This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Sino-Ocean Receives $7bn Credit Line from ICBC

December 21, 2022

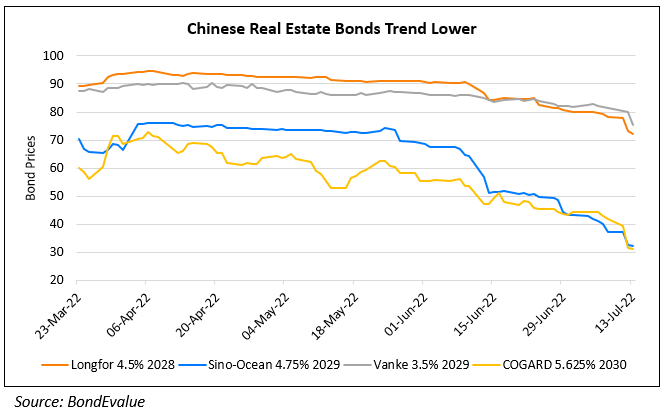

Sino-Ocean received an RMB 50bn ($7bn) credit line from ICBC on December 15. This comes as a positive update after China’s measures to ease financial stress on developers where ICBC said it would provide RMB 655bn ($91.5bn) in credit lines to 12 developers, of which Sino-Ocean was not in the list. The update follows the news of up to $7bn in credit lines signed between COGARD and Postal Savings Bank of China which saw its dollar bonds rally. However, Bloomberg analysts note that the support is unlikely to ease the developer’s urgency to raise cash via asset disposals, given that it has RMB 29bn ($4.2bn) in debt due through mid-2024 and is under pressure to deliver presold properties amid weak sales. It is also expected to divest its stakes in more office and retail properties in Tier 1 and 2 cities.

Sino-Ocean’s dollar bonds were trading higher with its 6% 2024s up 4.5 points to 59.5 cents on the dollar.

Go back to Latest bond Market News

Related Posts: