This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

R&F Properties Downgraded To B- On Refinancing Uncertainty

October 11, 2021

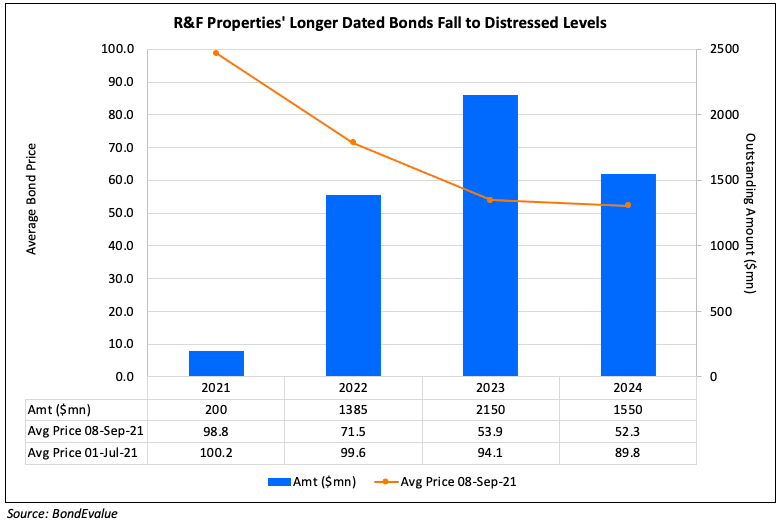

R&F Properties was downgraded by S&P to B- from B with a negative outlook due to its constrained liquidity arising from weakening cash generation from sales. Despite a recent shareholder capital injection of RMB10.4bn ($1.6bn) that partially helps them with liquidity, R&F’s slowing sales are an offsetting factor. The rating agency expects sales to remain weak over the next one year. S&P expects contracted sales to decline by 13%-15% for 2021 to RMB 128-130bn (~$30bn), and fall 4-6% further during 2022, reducing cash inflows over the next 6-12 months and delaying liquidity improvement. Also, lower cash collection due to tightening mortgage availability will further hinder R&F’s liquidity. R&F’s total cash to short-term debt stayed low at about 55% as of end-June 2021 and its interest coverage was at 63% end-2020. Cash collection is expected to stay low at ~65-70% over 2021-22 vs. 78% for 2020.

R&F has considerable repayments over the next 12 months as compared to its cash on hand. It needs to repay about RMB 17bn ($2.6bn) by the end-2022, including an RMB 4bn ($620mn) corporate bond and a $650mn offshore bond in 2H2022. Additionally, its profitability and market position have weakened. S&P notes that asset sales are key to materially improving R&F’s liquidity profile with the developer having completed disposals of ~RMB 5bn ($780mn) YTD. On the positive side, R&F’s “financial transparency is higher than peers” due to limited use of JVs.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

R&F Properties’ Bonds Continue Fall to Fresh Lows

September 8, 2021

Ronshine Downgraded by Moody’s to B2

September 17, 2021