This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

S&P Revises Macao Casino Operators’ Outlook Higher on Post-Pandemic Recovery

May 24, 2023

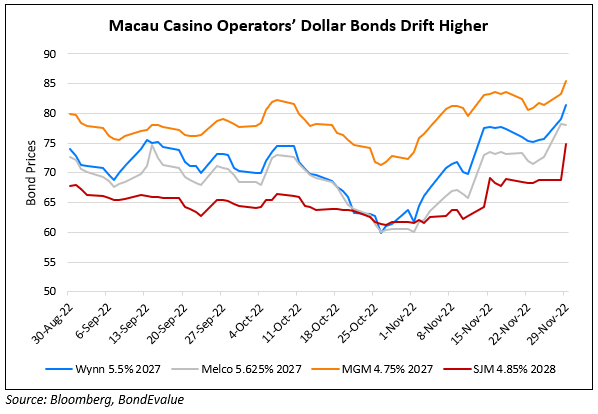

S&P in a report emphasized its positive outlook on the Macao casino sector as part of its post-pandemic recovery. Macao’s gaming revenue is experiencing a more “robust recovery” than they previously anticipated. In 1Q 2023, gross gaming revenue (GGR) recovered to 67% of 1Q 2019 levels vs. expectations of 35-40%. This is likely to further accelerate to 60-70% of 2019 levels in 2H 2023. The rating agency believes that the rapid pace of recovery would help in casino operators’ EBITDA and cash flows witness a fast improvement. In particular, MGM China’s cash flows are expected to improve faster than peers thanks to receiving an additional 200 tables under a new concession. Melco Resorts they note, may outperform Wynn and Las Vegas Sands in late 2023 and 2024 due to incremental hotel capacity from its Studio Phase 2.

On the back of this, S&P has revised its negative rating outlooks on LVS and Wynn to positive and to stable for Melco Resorts, Studio City and MGM Resorts. They also note that over 90% of the rated issuers’ bond maturities are fall in 2025 or after that, with credit metrics also set to improve by then. S&P also opined on the major topic of incumbent operator’s investments over the 10-year following the grant of their licenses. S&P says that their investments are manageable due to expectations of a faster than expected cashflow recovery.

In the table below, we have given a list of rated Macao casino operators with dollar bonds comparable maturities to assess relative value.

Studio City’s dollar bond due January 2028 offers the highest yield at 11.47% with a Z-Spread of 759bp. Interestingly, MGM China’s 2027s offer a yield of 7.87% with a Z-Spread of 389bp, lower than similar-to-higher rated peers like Wynn and Melco. To see the full list of Macao casino operators’ dollar bonds, login to the BondEvalue App by clicking here.

Go back to Latest bond Market News

Related Posts: