This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Sands China, Nippon Life, CMB Launch $ Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

September 9, 2021

US markets ended weaker on Wednesday – S&P was down 0.1% extending its fall for a third straight day and while NASDAQ lost 0.6%. Utilities up 1.8% and Consumer Staples and Real Estate up more than 0.5% moved the markets up while Energy and Materials down more than 1% dragged them lower. European stocks also closed lower, extending the week’s losses – DAX, CAC and FTSE were down 1.5%, 0.9% and 0.8% respectively. Brazil’s Bovespa tumbled 3.8% a day after the independence day holiday. Saudi’s TASI and UAE’s ADX were up 0.4% and 0.7% respectively. Asian markets took a cue from the US markets and have started in the red during early trade – HSI down 0.9% led the losses, and Nikkei, Shanghai and Singapore’s STI followed with losses of 0.4%, 0.3% and 0.2% respectively. US 10Y Treasury yields fell 4bp to 1.33%. US IG and HY CDX spreads tightened 0.5bp and 2.8bp respectively. EU Main CDS spreads were broadly flat and Crossover CDS spreads widened slightly by 0.4bp. Asia ex-Japan CDS spreads widened 0.9bp. Wednesday saw another busy day for the primary markets with 54 new USD/EUR bond deals following Tuesday’s 62 new bond deals.

Join Us for The Upcoming 8-Module Course on Bonds – Curated for Investors & Professionals

The course will be conducted via Zoom over 8 modules on 27-30 September and 4-7 October (Monday-Thursday) at 5pm Singapore / 1pm Dubai / 10am London. The course will be conducted by senior debt capital market bankers and professionals who will cover both fundamental concepts as well as the practical aspects of bonds.

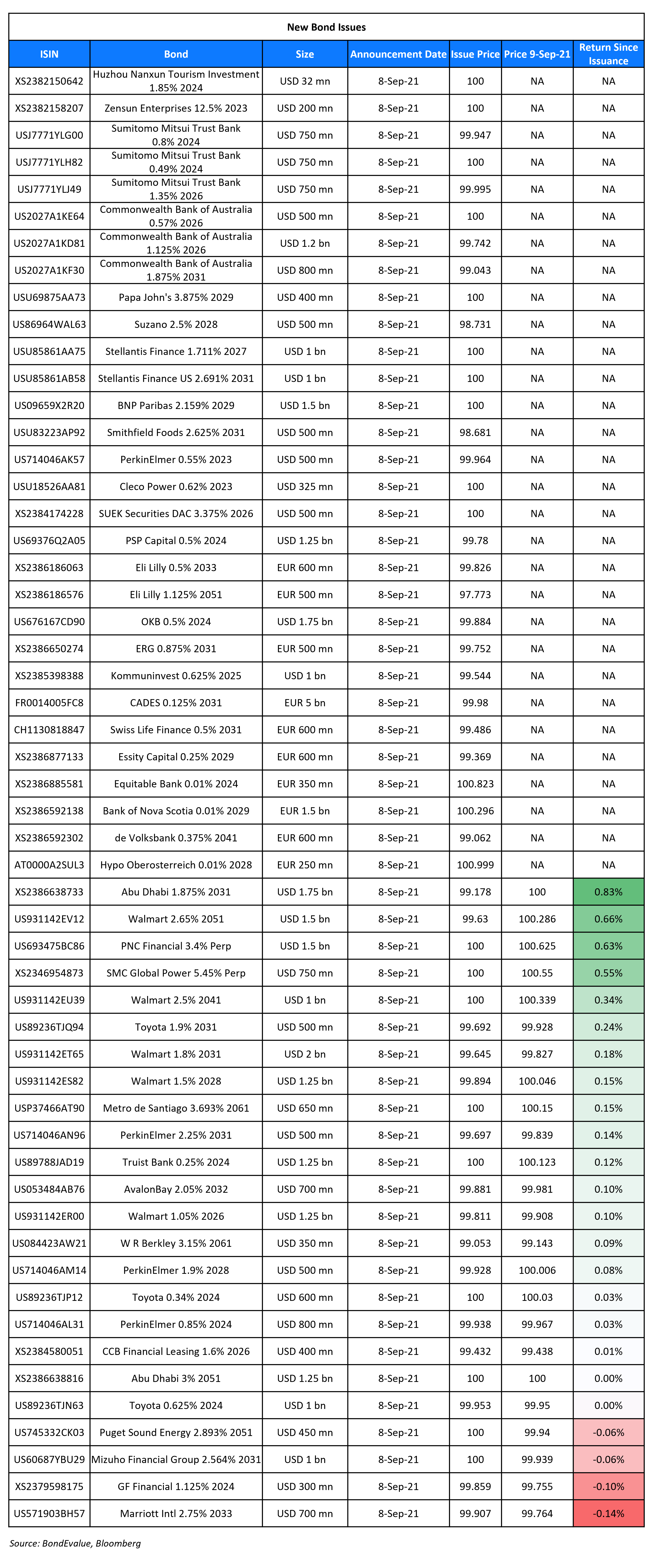

New Bond Issues

- Sands China $ 5Y/7Y/10Y at T+190/215/230bp area

- China Merchants Securities International $ 500mn 3Y at T+130bp area

- CMB Financial Leasing $ 3Y/5Y green at T+130/150bp area; EUR 3Y green @ MS+125bp area

- Nippon Life $ 30NC10 bond at 3.25% area

- Denso $ 5yr sustainability at T+70bp area

Emirate of Abu Dhabi raised $3bn via a two-part deal. It raised $1.75bn via a 10Y bond at a yield of 1.966%, 27bp inside initial guidance of T+90bp area, and $1.25bn via a 30Y bond at a yield of 3%, 24.4bp inside the initial guidance of T+130bp area. The bonds have expected ratings of AA/AA (S&P/Fitch). The new 10Y bonds offer a new issue premium of 4.6bp over its older 1.7% bonds due March 2031 while its new 30Y bonds priced 1bp inside its older 3.875% bonds due April 2050, despite the longer tenor.

SMC Global Power raised $150mn via a tap of 5.45% PerpNC5 at a price of 100.125 (yield of 5.42%), inside the initial guidance of 100 area. The bonds are unrated, and received orders over $375mn, 2.5x issue size. Proceeds will be used for investments in a power plant and related assets or for general corporate purposes. There is a coupon step-up of 250bp on December 9, 2026 as well as a dividend pusher and stopper. Philippine conglomerate San Miguel wholly owns SMC Global Power, which generates electricity from natural gas, coal and renewable energy such as hydroelectric power, and is also engaged in distribution and retail electricity services. The 5.45% Perps are currently trading at 100.55 yielding 5.33%.

CCB Financial Leasing raised $400mn via a 5Y bond at a yield of 1.719%, 50bp inside the initial guidance of T+140bp area. The bonds have expected ratings of A2/A (Moody’s/Fitch), and received orders over $4bn, 10x issue size. The bonds will be issued by CCBL (Cayman) 1 Corp and guaranteed by CCB Leasing (International) Corp Designated Activity Co. The notes will have the benefit of a keepwell and liquidity support deed and a deed of asset purchase undertaking provided by CCB Financial Leasing. The new bonds are priced 0.9bp wider to its existing 0.018% 2026s that yield 1.71%.

Zensun raised $200mn via a 2Y bond at a yield of 12.5%, in line with final guidance of 12.5%. The bonds have expected ratings of B3 (Moody’s) and will be guaranteed by parent company Zensun Group.

Commonwealth Bank of Australia raised $2.5bn via a three-tranche deal. It raised:

- $1.2bn via a 4.75Y bond at a yield of 1.181%, 22bp inside the initial guidance of T+60bp area

- $500mn via a 4.75Y floater at SOFR+52bp or a yield of 0.57% vs. initial guidance of SOFR equivalent

- $800mn via a 10Y bond at a yield of 1.981%, 20bp inside the initial guidance of T+85bp area

The bonds have expected ratings of Aa3/AA-.

GF Financial raised $300mn via a 3Y bond at a yield of 1.173%, 42bp inside the initial guidance of T+115bp area. The bonds have expected ratings of A2 (Moody’s), and received orders over $2.85bn, 9.5x issue size. The bonds will be issued by GF Financial Holdings BVI. The bonds are supported by a letter of credit from Nanyang Commercial Bank. GF Holdings (Hong Kong) Corp, which is a direct wholly owned subsidiary of GF Securities and listed in Shenzhen and Hong Kong, has provided a keepwell agreement. The company manages GF Securities’ business in Hong Kong and overseas markets.

