This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

PFC, Sunac Launch New $ Bonds; Macro; Rating Changes; New Bond Issuances; Talking Heads; Gainers & Losers

January 21, 2021

US equities ended on a strong positive note with the S&P and Nasdaq up 1.4% and 2% respectively with the FAANGS up ~5%. US 10Y Treasury yields were 1bp lower unchanged. Joe Biden was inaugurated as the 46th US president and signed a series of 17 executive orders including joining the Paris climate accord. FTSE, DAX and CAC gained 0.41%, 0.77%, 0.53%. US IG CDS spreads were 0.2bp wider and HY was 1bp tighter. EU main and crossover CDS spreads also tightened 1.6bp and 9.6bp respectively. Asia ex-Japan CDS spreads tightened 0.5bp and Asian equities are off to another positive start, up ~0.7% today.

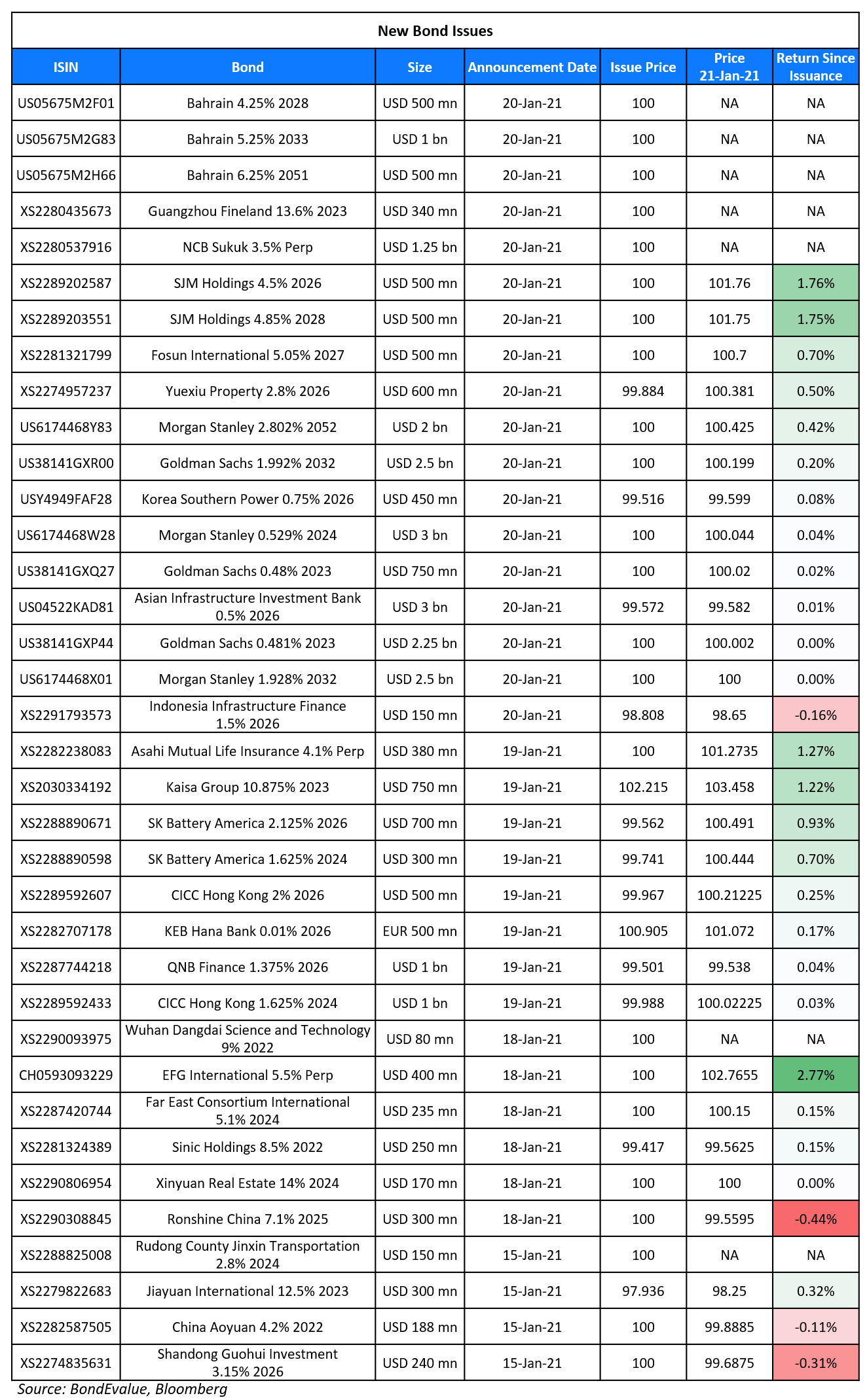

New Bond Issues

- PFC $ 10Y at 3.75% area

- Sunac $ 3.25NC2/5NC3 at 6.5%/7.05% area

- Mongolian Mortgage $ 3Y at 9.125% area

- Guorui Properties 3NP1.25 at 16.132% yield to put (YTP)

SJM Holdings raised $1bn via a dual tranche offering. It raised $500mn via a 5Y non-call 3Y (5NC3) bond at a yield of 4.5%, 50bp inside initial guidance of 5% area. It also raised $500mn via a 7Y non-call 4Y (7NC4) bond at a yield of 4.85%, 52.5bp inside initial guidance of 5.375% area. The bonds have expected ratings of Ba2/BB+.

