This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

The Week That Was (29th Nov – 5th Dec)

December 6, 2021

-png.png)

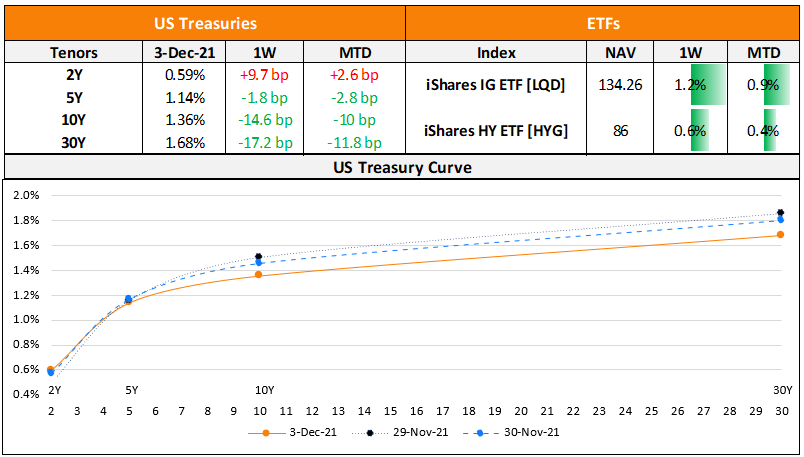

The US yield curve flattened for four consecutive days with the 2s10s ending the week at 74.97bp, down 20bp WoW, the lowest since December 2020, on the back of a frontloading of the Fed’s rate hikes to mid-2022 and risk-off fears weighing on long-end yields. US primary markets saw a sharp increase in issuances over the prior week that had Thanksgiving holidays to $22.6bn vs. $3.7bn in the prior week. IG issuances rose $19.1bn vs. $3bn in the prior week, led by Goldman’s $2.25bn dual-trancher, BofA’s $2bn issuance, Capital One’s $1.75bn two-trancher and T-Mobile’s $1.5bn issuance. HY issuance on the other hand was muted with Starwood Property Trust being the sole issuer with a $400mn issuance vs. almost no new deals in the week before as US junk bond funds saw the largest monthly outflows in 8 months. In North America, there were a total of 31 upgrades and 11 downgrades combined across the three major rating agencies last week. LatAm saw no issuances for a second consecutive week. In South America, there was 1 upgrade and 1 downgrade each combined across the major rating agencies. EU Corporate G3 issuance saw a sharp drop to $11.3bn vs. $23.4bn in the week prior with Daimler Trucks alone raising $6bn via an eight-part deal, followed by ING Bank’s €1.5bn issuance. Across the European region, there were 23 upgrades and 20 downgrades across the three major rating agencies. The GCC saw no issuances for a second consecutive week. Across the Middle East/Africa region, there were 2 upgrades and no downgrades across the three major rating agencies. APAC ex-Japan G3 issuance saw another dull week with only $2bn in issuances vs. $2.2bn in the week before led by SPIC’s $1.3bn PerpNC3.5 preferreds, Chengdu Economic and Technological Investment’s $300mn issuance and Shandong Commercial Group $200mn deal. In the Asia ex-Japan region, there were 7 upgrades and 8 downgrades combined across the three major rating agencies last week.

Go back to Latest bond Market News

Related Posts:

1, 2, 3, 4th Fed Hike!

June 14, 2017

Fed Survey Results Supportive of Funds Flow into Bonds

September 10, 2017