an initial staff-level funding approval from the IMF,...

Wanda Commercial and Wanda HK Downgraded to C

Dalian Wanda Commercial Management Group (Wanda Commercial) and Wanda Commercial Properties (Hong Kong) were downgraded to C from CC by Fitch. They also downgraded the ratings on the dollar bonds guaranteed by Wanda HK and issued by Wanda Commercial's subsidiaries to...

COGARD, Sino-Ocean Dollar Bonds Rally on Inclusion to Draft List

Country Garden's (COGARD) and Sino-Ocean's dollar bonds were up by 1.5-2 points across the curve after sources noted that they were included on China's draft list of 50 developers eligible for financing support. They noted that the list also included CIFI Holdings....

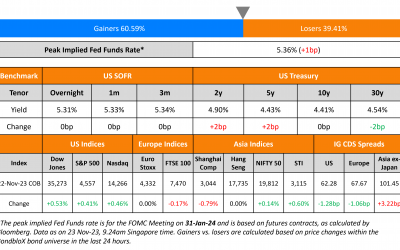

Macro; US Durable and Capital Goods Orders Drop

US Treasury yields were broadly flat across the curve on Wednesday. US initial jobless claims fell by 24k to 209k in the week ending November 18, better than the estimated 227k. Durable Goods Orders fell 5.4% YoY, worse than expectations of a 3.2% drop. Capital Goods...

Rite Aid Given March 1 Deadline by Bankruptcy Court

Rite Aid has been given a deadline of March 1 by the Bankruptcy Court to reorganize its business. The ruling comes after complaints about the case moving too fast, from the lower-ranking creditors. They argued that they needed more time to review the $3.45bn loan...

Wanda Seeking Dollar Bond Extension

Wanda Properties, a key unit of Dalian Wanda has asked to extend the maturity on the 7.25% bonds due 29 January 2024 by eleven months to 29 December 2024. Sources noted that the company is offering to pay 10% of the principal in January, 20% in May, 30% in September,...

Julius Baer’s Dollar Bonds Drop on Finma’s Scrutiny Over Signa

Julius Baer's dollar bonds were down as much as 4 points after news that its €600mn ($655mn) exposure to Signa Holding GmBH was now being monitored by Swiss regulator Finma, according to sources. The company had set aside CHF 70mn ($79mn) for souring debt in the first...

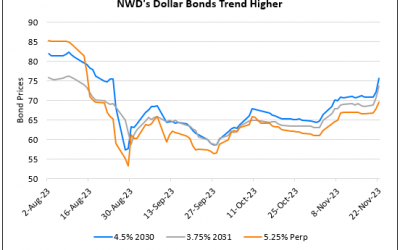

NWD’s Dollar Bonds Move Higher

New World Development's (NWD) dollar bonds moved higher by over 2-3 points across the curve yesterday. While there was no specific news available regarding the company, NWD's bonds have been trending higher since the beginning of the month. NWS Holdings, the flagship...

Marks & Spencer Upgraded to BBB- by S&P

Marks & Spencer (M&S) was upgraded to BBB- from BB+ by S&P. The rating action came on the back of a strong 1H 2023 operating performance. It reported revenue growth of 14.7% YoY in its food division, stronger than the market expectations in both volume and...