This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

The Week That Was (25 July – 30 July, 2022)

US primary market issuances fell to $16.4bn vs. $40.1bn in the previous week. IG issuances stood at $15.2bn vs. $39.2bn in the week prior, led by American Express and Truist Financial raising $3.5bn and $2.5bn respectively via two-tranche deals. In the HY space, issuances rose to $1.2bn from $760mn in the week prior, led by Avient raising $725mn. In North America, there were a total of 19 upgrades and 16 downgrades across the three major rating agencies last week. US IG funds’ losing streak continues for its eighteenth consecutive week, seeing a $2.44bn outflow in the week ended 29 July as per Lipper data. Conversely, HY funds saw an inflow of $4.83bn. In the LatAm region, there were no new deals vs. $1.2bn in the week prior. In South America, there were no upgrades and 7 downgrades across the major rating agencies. EU Corporate G3 issuance dipped 50% to $4.5bn led by NRW Bank raising $1bn, followed by BAWAG P.S.K. raising $750mn via a dual-trancher. Across the European region, there were 27 upgrades and 65 downgrades across the three major rating agencies. The GCC G3 region had no new deals for the third straight week. Across the Middle East/Africa region, there was 1 upgrade and 8 downgrades across the three major rating agencies. APAC ex-Japan G3 region issuances fell to $2.1bn vs. $5bn in the week prior – Posco raised $1bn via a dual trancher, followed by Lotte raising $300mn. In the APAC region, there were 3 upgrades and 14 downgrades combined across the three rating agencies last week.

Go back to Latest bond Market News

Related Posts:

The Week That Was (Oct 4th – 11th)

October 11, 2021

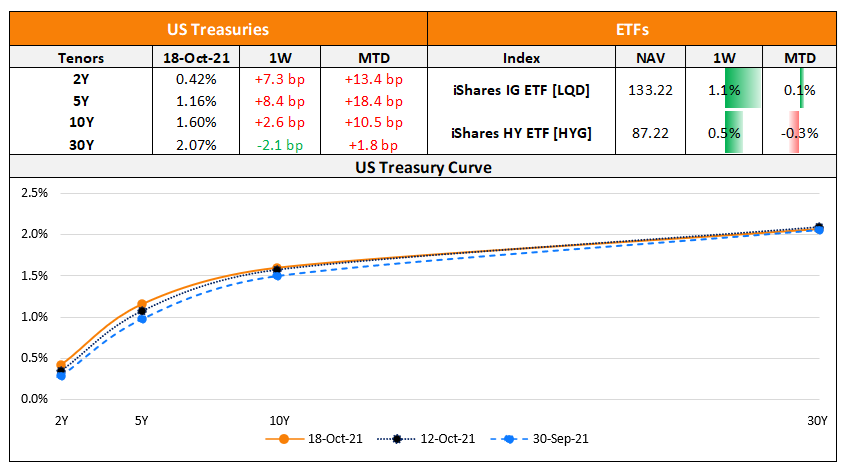

The Week That Was (11 – 17 Oct 2021)

October 18, 2021

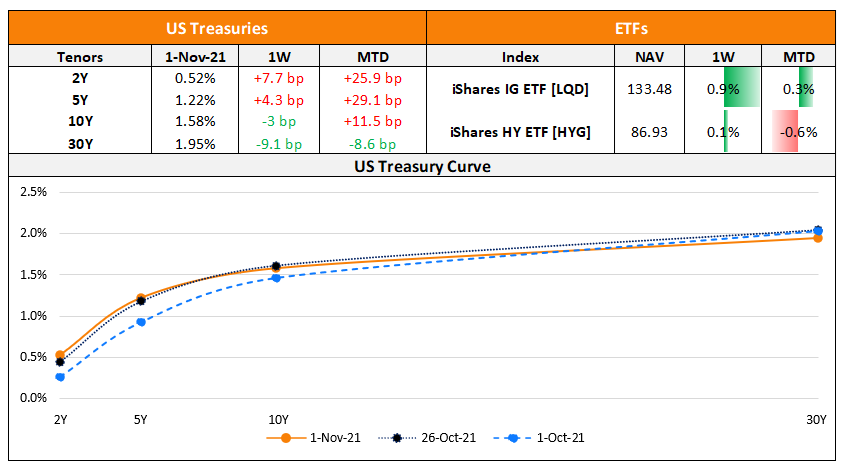

The Week That Was (25 – 31 Oct)

November 1, 2021