Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

COGARD Proposes Grace Period for Local Bond; Set to Report $7.55bn Loss in H1

Country Garden (COGARD) has proposed a grace period of 40-days for payment on a local yuan bond maturing September 2, to avoid triggering a default on the notes. The Chinese developer is also to set report its first-half results with net losses expected at about...

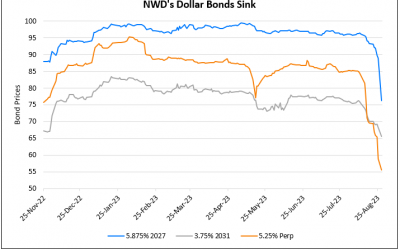

NWD Refutes Blogger’s Allegations of Pledging Projects for Financing

New World Development (NWD) dollar bonds continued to move lower by 1-3 points. The drop in NWD's bonds comes after a blogger was said to have made several allegations on the company facing debt woes. A spokesperson from NWD came out saying that the blogger's alleged...

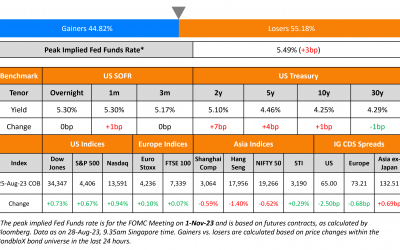

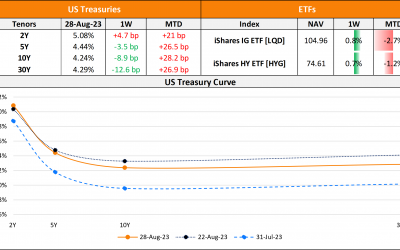

Treasuries Reverse Jackson Hole Move

US Treasury yields dropped across the curve led by the 2Y and 5Y that fell 10-11bp. The manufacturing sector continued to show signs of contraction with the Dallas Fed Manufacturing Activity at -17.2 vs expectations of -19.0. CME probabilities for a 25bp hike in...

StanChart To Sell Aviation Leasing Arm for $3.6bn

Standard Chartered (StanChart) said that it was selling its global aviation finance leasing business to Saudi Arabia's AviLease aka Aircraft Leasing Co, for about $3.6bn. AviLease is owned by Saudi's sovereign wealth fund PIF. StanChart's aviation leasing arm owns and...

Vedanta Wins Arbitration Against Government Demanding Higher Payout

Vedanta won an arbitration against the government which demanded a higher payout from the company after it disallowed recovery of ~$1.16bn in certain costs. The contract noted that Vedanta could recover all costs incurred before splitting profit with the government in...

NWD’s Dollar Bonds Continue to Drop Sharply

Dollar bonds of Hong Kong-based developer New World Development (NWD) continued to fall sharply, following the broader selloff in several Hong Kong issuers on Friday. Real estate agency JLL had reported that Hong Kong developers' sales were at its lowest since 2019...

UBS Said to be Lining Up AT1 Issuance

UBS Group is said to be planning an AT1 bond issuance as early as September, as per sources. This would be the Swiss lender's first issuance of the subordinated instruments after the historic $17bn Credit Suisse AT1 write-off in March. Post that, BNP Paribas was the...

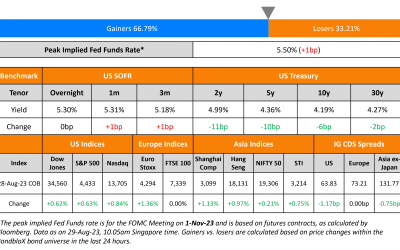

Powell Hints At Possible Increase in Rates, With Cautious Approach

US Treasury yields inched higher led by the 2Y that rose 7bp to 5.1% and the 5Y that was up 4bp. At Jackson Hole, Fed chair Jerome Powell said that they were "prepared to raise rates further" and that they would "proceed carefully as we decide whether to tighten...

The Week That Was (21 – 27 August, 2023)

US primary market new deals dropped sharply last week to $3.8bn vs. $16.7bn a week prior. IG deals took the majority of volumes with $3.2bn in deals led by Charles Schwab's $2.35bn two-trancher and Prudential Insurance's $500mn deal. There were no HY deals last week....