This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Sino-Ocean’s Dollar Bonds Slip Following Coupon Delay

March 22, 2023

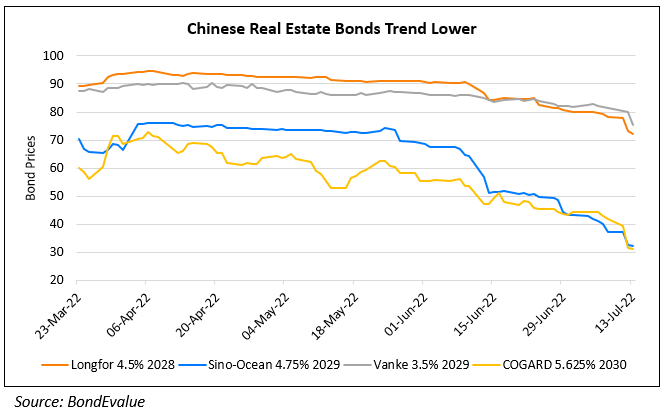

Chinese real-estate developer Sino-Ocean saw its dollar bonds plunge late on Tuesday following news that it will defer a coupon payment, Bloomberg noted. The selloff was led by its 6.876% Perps, on which the company is said to have delayed a coupon payment that was originally due on Tuesday, as per people familiar with the matter. A company spokesperson said that the move does not constitute a default and that the decision was to preserve cash, given that financing conditions in the real estate industry have not materially improved. The news pushed the Perps lower by over 15 points to 29.83, along with its other dollar bonds which were down ~10 points.

The reason Sino-Ocean could delay coupons without triggering a default is because the Perps have Discretionary Coupons (Term of the Day, explained below). The 6.876% Perps’ prospectus states that “The Issuer may, at its sole discretion, elect to defer (in whole or in part) ) (a) from the Issue Date to the Second Call Date, any Distribution which is otherwise scheduled to be paid on a Distribution Payment Date.” This is another reminder of the risks associated with subordinated bonds, after the massive $17bn writeoff of Credit Suisse AT1s earlier this week.

Go back to Latest bond Market News

Related Posts: