This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Sino Ocean, Korea Water Launch $ Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

April 20, 2022

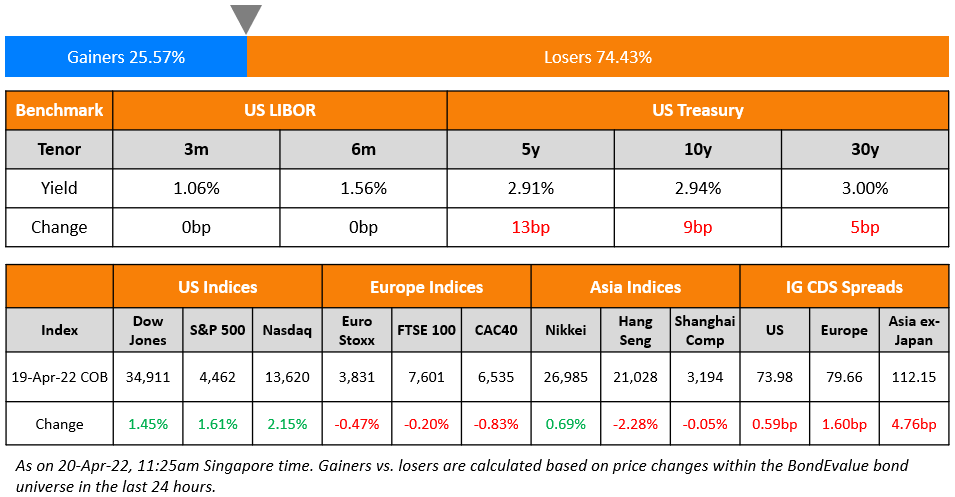

The S&P and Nasdaq closed higher on Tuesday, up 1.6% and 2.2% respectively. Consumer Discretionary, Real Estate and Communication Services led the gainers, up over 2% each. US 10Y Treasury yields eased 9bp to 2.94%. European markets closed weaker after an extended weekend – DAX, CAC and FTSE were down 0.1%, 0.8% and 0.2%. Brazil’s Bovespa ended 0.6% lower. In the Middle East, UAE’s ADX was down 0.4% and Saudi TASI was down 1.7%. Asian markets have opened with a positive bias – HSI, STI and Nikkei were up 0.8%, 0.7% and 0.6% while Shanghai was down 0.2%. US IG and HY CDS spreads widened 0.6bp and 1.1bp respectively. EU Main spreads were 1.6bp wider and Crossover spreads were 5.7bp wider. Asia ex-Japan CDS spreads were 4.8bp wider.

New Bond Issues

- PSA International S$ 5Y at 3.2% area

- Sino-Ocean Group $ 3Y Green at 3.8% area

- Korea Water Resources $ 3Y Green at T+115bp area

JPMorgan raised $8.5bn via a four-tranche deal. Details are given in the table below:

BNY Mellon raised $1.7bn via a three-trancher. It raised:

- $950mn via a 3Y bond at a yield of 3.355%, 17bp inside initial guidance of T+70bp area

- $400mn via a 3Y FRN at SOFR+62bp, vs. initial guidance of SOFR equivalent area

- $350mn via a 7Y bond at a yield of 3.866%, 10bp inside initial guidance of T+100bp area

The bonds are rated A1/A. Proceeds will be used for general corporate purposes.

Bank of America (BofA) raised $2bn via a PerpNC5 preference share (Term of the Day, explained below) issuance at a yield of 6.125%, 12.5bp inside initial guidance of 6.25% area. The bonds are rated Baa3/BBB-. The SEC registered depositary shares, represent a 1/25th interest in a share of BofA fixed-rate reset non-cumulative preferred stock. The bonds have an optional redemption on any dividend payment date (January 27, April 27, July 27 and October 27 of each year beginning on July 27, 2022).

TSMC raised $3.5bn via a four-trancher. Details are given in the table below.

Mirae Asset pulled its 3Y bond deal. A banker to the transaction said that it was due to unfavorable market conditions.

New Bonds Pipeline

- ST Engineering hires for $ 5Y and/or 10Y

- Nanyang Commercial Bank mandates for $ AT1

- Continuum Energy Aura hires for $ Green Bond

- Jubilant Pharma hires for $ bond

- Sael Limited hires for $ 7Y Green bond

- Kalyan Jewellers India hires for $ bond

Rating Changes

- Fitch Downgrades Qatari Banks; Stable Outlook

- Fitch Affirms Guangzhou R&F at ‘CC’, Downgrades Notes on Poor Recovery Prospects

Term of the Day

Preference Share

Preference shares are a type of security issued by corporates that has features of both bonds and common stock. In terms of capital structure, preference shares pay dividends and have seniority over common stock but are subordinated to bonds. They do not have voting rights unlike common equity and pay dividends out of each year’s net profits. There are various types of preference shares – non-cumulative, redeemable/irredeemable, convertible, participating etc. In the case of cumulative preference shares, the company can pay cumulative dividends in the following year if the particular year’s profits are not enough. Preference shares may differ from CoCos. For example, they are based on the income statement while CoCos are balance sheet based. For instance, a bank making a loss after tax in a year may be able to pay interest on CoCos if capital levels are satisfactory but not dividends on preference shares. Alternatively, a bank making some profits could pay preferred dividends but may not be able to pay up on CoCos if capital levels are unsatisfactory and thus may get triggered. Differences of preference shares as against perpetual bonds, may include characteristics like step-ups etc. besides capital structure seniority of the latter.

Talking Heads

On Junkiest Junk Bonds Flash a Warning Sign for the Economy

Jack Parker, research analyst at Brandywine Global Investment Management

“We are steering away from the most egregious parts of the market in terms of credit risk… Investors would be smart to avoid CCC risk, especially the highly levered LBO deals where interest coverage is low and covenants are loose, leaving little room for error should they experience a fundamental slowdown in the business.”

Becky Qin, portfolio manager and senior manager selection analyst at Fidelity

“The high level of current uncertainty around the war in Europe, slowing growth, high inflation and tightening financial conditions mean we prefer to be positioned defensively in credit”

On Fed’s Evans Sees Rates Rising Above Neutral Level

“Probably we are going beyond neutral. That’s my expectation, when I see that, taking out special factors, I’m still left with 3 to 3.5% inflation. That’s not what we want. If we’re at a 2.5% inflation rate, I think we have more things to ponder there… By that time (December), we’re at neutral, and to the extent we don’t see it coming down, we’re going beyond neutral, absolutely.”

On Global Markets Remain Vulnerable to Central Bank Tightening

Tobias Adrian, director of the IMF’s monetary and capital markets department

“Central banks may have to tighten more than what is currently priced in, so there could be surprises down the road. I do think equities could see another sharp sell-off. Bonds could sell off further. Credit spreads have widened, but not dramatically so far. And yields could go up further. There could be further sell-off in rates of fixed-income, sovereign securities. So I think nothing is safe right now.”

Top Gainers & Losers – 20-Apr-22*

Go back to Latest bond Market News

Related Posts: