This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

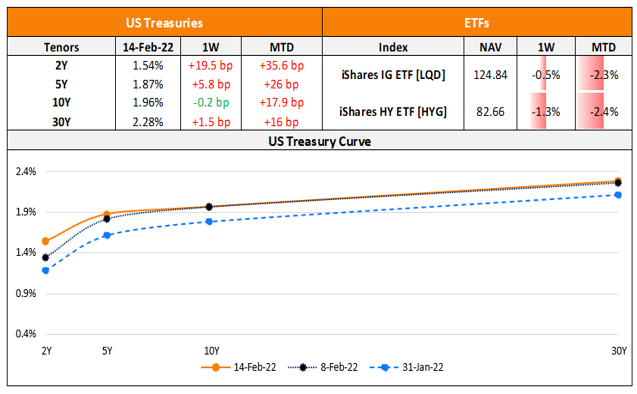

The Week That Was (7 – 13 Feb, 2022)

February 14, 2022

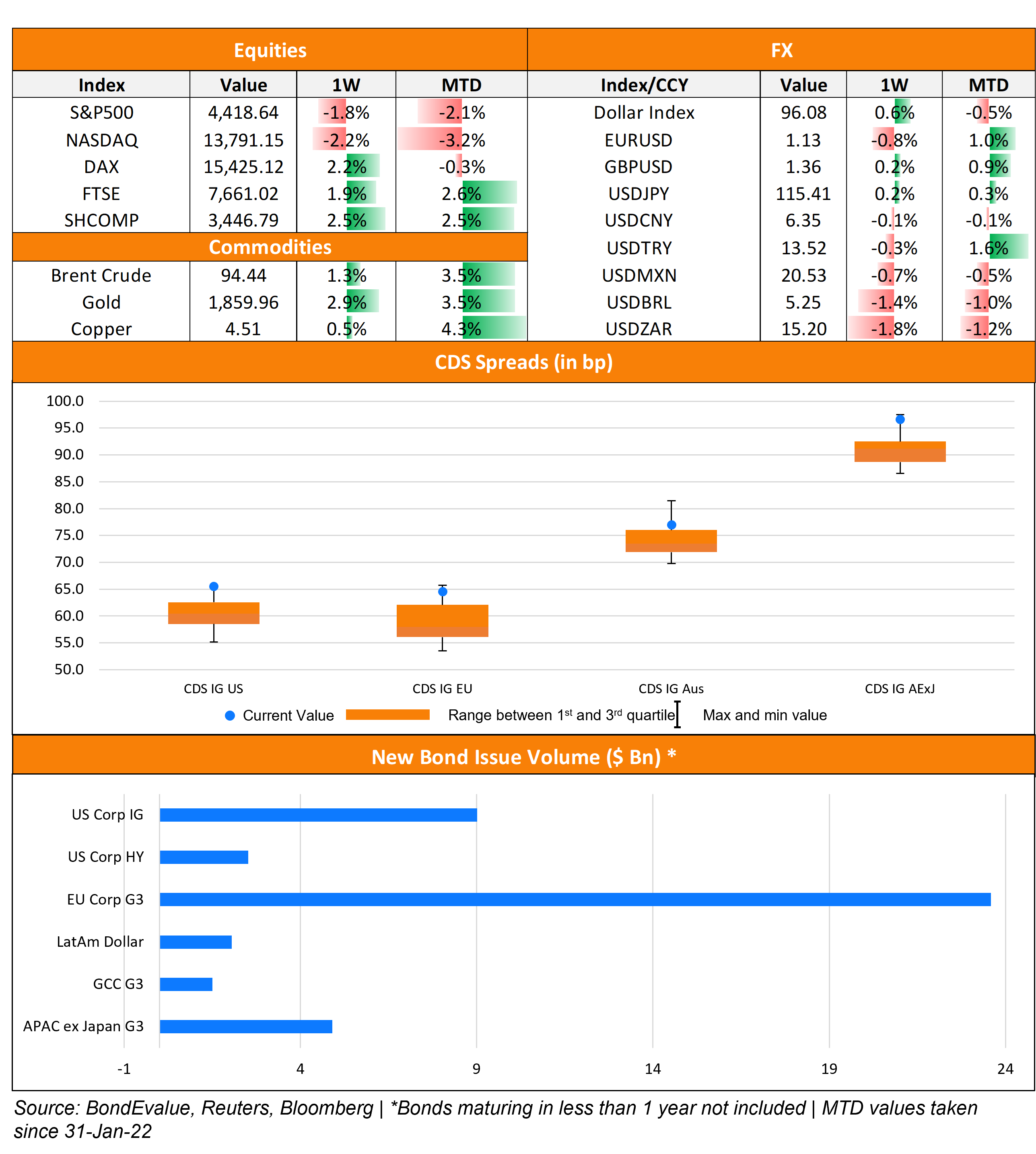

The US 10Y Treasury yield crossed 2% on Thursday, the first time since July 2019 after US inflation hit a 40Y high. US IG CDS spreads widened 5bp and HY CDS spreads widened 17bp during the week. Goldman notes that investors have now pulled out $15.8bn from US junk bond funds YTD, the worst outflows during the start of a year since 2010. US primary market issuances more-than-halved to $11.4bn vs. $25.7bn in the week prior on the back of risk-off sentiment and anticipation of a hawkish Fed ahead of the March policy meeting. IG issuances led the way at $9.1bn vs. $19.2bn in the week prior to that while HY issuances were at $2.3bn vs. $3.1bn in the week prior. The IG space was led by Union Pacific Corp’s $2.25bn three-trancher followed by Aptiv Corp’s $1.8bn dual-trancher. In the HY space, NCL Corp raised $1.6bn followed by News Corp’s $500mn deal. In North America, there were a total of 25 upgrades and 19 downgrades combined across the three major rating agencies last week. LatAm saw $2.5bn vs. $5.3bn in issuances in the week prior led by CFE’s $1.75bn sustainability two-trancher and Coruripe’s $300mn deal. In South America, there was 1 upgrade and 3 downgrades across the major rating agencies. EU Corporate G3 issuances were higher at $23.5bn vs. $17.3bn in the week prior, led by Rabobank’s $5bn issuance and ING Groep’s $3bn dual-trancher. Across the European region, there were 13 upgrades and 21 downgrades across the three major rating agencies. GCC G3 issuance were at a $1.5bn vs. a mere $170mn in the week before with Riyad Bank and DIB raising $750mn each via sukuk deals. Across the Middle East/Africa region, there were 3 upgrades and 21 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances stood at $4.9bn vs. $3.6bn led by CITIC’s and ANZ’s $1bn two-trancher each and Kookmin Bank’s $700mn two-part deal. In the APAC region, there were 4 upgrades and 14 downgrades combined across the three major rating agencies last week.

Go back to Latest bond Market News

Related Posts:

The Week That Was

August 2, 2021

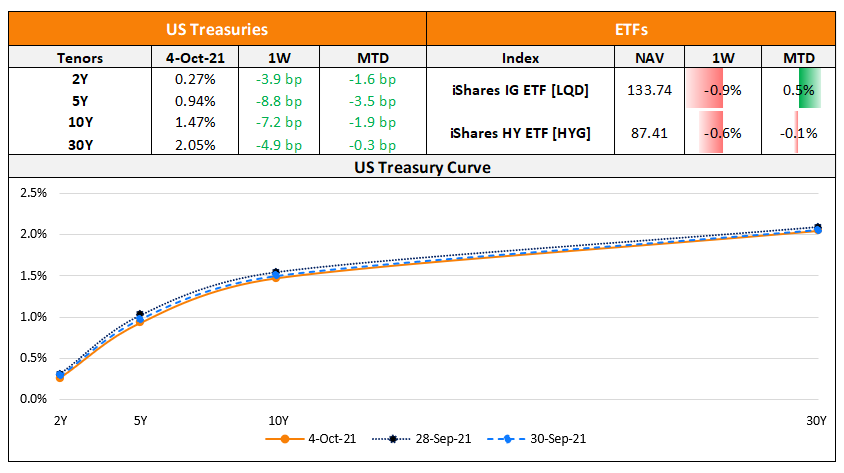

The Week That Was (27 Sep to 3 Oct 2021)

October 4, 2021

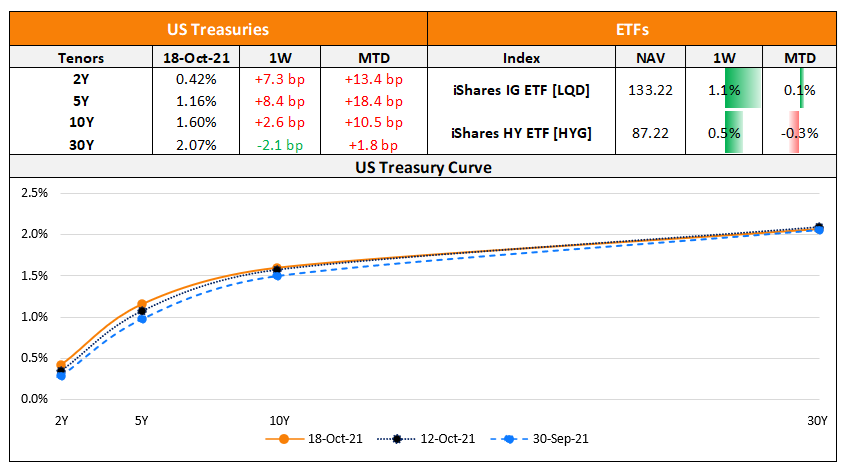

The Week That Was (11 – 17 Oct 2021)

October 18, 2021