This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Sinic’s Dollar Bonds Nosedive Post Fitch Outlook Change

September 20, 2021

Chinese real estate developer Sinic Holdings (Group) Company Limited saw its dollar bonds nosedive with its $246mn 9.5% bonds due next month on October 18 leading the losses, down a massive 35 points on Friday to close at 57 cents on the dollar. Its 8.5% bonds due in January 2022 fell by ~13 points to now trade at 63 cents on the dollar. This seems to be the spillover effects of overall stress on the Chinese real estate sector as investor concerns grow over developers’ ability to meet upcoming coupons and redemptions.

The fall in Sinic’s bonds comes after Fitch changed its outlook on the developer to negative last week when it affirmed Sinic’s B+ rating. The affirmation was driven by “Sinic’s adequate liquidity, feasible refinancing plan and improving leverage, as measured by net debt (including guarantees to JVs and associates)/adjusted inventory, of 47% in 1H 2021, compared with 52% at end-2020.” The negative outlook was however because of “Sinic’s weakened access to the debt capital market and rising execution risks of its high-churn business strategy.” Fitch added that the company has $694mn of offshore bonds due in October 2021, January 2022 and June 2022, that will likely have to be paid with cash on hand as the bonds are currently trading at distressed levels.

Go back to Latest bond Market News

Related Posts:

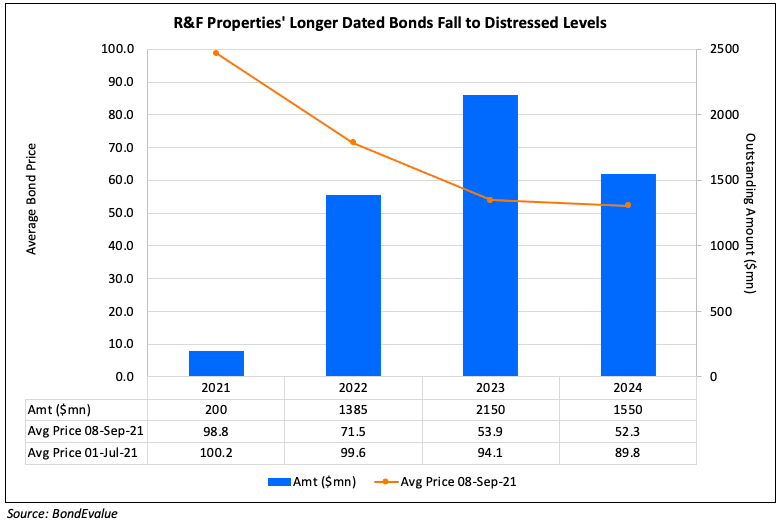

R&F Properties’ Bonds Continue Fall to Fresh Lows

September 8, 2021

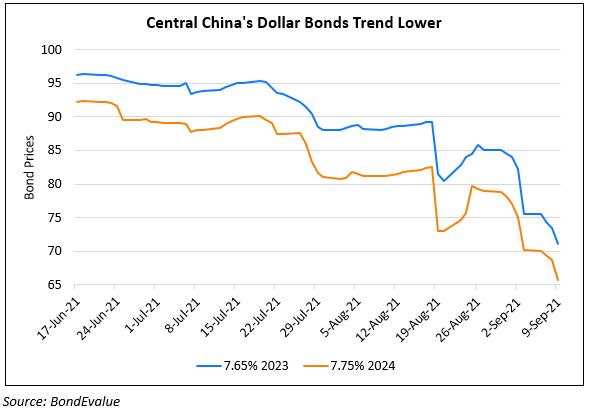

Central China’s Dollar Bonds Fall ~4% on Concerns Over Project Delay

September 10, 2021