This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Record Bond Fund Withdrawals, Garuda CEO says “Won’t Default”

March 23, 2020

As more countries lockdown to fight the spread of the virus, policy makers scramble to try and ward off what may be a deep global recession. E-mini S&P futures fell by 5% this morning to be limit down giving a taste of the pain to come. Investors who have used leverage to buy bonds and other assets would be getting calls from their private bankers to top up cash, if they haven’t already. As this rush to liquidity continues, the dollar was the main gainer last week as the world’s reserve currency.

US Junk Bonds enter Distressed Territory, Record Bond Fund Withdrawals

The average spread over treasuries widened 37 bps to 1013 bps, which is the highest since June 2009 for bonds in the Bloomberg Barclays US Corporate High-Yield Index. This level is usually linked with distress and the index has surged 550 bps in the last two weeks. This comes as a record $108bn was pulled from funds and exchange-traded funds in the last week ending Thursday, nearly four times the previous record. On the other hand, more than $90bn has flown into money market funds as investors flock to cash. This could be another reason why US government debt has come under stress recently as fund managers get rid of their most liquid holdings to meet redemptions. Some analysts say the worst is yet to come, even as the amount of distressed bonds and loans in the market doubled from two weeks ago to $533bn.

For the full story, click here.

Garuda Indonesia Says Won’t Default on Debt

PT Garuda Indonesia has been severely hit by the virus, primarily from entry restrictions to Saudi Arabia as the carrier flies more than half a million pilgrims to Mecca and Medina each year. The airline has also cut Singapore flights to three a day from ten. CEO Irfan Setiaputra who took over two months ago after his predecessor was dismissed for allegedly smuggling a Harley Davidson motorcycle, says “For sure it is impossible for us to default in this note. We are in discussions with several banks outside Indonesia as well as several state-owned banks in Indonesia. The progress of the discussion is quite positive and we are finalizing the term sheets with them, we do hope that we are going to do the refinancing rather than restructuring of this debt.”

For the full story, click here.

Sunac China Buys back Two Dollar Bonds

As per a company filing, Sunac China says it repurchased $78.6mn of 8.625% 2020 due in July and $6.875% 2020 notes due in August in the open market. The bond due July had dropped from 101 to 94 in the last week and is currently trading at 96.

Amazon India Partner’s Dollar Bond Falls

Amazon’s Indian brick-and-mortar retail partner, Future Retail, has hit a record low in the bond market as concerns rise about the founding family’s debt. Future Retail operates the hypermarket chain Big Bazaar and its dollar notes hit 65 cents, the lowest since issuance in January. Indicative price showed a few cents above that level on Friday.

For the full story, click here.

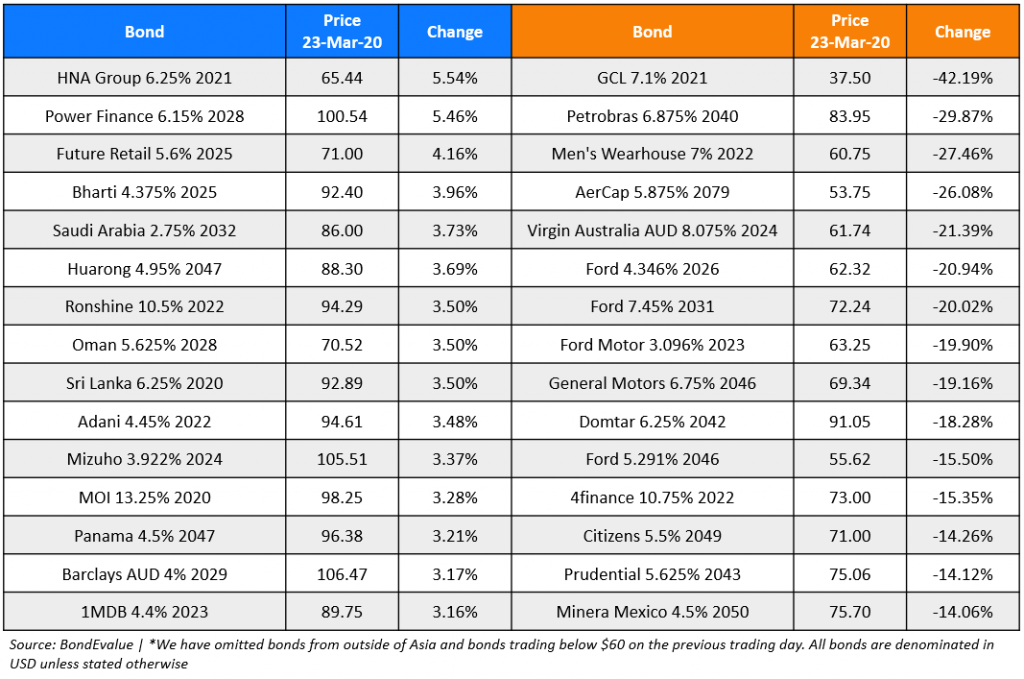

Top Gainers & Losers – 23-Mar-20*

Chinese Real Estate Firms Living on Short-Term Cash

Roughly 500 property development companies had borrowed via short term bonds to manage its cash flows. These real estate companies are now expected to face a strain on their cash flows as about 500bn yuan of bonds are due for redemption.

For the full story, click here.

Pandemic Bonds’ Structure Comes Into Question

Several years ago, in the aftermath of the Ebola outbreak in West Africa, the World Bank launched “pandemic bonds” to offset the crushing costs of stemming a global epidemic. Launched in 2014 and backed by about $190mn in promised financing from donor countries like Australia, Germany and Japan, investors of these bonds have reaped more profits than the countries battling epidemics. The problem this time comes as only the world’s poorest countries are eligible for funds making the immediate pay-out unlikely as the hardest-hit countries by the corona virus include China, Italy, Iran, Spain and South Korea. Another problem is the payout conditions that are too arbitrary and long (12 weeks to pass, outbreak must be sustained, have affected at least two countries, have caused at least 250 deaths). If the idea is to help prevent a pandemic, these conditions could delay a payout until it is too late. The World Bank said March 23 would be 12 week date and a decision would be made today by an independent agency.

For the full story, click here.

Other Stories

Virgin Australia Downgraded to B3 from B2 by Moody’s; Airline to Cut More Domestic Flights

Chinese Bond Gauge Ends Month-Long Run of Gains

These are the 6 Relief Tools Major Countries are Using to Fight an Inevitable Coronavirus Recession

Go back to Latest bond Market News

Related Posts: