This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Perpetual Bonds – Impact of Call Dates and Resets on Prices

March 19, 2020

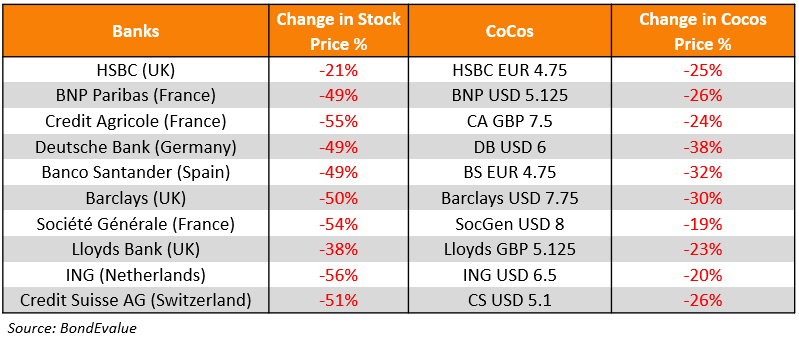

Stocks of many banks have taken a major hit in the last month as Central Banks cut interest rates to reduce the economic impact of the ongoing pandemic. The table below shows how bank stocks and one of their worst performing Contingent Convertible (CoCos) have fared in the last month.

Banks’ Stocks vs. CoCos – 17 Feb to 17 March 2020

Although we expect all CoCos to decline in prices due to the recent turmoil, the level of impact on each CoCo of the same issuer varies based on a multitude of factors including Currency, next Call Date, Reset Index and Spread over Index. Let’s focus on a basket of CoCos issued by HSBC Holdings Plc to analyse how the ‘Next Call Date’ and the ‘Reset Index plus Spread’ affected the prices. The HSBC CoCos used are all rated Baa3 by Moody at the time of writing.

Something to note first, is how investors look at yields. Prior to the recent move of prices lower, the CoCos were trading well above their Call Price. This means that the Yield to Call (YTC) on them was lower than the Yield to Maturity (YTM) as investors assume the bonds would be called on the first Call Date. After the decline, the prices are well below the Call Price and the Yield to Call has shot up rendering the number not very useful. Investors generally look at Yield to Worst (YTW) which takes the lower between YTC and YTM to give them the right picture.

An example shown below is HSBC USD 6.875 Perp that had a much lower YTC of 2.7% vs YTM of 6.3% on 17 Feb. By 17 Mar, the YTC had shot up to 10.8% and YTM was at 6.9%. YTM makes more sense in this situation.

Next Call Date

During periods of high volatility, we would expect the impact on CoCo prices to be higher, the further away the next call date is. This is because until the call date, the CoCo behaves like a Fixed Coupon Bond paying regular coupons. The further away the call date, the higher the duration on the bond will be and hence the higher impact on prices. The data shows this, but also shows that eventually, the price impact flattens out and reduces as the total return compensates the holder. The expectation is that coupons will still be paid regularly and given enough time, issuers will also be more likely to call the CoCos.

Reset Index Plus Spread

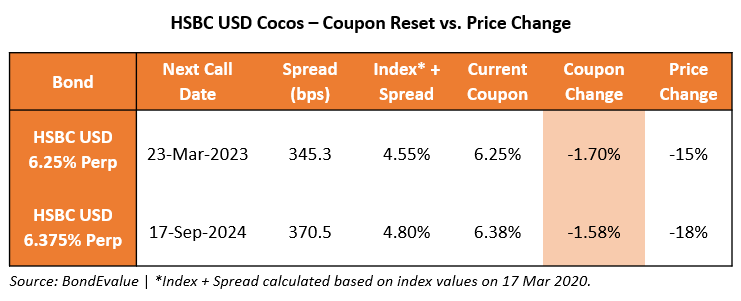

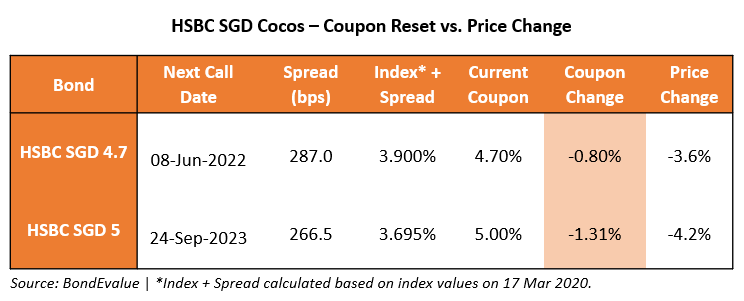

Coupons for CoCos usually reset to an Index plus Spread on the Call Date if they are not called. Since the prices have moved well below the Call Price, investors would be keen to know what the Index is, its current value, the spread and hence the new coupon rate that the CoCo will reset to (Index + Spread).

If we compare two similar HSBC USD Perps, we can see that the drop in price is higher for the bond that will reset to a lower coupon rate because of lower Index plus Spread. The different Call Dates also impacts the price change below.

Another Example – BNP

Let us also look at BNP as another example. We see a similar overall pattern that price impacts increase, flatten and then reduce as we go across the next call dates. Deutsche Bank recently announced that they are not likely to call one of their CoCos, which sent prices on some of their CoCos lower by 30%-40%. Similar data for Deutsche Bank and other banks are provided with the reference data.

BondEvalue has added the Next Reset Date, the Reset Index (Current Level), the Spread and the full name of the Reset Index to the Yield Analysis section so that you can gauge where the coupons on your Perps and Floating rate bonds will likely be reset.

Track Coupon Reset Data for CoCos on the BondEvalue App

BondEvalue has added the Next Reset Date, the Reset Index (Current Level), the Spread and the full name of the Reset Index to the Yield Analysis section so that you can gauge where the coupons on your Perps and Floating rate bonds will likely be reset.

Other Factors

For the above analysis, we have not considered other factors that can affect the price movement of CoCos. These could include write-down trigger levels, partial or temporary write-down clauses, cash or stock settlements and other similar issue-specific clauses.

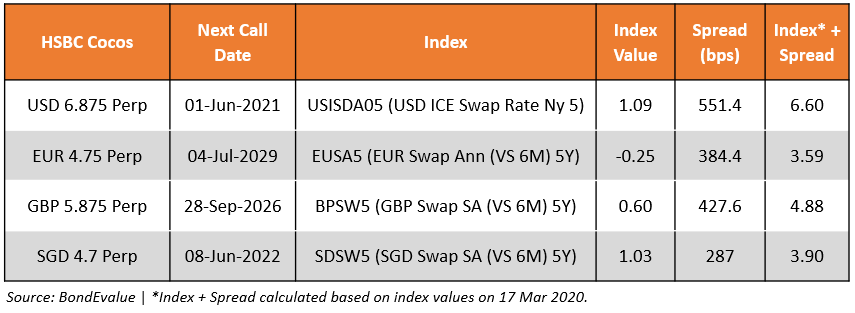

Reference Data (source BondEvalue)

Table below shows the details of a few HSBC CoCos including next call date, the index used to reset the coupon, the recent value of these indices and the spread over the index. Index plus Spread shows where the next coupon reset would be using current levels.

Table below shows how bank CoCos have performed in the last month (sorted by Bank, Currency and Next Call Date).

Source: BondEvalue

Go back to Latest bond Market News

Related Posts: