Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

ECB Hikes by 25bp

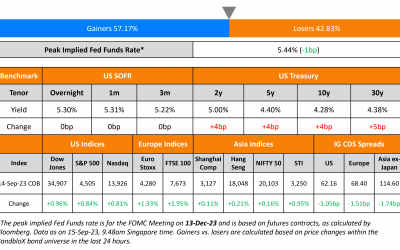

US Treasury yields jumped 4bp higher cross the curve as US retail sales and PPI data rose in August by more than forecasts. Retail Sales was up 0.6% beating estimates of a 0.1% increase and core retail sales improved 0.2%, better than forecasts of -0.1%. PPI came at...

Egypt Planning to Advance Presidential Elections

Egypt is planning to hold its presidential elections before end-2023, much earlier than the initial February 2024 date, as per sources. While no official date has been released yet, this news comes amid the nation's economic crisis with inflation soaring higher....

Adani In Talks for $3.5bn via Syndicated Loans, Say Sources

Adani Group is said to be in talks with banks to arrange $3.5bn in syndicated loans to refinance debt, in particular the one taken for its purchase of Ambuja Cements. It had taken $3.8bn in debt for the purchase and sources say that Adani will repay at least $300mn on...

US CPI at 3.7%; Core CPI at 4.3%

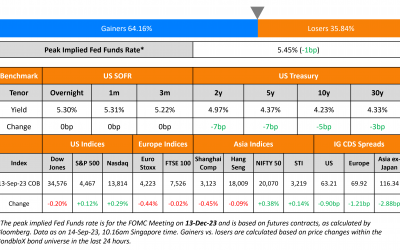

US Treasury yields moved lower across the curve by 5-7bp following the US inflation report. US CPI for August 2023 came at 3.7%, higher than expectations of 3.6% and the previous month’s 3.2%. Core CPI continued its downward trend to 4.3%, inline with expectations of...

COGARD Dollar Bondholders Said to Weigh Legal Options Incase of Default

Some of Country Garden's (COGARD) offshore bondholders are said to be in talks with law firm Ashurst, to consider legal options if the company does not meet its debt repayment obligations or defaults, as per sources. The company has been witnessing deteriorating...

VEON’s Dollar Bonds Rally on Early Redemption Announcement

Dutch communications and technology company VEON Holdings will fully redeem its bonds due December 2023 and June 2024 early, in a statement. The early redemption of the two notes will be done on September 27. Separately, VEON also said that it has agreed with the...

Vedanta Looking to Extend 2024s and 2025s by 3 Years

Vedanta Resources Limited is said to have discussed a potential maturity extension of 3 years on the company's dollar bonds due in 2024 and 2025 at a meeting with investors in Hong Kong on Monday, as per The Economic Times (ET). This comes after news of the Anil...

Royal Caribbean CFR upgraded to B1 from B2, and outlook changed to positive by Moody’s

Moody's upgraded Royal Caribbean Cruises Ltd. from B1 to B2 on the back of expectation that increased capacity, stronger pricing and improved cost controls will enable the issuer to lower debt/EBITDA to around 5x at the end of 2023. The company has paid down about...

COGARD Wins Approval to Extend Repayment on Local Bonds

Country Garden (COGARD) has won local creditors' approval to extend repayment by three years on six local bonds, in a positive news for the developer. There are two other yuan bonds for which the voting deadline for approving payment extensions was moved to late...