This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

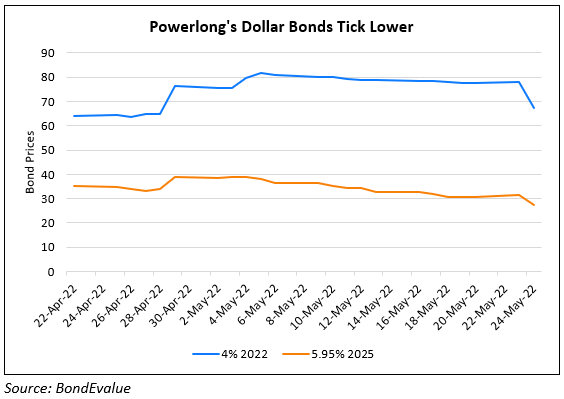

Powerlong’s Dollar Bonds Plummet up to 10 Points

May 25, 2022

Dollar bonds of Powerlong Real Estate dropped as much as 8-10 points on Tuesday. While the exact reason for the drop is not known, the developer was recently downgraded by Moody’s to Caa1 from B3 due to high refinancing risk and weakened liquidity. Moody’s expects Powerlong to use its internal resources to repay $600mn of maturing debt in 2022, which will further weaken its liquidity.

Go back to Latest bond Market News

Related Posts: