This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Tencent Music, Hysan Launch $ Bonds; Abu Dhabi Raises $5bn via Bonds; J Crew Wins Court Approval for Restructuring

August 26, 2020

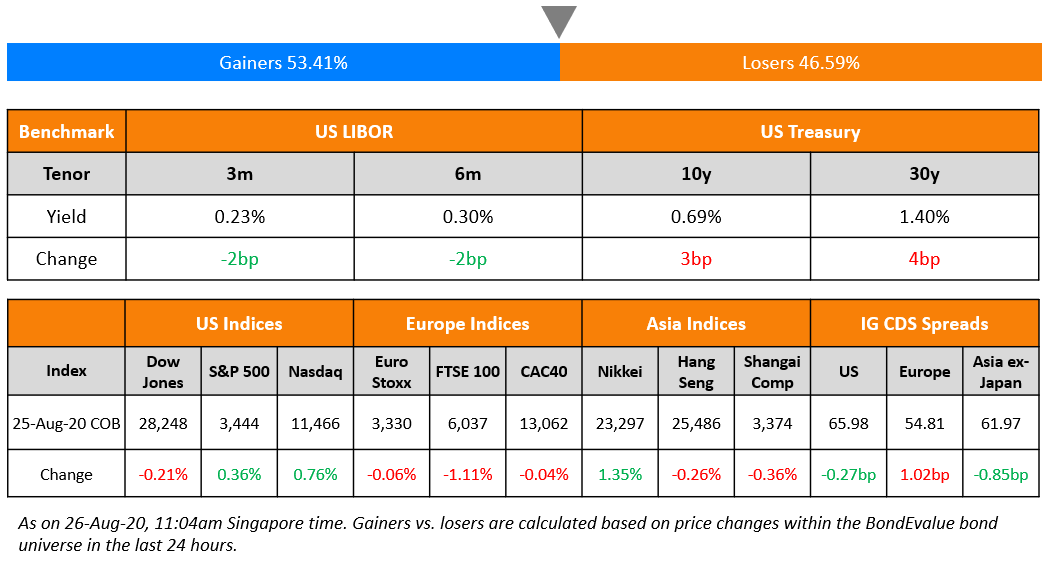

Markets are showing confidence as top US and Chinese officials reaffirm their commitment to an initial phase of a Sino-American deal along with positive news regarding potential Covid-19 vaccines. S&P and Nasdaq rose enough to post more record highs, but the DJI saw some slippage. US economic data was mixed with a 13.9% increase in July new home sales and a 6.9 point drop in Conference Board consumer confidence to 84.8. European indices were unchanged to slightly lower with the FTSE 100 underperforming due to sterling strength. US treasuries continue to lose ground with yields higher by around 3bp. Credit markets including high-yield bond issuance are showing signs of strength as appetite for risk among investors is increasing.

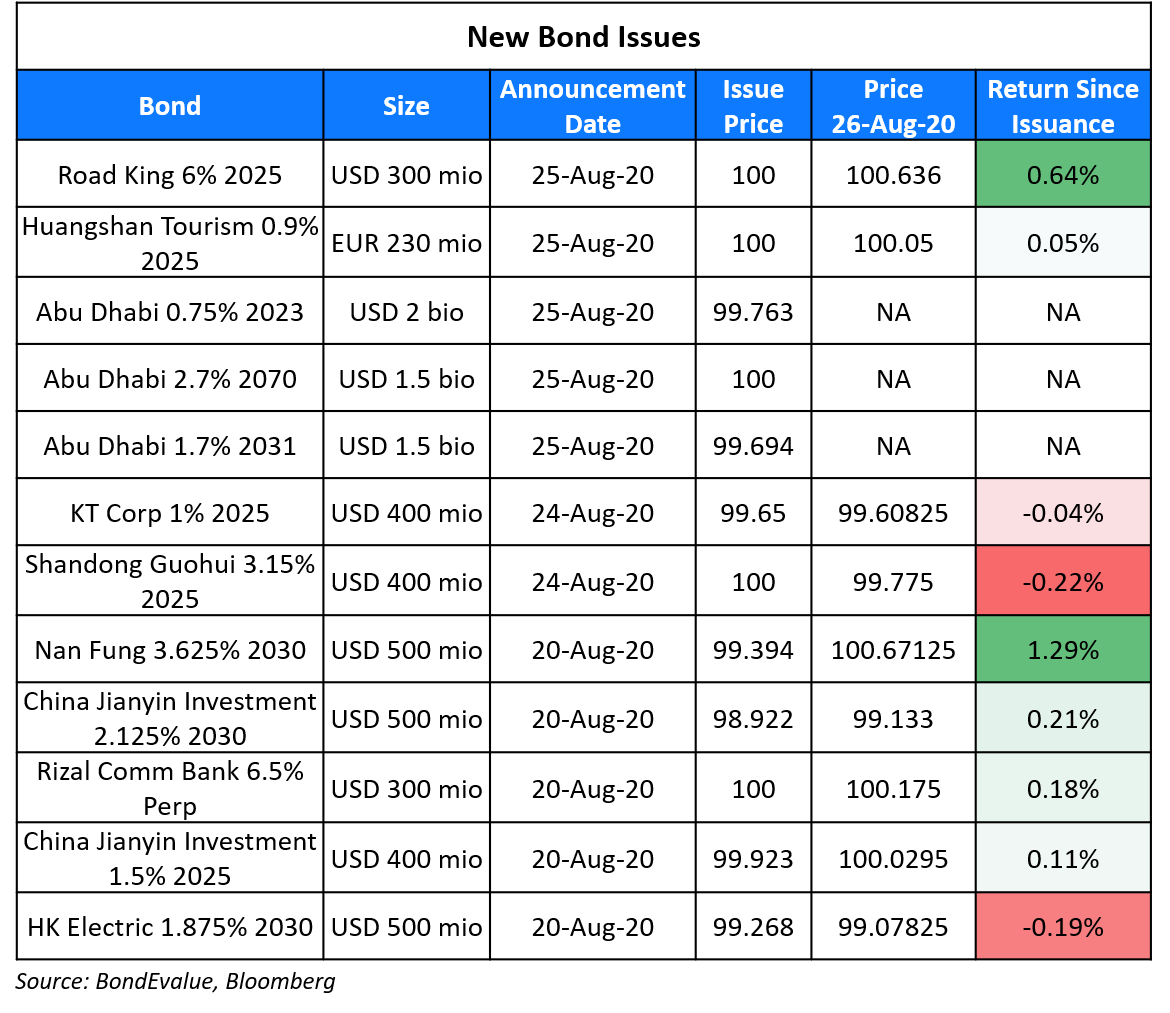

New Bond Issues

- Tencent Music $ 5/10yr @ T+155/180bp area

- Hysan $ tap 4.85% Perp NC3 @ 100.5% area

Road King Infrastructure raised $300m via 5Y non-call 3Y (5NC3) bonds to yield 6.0%, 40bp inside initial price guidance of 6.4% area. The bonds, with expected ratings of Ba3/BB-, received orders over $2bn when final guidance was announced, 6.67x issue size. Proceeds will be used to fund a concurrent exchange and tender offer for its outstanding $385m 7.75% notes due April 18, 2021. Details of the tender offer are as follows:

- A par-to-par exchange to its new 5NC3 bonds on top of an exchange premium of $31 per $1,000 in cash and accrued interest, subject to a cap of $100mn, and

- A cash tender offer at par plus a tender premium of $29.5 per $1,000 and accrued interest, subject to a cap of $150mn

The deadline for the exchange and tender offer is September 2.

Rating Changes

Moody’s changes the outlook on Chile’s ratings to negative, affirms A1 ratings

Moody’s downgrades Carnival’s CFR to B1; outlook negative

Moody’s downgrades Royal Caribbean’s CFR to B1; outlook negative

Fitch Downgrades Bombardier’s Sr. Unsecured Notes to ‘CCC’/’RR4’; Affirms IDR at ‘CCC’

Moody’s affirms SBI’s Baa3 deposit ratings, downgrades standalone profile to ba2 from ba1

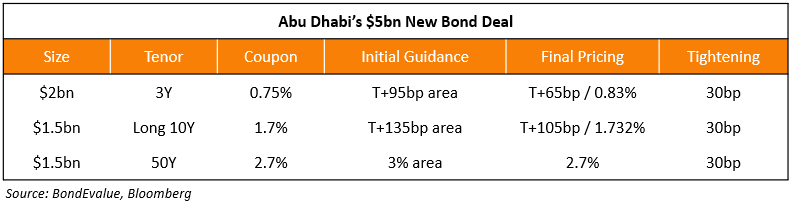

Abu Dhabi Raises $5 Billion in Third Issuance This Year

Abu Dhabi returned to the primary bond markets for the third time this year with a jumbo $5bn three tranche issuance. The oil-rich Gulf nation raised $7bn via new bonds in April followed by a $3bn tap of those bonds in May. Details of the new issuance are as follows:

The AA-rated issuer capitalized on the ultra-low yield environment and investor appetite for longer tenor bonds with its first ever 50Y bond, which offers a yield of 2.7%. The new bonds received orders worth $24bn, almost 5x issue size that allowed it to tighten pricing across the three tranches by 30bp. The final pricing on the 10Y tranche was in line with its 3.125% bonds due April 2030, which were trading at 112.3 yielding 1.73% on the secondary markets.

Richard Briggs commented on the pricing of the new bonds stating, “The reason they’re wider than similarly-rated credits from outside of the GCC (Gulf Cooperation Council) is largely due to supply risk, given they are becoming a more frequent issuer, and that will persist if oil prices remain muted.”

For the full story, click here

European Interbank Interest Rates Drop to Record Low on ECB Liquidity Support

This week the three month Euro Interbank Offered Rate (Euribor), a measure of interbank interest rates in the Euro area saw an all-time low of minus 0.491%. The drop in the benchmark interest rate was a result of liquidity injected by the European Central Bank (ECB) to help fight the COVID slowdown. The Eurozone banks availed more than €1.3tn of loans from the ECB in June that wiped out the need for inter-bank borrowing. The Euribor had earlier touched minus 0.486% on March 12 before the enforcement of the lockdowns. It then rose to a four year high of minus 0.16% in April as the cost of capital increased for some banks due to weakening balance sheets in the face of the economic impact of the pandemic. This caused the gap between Euribor and Eonia (Term of the day, explained below) to increase to its widest since the eurozone debt crisis in 2012. However, the ECB’s intervention through the provision of capital once again led to a fall, this time to record lows. The Euribor-Eonia spread fell into negative territory for the first time for more than a day or two.

.png?upscale=true&width=1400&upscale=true&name=3%20Month%20Euribor%20Drops%20to%20Record%20Low%20(1).png)

“There is so much cheap liquidity in the system, banks don’t want to borrow any more, so they’re pricing themselves out of the wholesale market,” said Mr Antoine Bouvet, a senior rates strategist at ING who added that “From the point of view of the ECB, this looks like a success story.” At the same time Peter Chatwell, head of multi-asset strategy at Mizuho cautioned that, “There’s a concern that what the ECB has done is artificially compress credit risk premia, without any of this cash necessarily finding its way into the real economy.”

For the full story, click here

J Crew’s Restructuring Plan Gets Go-Ahead from US Federal Court

American retailer, J Crew won approval for its restructuring plan from a Virginia Federal Court on Tuesday. This opens the door for the company to emerge from Chapter 11 bankruptcy by September. As per the approved plan, shareholders TPG Capital LP and Leonard Green & Partners will lose their entire equity share in J Crew and creditors Anchorage Capital Group LLC, David Kempner Capital Management LLC and GSO Capital Partners LP would become the new owners. The details of the restructuring plan are as follows:

- Old secured debt of over $1.6bn will be converted to equity

- $400mn worth of bankruptcy loan would be converted to term loans

- The company will receive $400mn via a new credit facility

The company had been struggling on the back of high leverage even before the pandemic. The pandemic forced it to temporarily close its stores, which eventually led it to file for bankruptcy protection under Chapter 11 on May 4. The clothing retail industry has been adversely affected by the slowdown with big names including Neiman Marcus Group, J.C. Penney Co Inc, Brooks Brothers forced to file for bankruptcy protection. J Crew’s 13% bonds due 2021 traded at 53.4 cents on the dollar, largely unchanged.

For the full story, click here

Term of the Day

Eonia

Eonia is the rate at which banks in the European Union (EU) and European Free Trade Area (EFTA) lend funds in the interbank money market denominated in euros. Prior to October 2019, Eonia was calculated based on quotes from banks. Since October 2019, it is calculated as the €STR, the new short-term rate published by the European Central Bank (ECB), plus a fixed spread of 8.5bp until it is discontinued on January 3, 2022. The €STR is based on daily money market transactions that banks report to the ECB in accordance with the Money Market Statistical Reporting (MMSR) Regulation. Since the €STR is based on actual transactions rather than quotes from banks, it is harder to rig compared to the older Eonia calculation. Central banks across the globe developed alternate benchmarks to the Libor after revelations of rigging by large banks.

Talking Heads

On China determined to keep ‘normal’ monetary policy

Sun Guofeng, head of the monetary policy department at the People’s Bank of China (PBOC)

“To cope with all sorts of uncertainties, the monetary policy requires greater certainty,” said Sun.

Liu Guoqiang, vice governor at PBOC

“Even as capital adequacy ratio drops further in the future, we cannot lower regulatory requirements. Doing so would be fooling ourselves,” said Liu.

“What we are waiting for is an improvement in expectations. If this improvement in expectations occurs, we would find no reason to have to establish greater restrictions on the exchange market,” he said.

“An influx of downgrades to high yield have historically helped the fallen angel indexes outperform, and there are expectations new downgrades are still coming,” Barna said. “New entrants tend to have higher credit quality, and it helps that most of these issuers intend to return to investment grade.”

“Investors have recognized that the greatest periods of outperformance in the private markets relative to public markets are as you’re going through and coming out of a downturn. One of the challenges on the distressed side has been that if you’re too early, you’re wrong,” he said. “So it’s a fine line of balancing how you’re going to approach the market and the opportunity recognizing you need to have the capital ready to go, but be patient. You can have some more positives in more difficult and challenging times as a lender,” Schardt said. “There’s a pendulum that swings between borrower-friendly structures and terms and more lender-friendly terms, structures and pricing.”

It was a sign the Federal Reserve may be “slower in reacting to inflation down the track,” allowing price increases to go above target, said Buckley. That’s a negative for bonds and means “there’s some room for yields to run. We’d describe it more as a normalization in inflation expectations,” she said. “We’re probably more concerned further out the curve.”

“So, the message from the market is that the top five companies can keep driving growth while the rest of the index companies lag. We think this implies ample room for a broadening of the rally, but it is difficult to see that happening without a better macro outlook,” says Rumble.

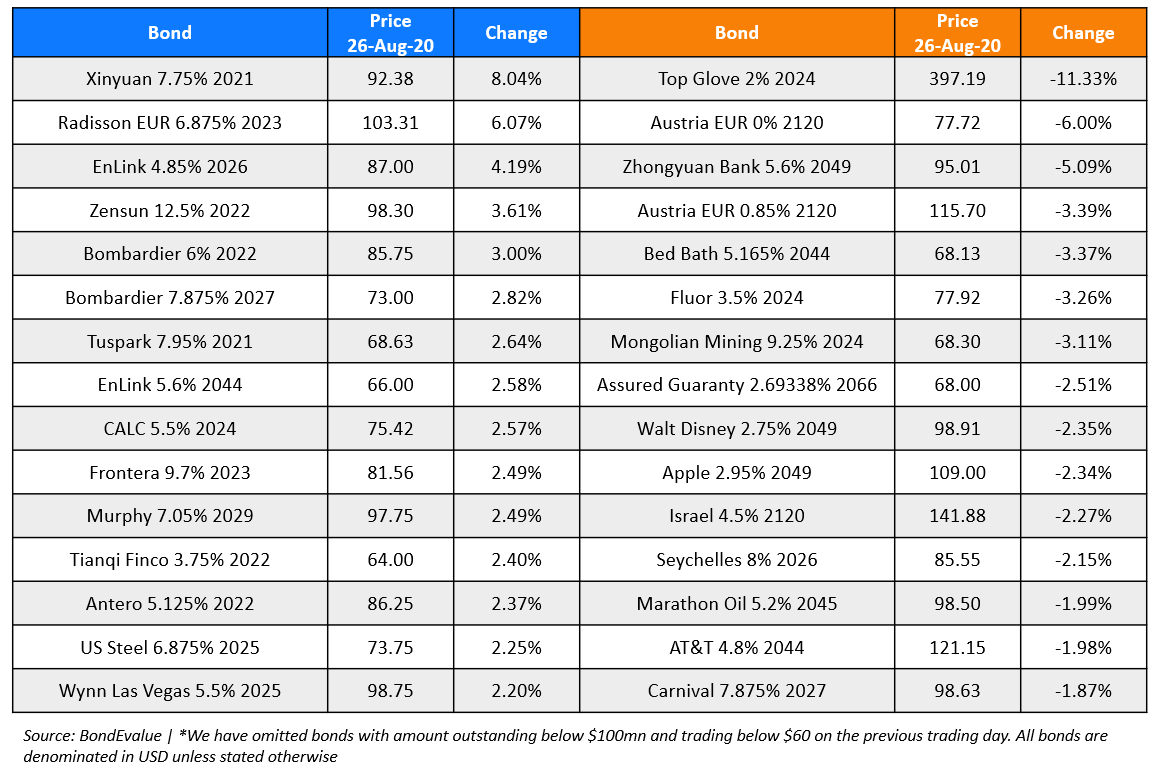

Top Gainers & Losers – 26-Aug-20*

Go back to Latest bond Market News

Related Posts: