This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

The Week That Was

July 26, 2021

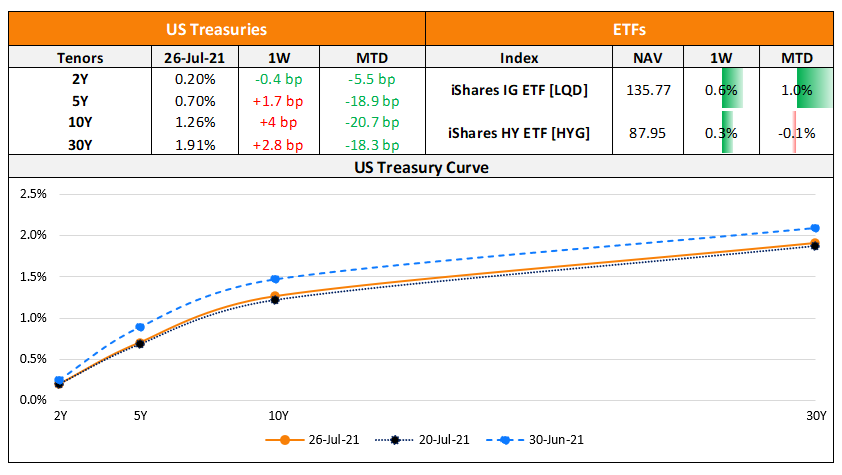

US primary market issuances dropped to $20.9bn vs. $32.4bn in the week prior. IG issuances fell to $15.2bn vs. $24.7bn in the prior week and HY issuances were also lower to $5.4bn vs. $7.3bn in the prior week. The IG space was led by VMware’s $3bn dual-trancher, DirecTV’s $2.3bn issuance and JPMorgan’s $2bn deal. In the HY space, Carnival’s $2.4bn deal and MavAcquisition’s $1.625bn dual-trancher led the tables. In North America, there were a total of 52 upgrades and 15 downgrades combined across the three major rating agencies last week. LatAm saw $6.35bn vs. $2.7bn in issuances in the prior week led by Chile’s $3.75bn three-trancher and Interchile’s $1.2bn issuance. EU Corporate G3 issuances rose to $13.6bn vs. $9.3bn in the week prior – Banca Nazionale del Lavoro’s €4.8bn led the table, followed by KfW’s €2bn issuance and Monte Paschi’s €700mn issuance. Across the European region, there were 32 upgrades and 15 downgrades across the three major rating agencies. GCC and Sukuk G3 issuances were muted on account of the Eid holidays last week as compared to $1.7bn in the week prior. Across the Middle East/Africa region, there were 3 upgrades and 5 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances rose to $8.9bn vs. $6.3bn in the prior week – Indonesia raised ~$2.24bn via a multi-currency EUR/USD bond offering followed by Chalco’s $1bn dual-trancher and China CITIC and ICBC International’s $600mn deals. In the Asia ex-Japan region, there were 2 upgrades and 13 downgrades combined across the three major rating agencies last week.

Go back to Latest bond Market News

Related Posts:

Fed Cuts Rates Again; Equities & Bonds Tank Again

March 16, 2020