Mizuho Financial Group raised $1bn via a 10Y tier 2 bond at a yield of 2.564%, 22-27bp inside the initial guidance of T+145-150bp. The bonds have expected ratings of A2/BBB+ (Moody’s/S&P). Mizuho Financial Group intends to use the net proceeds to make a subordinated loan to Mizuho Bank that would qualify as Tier 2 capital under applicable domestic banking regulations and internal TLAC under Japanese TLAC standards. The bank will use the funds for general corporate purposes.

Sumitomo Mitsui Trust Bank raised $2.25bn via a three-tranche deal. It raised:

- $750mn via a 3Y bond at a yield of 0.818%, 20bp inside the initial guidance of T+60bp area

- $750mn via a 3yr floater at SOFR+44bp or a yield of 0.49% vs initial guidance of SOFR equivalent

- $750mn via a 5yr bond at a yield of 1.351%, 20-25bp inside the initial guidance of T+75-80bp area

The bonds have expected ratings of A1/A (Moody’s/S&P).

Huzhou Nanxun Tourism Investment raised $32mn via a 35-month bond at a yield of 1.85%, 8bp inside the initial guidance of 1.93% area. The bonds are unrated. The senior unsecured notes will have the benefit of an irrevocable standby letter of credit issued by ICBC Zhejiang provincial branch.

New Bonds Pipeline

- IBK $ sustainability 3Y or 5Y bond

- Oxley Holdings S$ tap of 6.9% 2024s bond

- JSW up to $1bn planned issuance

- ICBC $6bn AT1 Perp

- Kuveyt Türk hires for $350m 10.25NC5.25 inaugural sustainability T2 sukuk

Rating Changes

- Allegheny Technologies Inc. Outlook Revised To Stable by S&P From Negative; New Debt Rated ‘B’

- Moody’s – Emerging Asia is growing at different speeds, with the pandemic still posing risks

- Fitch Revises Banco BPI’s Outlook to Stable After Similar Action on CaixaBank

Term of the Day

Inverted Yield Curve

An inverted yield curve occurs when short-term yields move higher than the long-term yields. With respect to Treasury bonds, an inverted yield curve (3M10Y curve or 2Y10Y curve) has historically shown an impending recession. Similarly, for corporate bonds, an inverted yield curve would indicate that while the company may struggle to meet short-term payments, it is likely to improve its financial position in the longer-term. An inverted yield curve would highlight liquidity risks for the issuer while solvency might still be fine.

El Salvador’s yield curve is seen as inverted with its 2023s yielding 12.4%, 2027s yielding 10.9% and its 2041s yielding 10%.

Talking Heads

On Fed’s Williams Talking About 2021 Taper Start

“It could be appropriate…Assuming the economy continues to improve as I anticipate, it could be appropriate to start reducing the pace of asset purchases this year…I will be carefully assessing the incoming data on the labor market and what it means for the economic outlook, as well as assessing risks such as the effects of the delta variant…I think it’s clear that we have made substantial further progress on achieving our inflation goal. There has also been very good progress toward maximum employment, but I will want to see more improvement before I am ready to declare the test of substantial further progress being met.”

“They will try hard to pitch this as a recalibration of purchases from emergency settings rather than the start of a taper down to zero…Higher yields might be tolerated, but higher spreads may not.”

On China Crackdown Creating Opportunities in Corporate Debt – Baring Asset Management

Omotunde Lawal, head of emerging-market corporate debt

“Looking back at similar crackdown episodes in the past, we note that the Chinese government did eventually ease restrictions to avoid stifling wider economic growth momentum. For most those past episodes, the market’s initial negative reaction created buying opportunities for long term investors…Despite the severe market volatility recently witnessed, generally speaking, Chinese corporate fundamentals remain strong…In the tech sector, for example, many of the companies impacted are investment-grade rated, with strong balance sheets, high net cash positions and low amounts of debt. In the real estate sector, for instance, companies that can endure the changes could emerge with stronger balance sheets….and for the tech sector, increased competition and the break-up of monopolies could bring fairer prices for consumers and better protections for workers.”

Top Gainers & Losers – 09-Sep-21*

.png)

Other Stories

Go back to Latest bond Market News

Related Posts:.png?width=1400&upscale=true&name=image%20(25).png)