This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

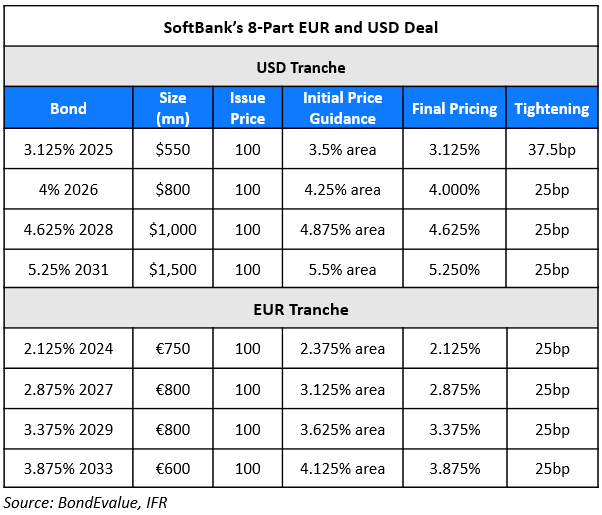

SoftBank Raises Over $7bn via Asia’s Second Largest Bond Deal YTD

July 1, 2021

SoftBank raised over $7bn via an eight-part EUR and USD offering (table above).

The bonds have expected ratings of BB+ and received combined orders over $16bn, ~2.2x issue size. SoftBank last tapped offshore bond markets in 2018 when they raised $1.25bn via USD bonds and €2.62bn via EUR bonds. A spokesperson for the company said the bond deal was due to good market conditions and to expand their investor base. The new dollar 2025s offer a new issue premium of ~10bp over its older 6.125% bonds due April 2025 while the new dollar 2028s were priced at a new issue premium of 40bp over its older 6.25% 2028 that currently yield 4.22%. Its new euro 2024s, 2027s and 2029s offer a new issue premium of 15.5bp, 14.5bp and 21.5bp over its older 4.5% bonds due April 2025, 5.25% bonds due 2027 and 4% 2029s.

SoftBank’s new USD bonds were trading slightly lower:

- 4% 2026s are trading at 99.91 yielding 4.02%

- 4.625% 2028s are trading at 99.64 yielding 4.69%

- 5.25% 2031s are trading at 99.85, yielding 5.27%

Go back to Latest bond Market News

Related Posts: