This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

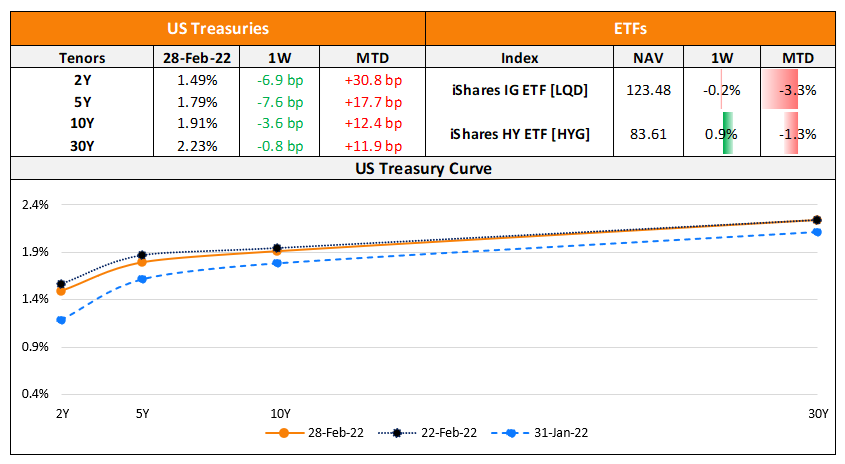

The Week That Was (21 – 27 February)

February 28, 2022

With a risk-off week due to the Russia-Ukraine military attacks, US Treasury yields swung wildly. The US 10Y yield dropped 10bp intraday early last week once news of Russia’s military attack on Ukraine broke out. US primary market issuances dropped to $17.2bn vs. $27.5bn in the week prior. Most of last week’s new deals were from investment grade (IG) corporates with $15.7bn in issuances and $1bn from high yield (HY) corporates. In comparison, the week prior to last week saw $27.5bn in IG deals and no HY deals. Last week’s deals were led by Wells Fargo raising $4bn, Aon’s $1.5bn via a two-trancher and ConocoPhillips’ $1.1bn issuance. Twitter’s $1bn was the only HY deal. In North America, there were a total of 26 upgrades and 13 downgrades combined across the three major rating agencies last week. LatAm saw $3.6bn vs. $2.5bn in issuances in the week prior led by Dominican Republic’s $3.56bn two-part deal besides other minor deals. In South America, there was 1 upgrade and downgrade each across the major rating agencies. EU Corporate G3 issuances were slightly higher at $23.2bn vs. $27.1bn in the week prior, led by ING Bank’s €8bn three-trancher, KfW’s €5bn issuance and Credit Mutuel’s $2bn to-trancher. Across the European region, there were 12 upgrades and 7 downgrades across the three major rating agencies. GCC G3 issuance were at $750mn vs. $105mn in the week before with First Abu Dhabi Bank and QIB Finance raising $500mn and $250mn each. Across the Middle East/Africa region, there were 2 upgrades and 3 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances stood at $6.4bn vs. $8.3bn led by Huatai Securities’ $1bn deal, CDB Leasing’s $950mn two-trancher, China Travel’s $700mn issuance and AgBank of China’s $600mn deal. In the APAC region, there were 14 upgrades and 10 downgrades combined across the three major rating agencies last week.

Go back to Latest bond Market News

Related Posts:

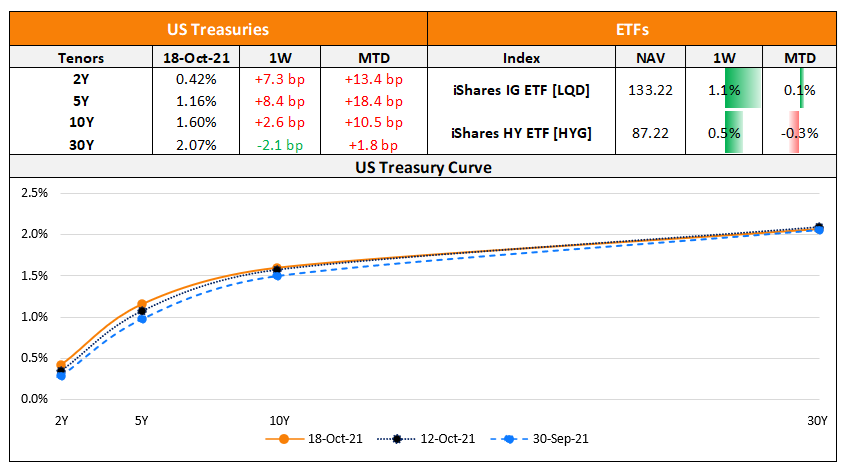

The Week That Was (Oct 4th – 11th)

October 11, 2021

The Week That Was (11 – 17 Oct 2021)

October 18, 2021

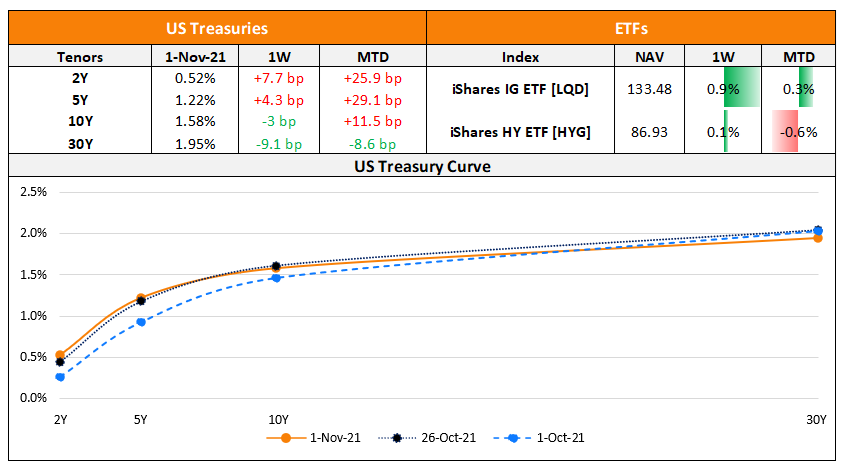

The Week That Was (25 – 31 Oct)

November 1, 2021