This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

The Week That Was (1st to 7th November)

November 8, 2021

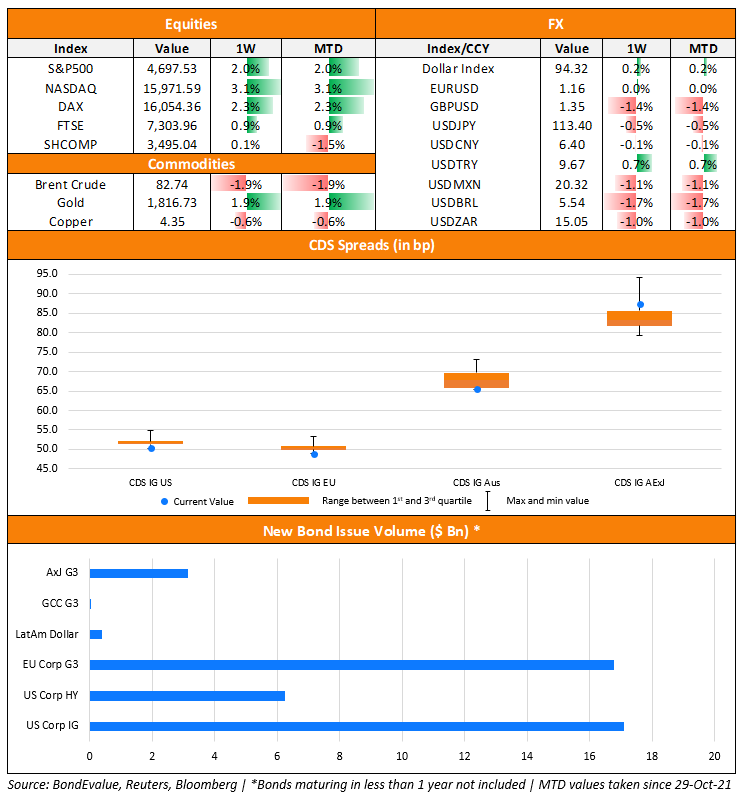

US primary markets saw a slight increase in issuances to $24.5bn vs. $21.1bn in the prior week. IG issuances dropped to $16.7bn vs. $17.2bn in the prior week while HY issuances rose to $6bn vs. $3.3bn in the prior week. The largest deals in IG space were led by JPMorgan’s $3bn deal followed by Raytheon’s $2.1bn dual-trancher. In the HY space, Asbury Automotive’s $1.4bn dual-trancher led the table followed by Navient and Molina Healthcare’s $750mn deal each. In North America, there were a total of 25 upgrades and 17 downgrades combined across the three major rating agencies last week. LatAm saw $388mn vs. $6.5bn in issuances in the week prior with Empresa Generadora de Electricidad Haina SA’s $300mn issuance being the largest amid other small issuances. In South America, there were no upgrades or downgrades combined across the major rating agencies. EU Corporate G3 issuances saw a fall to $16.8bn vs. $21.8bn in the week prior with Deutsche Bank’s $2.5bn dual-trancher, Danske Bank’s €1.25bn deal and Faurecia’s €1.2bn deals leading the table. Across the European region, there were 12 upgrades and 7 downgrades across the three major rating agencies. The GCC G3 saw no issuances vs. $665mn in issuances in the prior week. Across the Middle East/Africa region, there was 1 upgrade and 2 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances saw a 55% drop to $3.2bn vs. $7.1bn in the week before. The largest deals were led by SPIC’s $900mn deal, and Bank of China’s $600mn deal, followed by Jinan Urban Construction’s and Medco Laurel Tree’s $500mn and $400mn issuances each. In the Asia ex-Japan region, there were 5 upgrades and 6 downgrades combined across the three major rating agencies last week – 4 of the 6 downgrades were of Chinese property developers that included Yango, Aoyuan and Ronshine.

Go back to Latest bond Market News

Related Posts:

The Week That Was (Oct 4th – 11th)

October 11, 2021

The Week That Was (11 – 17 Oct 2021)

October 18, 2021