Fosun International raised $500mn via a 6Y non-call 4Y (6NC4) at a yield of 5.05%, 40bp inside initial guidance of 5.45% area. The bonds have expected ratings of BB and received orders over $3.5bn, 7x issue size. Fortune Star (BVI) is the issuer and the Hong Kong-listed parent is the guarantor. Proceeds will be used to refinance offshore debt, including a tender offer, and for working capital and general corporate purposes. The tender offer is for its $1.189bn 5.25% 2022s with a purchase price of $1,017.5 plus unpaid and accrued interest per $1,000 in principal and the deadline is January 29. Their 5.25% 2022s currently trade at 101.56.

Li & Fung raised $100mn via a tap of its 4.5% 2025s at a yield of 4.04%. The bonds are rated Baa3/BBB and the coupons will increase by 25bp for each notch the bonds are downgraded below investment grade, capped at 100bp if the bonds are cut to B or lower. If the bonds are subsequently upgraded, then the rate will decrease by 25bp per notch floored at the initial rate. The downgrade protection will cease to exist if upgraded to Baa1/BBB+ (stable/positive). The tap trades at a new issue premium of 31bp over their initially issued 2025s which currently yield 3.73%.

Korea Southern Power raised $450mn via a 5Y green bond at a yield of 0.849%, or T+40bp, 35bp inside initial guidance of T+75bp area. The bonds have expected ratings of Aa2/AA- and received orders over $3.2bn, 7.1x issue size. Proceeds will be used for existing and future eligible projects in accordance with the issuer’s green bond framework. The issuer is a thermal generation company wholly owned by Korea Electric Power Corporation (KEPCO) which is 51% owned by the government.

Guangzhou Fineland raised $103.75mn via a 2.5Y bond at a yield of 13.6%, 25bp inside initial guidance of 13.85% area. The bonds have expected ratings of B3 and received orders over $375mn, 3.6x issue size. Proceeds will be used for offshore debt refinancing. Asia bought all the bonds – asset/fund managers/ hedge funds received a combined 87%, and private banks 13%.

Panama raised $2.45bn via a dual-trancher. It raised $1.25bn via a tap of its 2.252% 2032s at a yield of 2.198% or T+112bp, 28bp inside initial guidance of T+140bp area. It also raised $1.2bn via a tap of its 3.870% 2060s at a yield of 3.384% or T+155bp, 25bp inside initial guidance of T+180bp area. Morgan Stanley and BBVA were the lead managers on the deal. Proceeds will be used for general budgetary purposes.

Paraguay raised $826mn via a dual tranche offering. It raised $600mn via a 12Y bond at par to yield 2.739%, or T+165bp, 35bp inside initial guidance of T+200bp area. It also raised $226mn via a tap of its 5.4% 2050s at a yield of 4.086% or T+230bp, 25bp inside initial guidance of T+230bp area, +/- 5bp. Proceeds will be used to repurchase its 4.625% 2023 bonds. Paraguay offered $1,078.75 for $1,000 in outstanding 2023s. Citi, Itaú, BBA and Santander were the bookrunners on the deal and the lead managers on the buyback.

New Bond Pipeline

- Woori Bank $ bond

- Laos $ bond

- Dubai Aerospace Enterprise $ bond

- Zurich Insurance $ 30.25NC10.25

- REC $ bond

Rating Changes

- Fitch Upgrades The Co-operative Bank’s Covered Bonds to ‘A+’; Negative Outlook

- Peabody Energy Corp. Downgraded To ‘CC’ From ‘CCC-‘ By S&P On Distressed Exchange; New Debt Rated; Outlook Negative

- INEOS Quattro Senior Secured Debt Downgraded To ‘BB’ By S&P On Lower Recovery Prospects After Changes To Proposed Refinancing

- Argentine Conglomerate CLISA Senior Secured Notes Rating Lowered To ‘D’ From ‘CCC-‘ By S&P On Exercise Of PIK Option

- Thyssenkrupp Outlook Revised To Negative On Continued Cash Burn; ‘BB-‘ Rating Affirmed

- Fitch Places Eldorado’s ‘BB-‘ Ratings on Rating Watch Negative

- Radiance Holdings (Group) Co. Ltd. Assigned ‘B+’ Rating With Stable Outlook

Goldman & Morgan Stanley Raise $13bn via New Jumbo Deals

US banks Goldman Sachs and Morgan Stanley raised $13bn via jumbo deals post their earnings release.

Goldman raised $5.5bn via a three tranche offering:

- $2.25bn via a 2Y non-call 1Y (2NC1) bond at a yield of 0.481%, or T+35bp, 10bp inside initial guidance of T+45bp area

- $750mn via a 2Y non-call 1Y (2NC1) floating rate note at SOFR+41bp. The yield on the bond currently is 0.37%.

- $2.5bn via a 11Y non-call 10Y (11NC10) bond at a yield of 1.992%, or T+90bp, 20bp inside initial guidance of T+110bp area

The bonds are SEC registered and have expected ratings of A3/BBB+/A

Morgan Stanley also raised $7.5bn via a three tranche offering:

- $3bn via a 3Y non-call 2Y (3NC2) bond at a yield of 0.529%, or T+40bp, 15bp inside initial guidance of T+55bp area

- $2.5bn via a 11.25Y non-call 10.25Y (11.25NC10.25) bond at a yield of 1.928%, or T+87.5bp, 17.5bp inside initial guidance of T+105bp area

- $2bn via a 31Y non-call 30Y (31NC30) bond at a yield of 2.802%, or T+97bp, 17.5bp inside initial guidance of T+115bp area

The bonds are SEC registered and have expected ratings of A2/BBB+/A

Goldman’s 5% Perps were up 0.2 to 100.37, yielding 4.78%. Morgan Stanley’s 5.875% Perps were flat at 113.13, yielding 3.3%.

Term of the Day

Downgrade Protection

Downgrade protection is a compensation to bondholders where the bond’s coupon will increase by a certain amount if the bonds are downgraded by credit rating agencies. In the case of Hong Kong-based supply chain manager Li & Fung’s tap of its 4.5% 2025s announced this morning, the bonds are rated Baa3/BBB and the coupons will increase by 25bp for each notch the bonds are downgraded below investment grade, capped at 100bp if the bonds are cut to B or lower. Here though, if they are subsequently upgraded, then the coupon will decrease by 25bp per notch floored at the initial coupon. The downgrade protection will cease to exist if upgraded to Baa1/BBB+ (stable/positive).

Talking Heads

“They realized that there is some limits to what monetary policy can do to effect change in the real economy,” said Ramjee. “The Fed will continue buying bonds issued by the U.S. Treasury in order to fund the fiscal programs.”

On European Central Bank set for a change of focus after unprecedented stimulus

In a research note by Anatoli Annenkov, a senior European economist at Societe Generale

“A more realistic objective, (rather) than aiming for 2% inflation two or three years ahead, is thus to focus on protecting favourable finance conditions, at the lowest cost possible while allowing a longer period for inflation to converge to target,” said Annenkov. “We thus see the ECB on hold for the near term, although growth expectations are weakening amid prolonged lockdowns.” “They will aim to find a consensus view before the summer,” said Annenkov. “The expected reformulation of the inflation target to a symmetrical one around 2% should not be controversial.”

Mark Wall, the chief economist at Deutsche Bank

“The ECB is trying to shift the market’s focus from yields to financial conditions,” said Wall. “The more convinced the ECB is that bank-based financial conditions indicators are improving sustainably, the less sensitive the ECB is likely to be about a rise in yields.”

On ECB capping bond yields but not calling it yield curve control

Christoph Rieger, head of fixed-rate strategy at Commerzbank AG

While that strategy is similar to yield curve control, “they’re calling it something different,” said Rieger. “My feeling is that this is an important thing for the ECB, they’re looking at it and they’re actually envious of the BOJ. They would love to have something like that.”

Katharina Utermoehl, an economist at Allianz SE

“There are a number of issues in opting for such a strategy, or adding this to the ECB toolbox,” said Utermoehl. “This could bring out the idea that actually the ECB is doing monetary financing.”

Florian Hense, European economist at Berenberg

“It’s not as explicit as the Japanese do it, but broader,” said Hense. “Once it’s out that you explicitly control the yield curve, this commitment can be very expensive.”

“We expect credit tightening and fiscal consolidation in 2021, but not policy rate hikes,” said Li. “The People’s Bank of China (PBOC) is likely to maintain a slightly dovish bias near term, given uncertainty associated with the uneven economic recovery, sporadic new COVID-19 outbreaks and CNY appreciation pressure.”

On United Airlines promises more cost cuts as cash burn rises

Scott Kirby, chief executive at the United Airlines

The Covid-19 pandemic “has changed United Airlines forever” and that the company planned to make “structural reductions” that would make it “more profitable than ever”

Helane Becker, Cowen analyst

“Airlines are doing their best to control costs, but there is a limit,” Becker said. “The industry needs a revenue recovery.”

“We are now not going to pay immediately, but we are going to pay in the future,” Yatani said.

Top Gainers & Losers – 21-Jan-21*

Go back to Latest bond Market News

Related Posts: